Warren Buffett Stocks: Liberty Latin America

Image Source: Pixabay

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 2.63 million shares of Liberty Latin America (Series A) (LILA) and 1.28 million shares of Liberty Latin America (Series C) (LILAK) for a total market value exceeding $31 million. Liberty Latin America currently constitutes over 0.01% of Berkshire Hathaway’s investment portfolio.

In this article, we’ll thoroughly examine Liberty Latin America’s prospects as an investment today.

Business Overview

Liberty Latin America is a leading communications company operating in over 20 countries across Latin America and the Caribbean under the consumer brands VTR, Flow, Liberty, Más Móvil, BTC, and Cabletica. The company’s communications and entertainment services to its residential and business customers in the region include digital video, broadband internet, telephone, and mobile services.

LILA's business products and services include enterprise-grade connectivity, data center, hosting, managed solutions, and information technology solutions with customers ranging from small and medium enterprises to international companies and governmental agencies. In addition, Liberty Latin America operates a subsea and terrestrial fiber optic cable network that connects approximately 40 markets in the region.

Liberty Latin America has three separate classes of common shares, which are traded on the Nasdaq Global Select Market under the symbols “LILA” (Class A) and “LILAK” (Class C), and on the OTC link under the symbol “LILAB” (Class B).

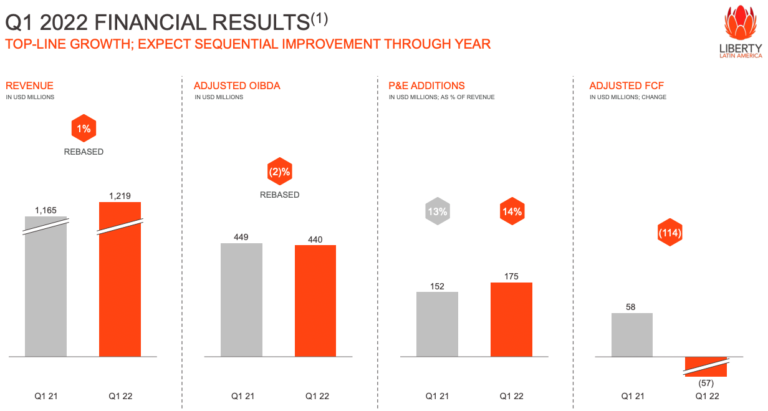

Source: Investor Presentation

On May 4, 2022, the company reported first-quarter results for the Fiscal Year (FY) 2022. For the quarter, revenue was lower than expectations by $40 million. however, year-over-year revenue is up 5% from $1,165 million to $1,219 million. Operating income was up 4% for the quarter compared to the first quarter of 2021.

The company reported a record mobile postpaid growth, which grew its fixed subscriber base. The mobile postpaid additions were over 120,00 new subscribers. Net earnings were down year-over-year by 5.6%, from $89 million in Q1 2021 to $84 million in Q1 2022. Free Cash Flow (FCF) was down $114 million versus the $58 million the company made in the same period last year.

Source: Investor Presentation

Growth Prospects

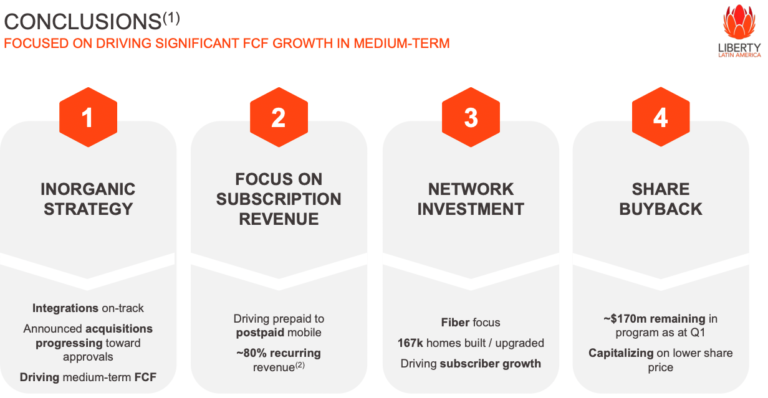

The company has multiple avenues for growth as the Latin American market is still growing. The company can continue to grow with strategic acquisitions across different markets. For example, the company has two integration programs in Puerto Rico and Costa Rica.

Another form of growth will come from converting prepaid customers to postpaid customers. This will create a more predictable recurring revenue for the company. Postpaid customers make up 80% of the company’s revenue. Lastly, the company can buy back some of its outstanding shares. The company has $170 million remaining in its buyback program after Q1.

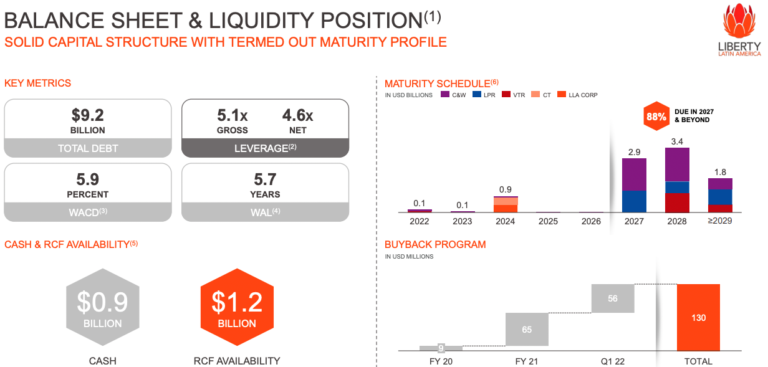

Source: Investor Presentation

Competitive Advantages & Recession Performance

The company’s competitive advantages come from its use of capital and diversity. The company has been acquiring different companies in Latin America. This will help the company become more competitive as it can lower costs and run more efficiently.

Since the company is a telecommunication company, it should do well during a recession. The company balance sheet has been improving in recent years. This would allow it to withstand a recession better if one were to come.

The company leverages 4.6X net earnings and 5.1X gross earnings.

Source: Investor Presentation

Valuation & Expected Returns

We expect the company to earn $0.71 per share for the year. The current price of $8.02 gives us a PE ratio of 11.3x. This looks attractive as we protect that the company will grow earnings at a CAGR of 10%-15% over the next five years.

Another note about the stock price is that the all-time low for the company is $7.01. Thus, buying at the recent price looks like an attractive deal. The company does not pay a dividend, but we think in the future it will. But for now, the company is focusing on growth projects.

Final Thoughts

The company looks like a solid play for an investor who wants exposure to the growth of Latin America. The company has a reasonably low PE, and future growth looks promising. Overall, we rate this as a buy for investors interested in investing in Latin America.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ...

more