Warren Buffett Stocks: Marsh & McLennan

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 404 thousand shares of Marsh & McLennan (MMC) for a total market value exceeding $63.34 million. Marsh & McLennan currently constitutes over 0.02% of Berkshire Hathaway’s investment portfolio.

This article will thoroughly examine Marsh & McLennan’s prospects as an investment today.

Business Overview

Marsh McLennan is a global professional services holding company active in risk, strategy, and people. The four main international businesses of the corporation are Marsh (insurance broker and risk management), Guy Carpenter (reinsurance and capital strategies), Mercer (human resources and consulting), and Oliver Wyman (strategy, economic, and brand consulting).

The company’s roots trace back to 1871 as the Dan H. Bomar Company. Thus it has a 150-year history of leadership and innovation. The company has clients in roughly 130 countries and 83,000 colleagues globally. Marsh McLennan trades under the ticker symbol MMC on the NYSE. MMC is headquartered in New York, New York, and is currently trading with a market capitalization of $78.7 billion. The corporation generates nearly $20 billion in annual revenues.

On April 21, 2022, the company reported first-quarter results for the Fiscal Year 2022. The company generated underlying revenue growth of 10%, adjusted operating income growth of 12%, and adjusted EPS growth of 16%. The company is well-positioned for another solid year.

Revenue beats estimates by $50 million and beat earnings by $0.16. Revenue came in at $5,549 million for the quarter compared to $5,083 million in the first quarter of 2021. Operating expenses did increase, however, by 10.2%. This was due to an increase in compensation and benefits.

Net income was up 8.9% year-over-year from $983 million to $1,071 million. Thus, earnings per share were up 9.9%, from $1.91 to $2.10 per share. The company also repurchased 3.2 million shares of stock for $500 million in the first quarter.

(Click on image to enlarge)

Source: Investor Presentation

Growth Prospects

The company has been growing earnings at a CAGR of 12.1% for over ten years. Over the past five years, CAGR has been 11.6%. We see this slowing down to 6.5% over the next five years.

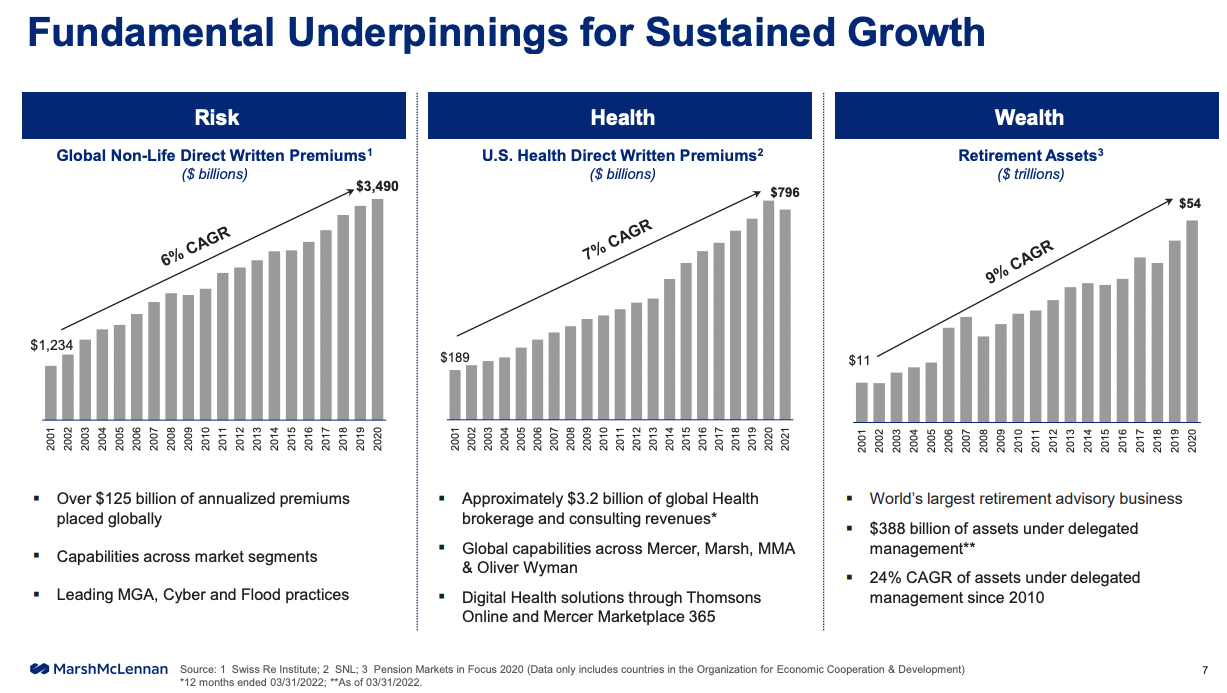

Continued growth drivers for the company will come from its Risk, Health, and Wealth segments. As you can see, each of these segments has been growing well since 2001.

Since 2010, the wealth segment has seen a 24% CAGR for assets under delegated management, one of the world’s largest retirement advisory businesses.

