Wednesday Winnings – Yesterday’s Futures Trades Make $9,360 To Start The Year Off Right!

A profit of $9,360 on 4 trades.

That's our record to start off 2017 for our Members, who got our PSW Report ahead of the open with the following 4 Futures Trade Ideas:

- Short Russell (/TF) Futures at 1,375 – fell to 1,355 for a $1,000 per contract gain

- Long Silver (/SI) at $16 – ran up to $16.50 for a $2,500 per contract gain

- Short Oil (/CL) at $55 – fell to $52.50 for a $2,500 per contract gain

- Short Gasoline (/RB) at $1.70 – fell to $1.62 for a $3,360 per contract gain.

As you can see from the video above, I reiterated our oil short and our silver long live at the Nasdaq, at the market open, getting America off to a great investing start for 2017. In the morning post, we also had a shorting idea for the Financials, using SKF and that's a longer-term trade idea using options but has the potential to return 4,100% on your cash outlay.

We will try to find some more fun Futures trade ideas in today's Live Trading Webinar, which we'll make the first free one of 2017 this afternoon at 1pm (EST) so come join us if you are interested in learning more about Futures, Options or just finding out which stocks we like for 2017.

In last week's Webinar (replay here) we also discussed silver (our Trade of the Year is Silver Wheaton (/SLW)) as well as Coffee (/KC) using the (JO) ETF, which already jumped 4% this week and we were worried it was only up because we called it but it's been able to sustain the gain and we're looking forward to some bullish action in 2017 that takes us all the way back to $25. The June options are still relatively cheap on JO and the set-up we like is:

- Sell 5 SBUX 2019 $45 puts for $3.70 ($1,850)

- Buy 20 JO June $18 calls for $2.50 ($5,000)

- Sell 20 JO June $21 calls for $1.00 ($2,000)

That puts you in the $6,000 spread for net $1,150 so your upside potential is $4,850 for a potential 420% return on your cash. You are obligated to buy 500 shares of Starbucks (SBUX ) for $45, which is 20% off the current price so, as long as you REALLY want to own SBUX for net $47.30 (the price of the put plus the cash you put into the trade) – it's all upside on JO! Net margin on the short puts is $2,263 so it's margin-efficient too!

Of course we also like the Coffee Futures long and we're in the July contracts (/KCN7) but they are very expensive contracts, moving $375 per penny that coffee goes up or down. The /KCN7 contracts are $1.46 this morning and that's already up 0.08 from last week's webinar, which is a gain of $3,000 per contract!

We like Futures trades in a choppy, toppy market because we can get in and quickly take our profits and get out and go back to CASH!!! (have I mentioned how much I like CASH!!! lately) so we can sleep soundly each night. There's a value to not having overnight risk that is not factored in by most traders but it's great to be flexible – especially coming into earnings season.

Speaking of earnings, Sonic (SONC) reports tonight and I hate to call a fast food chain with a p/e of 20 cheap but, compared to its peers, it is. Not much is expected of SONC, they've been serial disappointers in 2016, missing every single quarter so expectations are very low, with analysts looking for a 17% drop in sales vs last year. A lot of that is due to changes in their franchise mix, and not a true reflection of problems with the core business.

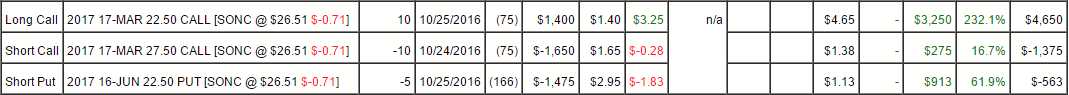

We've already played SONC, when it was much cheaper and we're well ahead on the spread in our Options Opportunity Portfolio that we picked up in October:

As you can see, we entered that trade for a net credit of $1,725 and it's well on the way to a $5,000 payout for a net return of $6,725 on cash (389%) if we can close March over $27.50 (now $26.50). As a new trade on SONC, I like:

- Sell 5 SONC June $25 puts for $2.15 ($1,075)

- Buy 5 SONC June $22.50 calls for $5 ($2,500)

- Sell 5 SONC June $27.50 calls for $2 ($1,000)

That's a net cost of $425 on the $5,000 spread so the upside potential is a $4,575 (1,076%) profit on cash in less than 6 months. Keep in mind, a trade like this obligates you to buy 500 shares of SONC for $25 and it's at $26 now, so not much of a discount – it's an aggressively bullish play ahead of earnings and we'll see how it plays out tomorrow.

Sadly, with the VIX so low, it's tough to get good options prices for our put-selling business but we do seem to find one or two interesting trade ideas each day in our Live Member Chat Room.

Primarily, we're in "watch and wait" mode this month as we wait for President Trump to take office and roll out his official agenda. Until then, please be careful out there….

Come join us inside our Live Member Chat Room or CHECK

Thanks for your information. Merry Christmas and Happy New year