Warren Buffett Stocks: HP Inc.

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned about 104 million shares of HP Inc. (HPQ) for a market value of $3.8 billion. HP represents about 1.0% of Berkshire Hathaway’s investment portfolio. This marks it as the 12th largest position in the portfolio, out of 49 stocks.

This article will analyze the computer hardware company in greater detail.

Business Overview

Hewlett-Packard’s story goes back to 1935 with two men in a one-car garage making a huge impact on electronic test equipment, computing, data storage, networking, software, and services that has lasted for more than eight decades.

On November 1st, 2015, Hewlett-Packard spun off Hewlett Packard Enterprise Company (HPE) – which was its enterprise technology infrastructure, software, and services business – and changed its name to HP Inc. (HPQ).

Today HP Inc. has centered its business activities around two main segments: printing, and personal systems, which includes computers and mobile devices.

HP released its second quarter 2022 results on May 31st. Reported revenue of $17 billion for the quarter was up 4% year-over-year. Non-GAAP earnings-per-share equaled $1.08 during the second quarter and was up by an impressive 16% versus the prior year’s quarter.

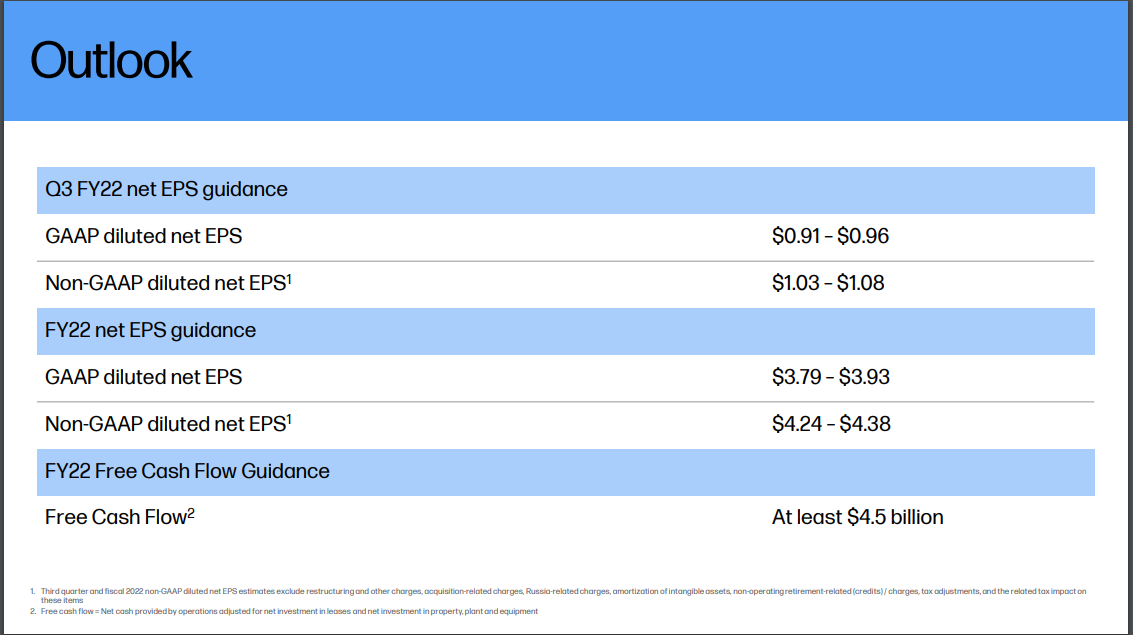

It is forecasted that earnings-per-share will hit a new record level this year, with management’s earnings-per-share guidance range being $4.24 to $4.38, which would represent growth of around 14% versus the previous year at the midpoint.

Source: Investor Presentation

In total, we estimate that HP can deliver $4.31 in earnings-per-share for the fiscal 2022 year.

Growth Prospects

HP Inc. has only operated as the standalone company it is today since 2016. Since 2016, the company has grown earnings-per-share by an incredible 20% per year. At the same time, HP’s annual dividend has more than doubled.

This earnings growth was the result of increasing net earnings, and a strong decline in the company’s outstanding shares. We expect the bulk of HP’s rapid growth to be behind it and that growth will slow significantly going forward.

HP is a top name in printing and personal computing systems, but growing pains are emerging, largely in part to customers leaning towards the purchase of mobile devices from competitors. In the second quarter, printing net revenue was down 6.8% year-over-year and made up 55% of total non-GAAP operating profit.

3D printing is a budding business but makes up only a small part of the company’s total revenue. 3D printing revenue grew more than 50% year-over-year, and may add meaningfully to the business in the future.

There is also a good chance HP continues to reward shareholders with consistent share repurchases. HP reduced its share count by over 30% between 2016 and 2021, which represented a near 8% annual share reduction.

We expect HP to deliver 4.0% annual earnings growth in the intermediate term.

Competitive Advantages & Recession Performance

HP is a leader in its two businesses, Printing, and Personal Systems. However, computer hardware is constantly morphing, and HP needs to continue innovating. Additionally, HP is geographically diversified, with net revenues outside of the U.S. making up 67% of total net revenue in the latest quarter.

The company prints cash, with fiscal 2022 free cash flow anticipated to be at least $4.5 billion. And, as a result, HP could be a major beneficiary of consolidation in the industry and become an acquirer of competing businesses. These businesses could be acquired for a good price in the wake of an economic downturn.

In the event of technological change, which happens frequently, HP would likely have the resources to purchase its way into these businesses. As of April 30th, 2022, HP had nearly $4.5 billion of cash and cash equivalents.

The company’s dividend today accounts for 23% of earnings, which is fairly safe. Since 2016, HP has averaged a payout ratio of 28%, so we believe the dividend is well covered. The dividend continued to grow even during the COVID pandemic.

Valuation & Expected Returns

HP Inc. shares have traded for an average price-to-earnings multiple of 9.3 since 2016. Shares are now below this average, which indicates that shares could be undervalued at the current 8.2 times earnings. As a result, we believe there is a potential for a valuation tailwind in the intermediate term.

Our fair value estimate for HP stock is 10.0 times earnings. If this proves correct, the stock will benefit from a 4.1% annualized gain in its returns through 2027.

Shares of HP currently yield 2.8%, which is below its 5- and 10-year average yields of 3.1 and 3.2%. On a dividend yield basis, HP shares seem to be trading at a slight discount.

Putting it all together, the combination of valuation changes and EPS growth produces total expected returns of 10.6% per year over the next five years. This makes HP a buy.

Final Thoughts

HP Inc. has grown earnings per share impressively over the last five years. Part of this is due to some revenue growth over the years, but the company’s share count has also declined massively.

HP looks like it will produce strong total returns from this point here, given a fair bit of growth, valuation expansion, and a good dividend yield. HP also generates strong cash flow, but revenue growth is not particularly strong.