Other growth drivers will come from acquiring new businesses such as PayneWest, Compass Financial Partners, Heritage Insurance, INSPRO, etc.

(Click on image to enlarge)

Source: Investor Presentation

Competitive Advantages & Recession Performance

Marsh McLennan has a broad competitive advantage in that it has unparalleled geographic reach with clients in over 130 countries, with 23 countries contributing over $100 million in revenue. Additionally, they list their talent pool as an advantage considering they have 83,000 experienced, diverse, and dynamic colleagues, nearly one-third of which have over ten years of tenure.

Their scale is massive, and they are in leading positions across insurance brokerages and consulting and possess one of the most significant Capex spend among insurance brokers.

The company has performed well during recessions. For example, during the Great Recession, the company earnings grew 20% in 2008 and 9% in 2009. This speaks volumes about how well this company performed during this time.

Durning COVID-19, the company also grew earnings by 7% for 2020. The following year in 2021, the company grew earnings by 24% year-over-year. This is impressive.

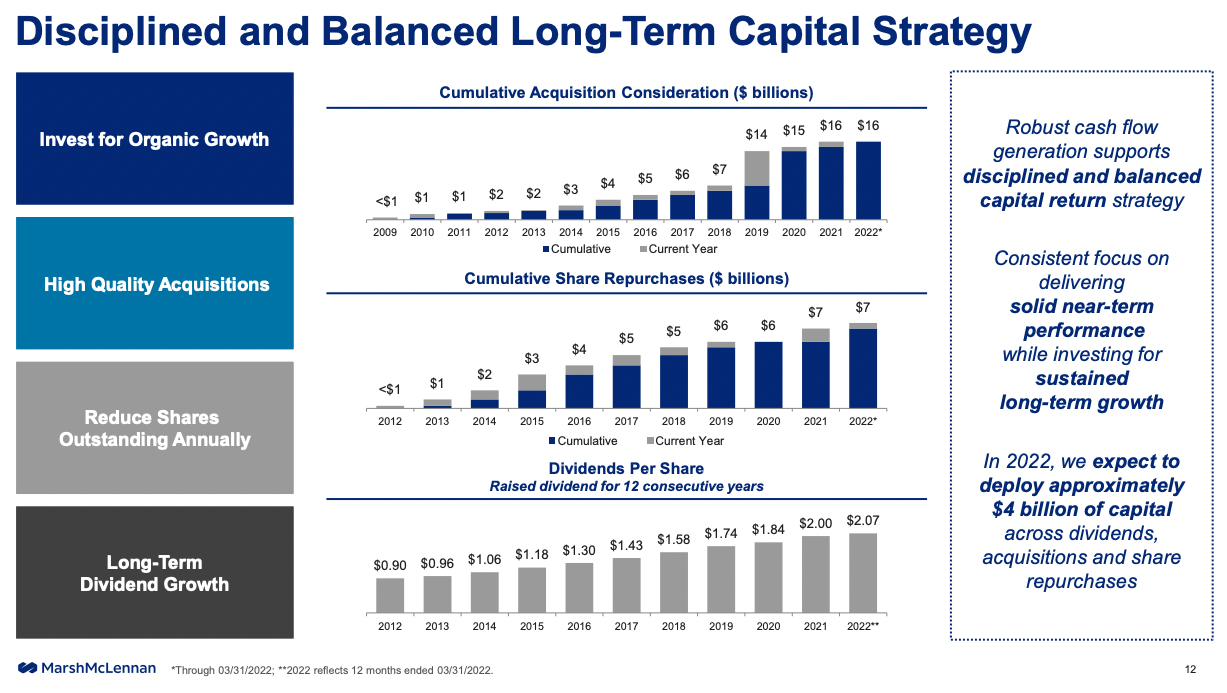

You can see that the dividend has been growing at a CARG of 8.8% over the past ten years. However, the company had to freeze the dividend increase in 2009. However, in 2010, is when the new dividend increase history began.

(Click on image to enlarge)

Source: Investor Presentation

Valuation & Expected Returns

We expect that the company will earn $6.83 per share for FY2022. The current price of $156.45 gives us a PE ratio of 24.1X earnings. This is high for the company.

The five-year average PE is 22.7X earnings. Thus, there is a valuation headwind. Also, the current dividend yield of 1.37% is lower than its five-year average of 1.63%. This is another indicator that the company is slightly overvalued at the current price.

We expect a CAGR of about 7% for the next five years. Thus, we think a further pullback is necessary to make this stock a more attractive buying opportunity.

Final Thoughts

Marsh McLennan is a leading global professional services firm with many businesses. We forecast annualized total returns of 7% into 2027, and the stock trades 2% above our estimated fair value. While we expect the company to continue growing, it appears to be trading with virtually no margin of safety. We rate MMC a Hold.

More By This Author:

Warren Buffett Stocks: Markel Corporation

Warren Buffett Stocks: Johnson & Johnson

Warren Buffett Stocks: Liberty Latin America