Walmart: The First Trillion Dollar Big Box

Image Source: Unsplash

While digital-retail company (and many other things) Amazon (AMZN) crossed the $1+ trillion mark a few years ago, it took until today for its biggest "physical" competitor -- Walmart (WMT) -- to do the same.

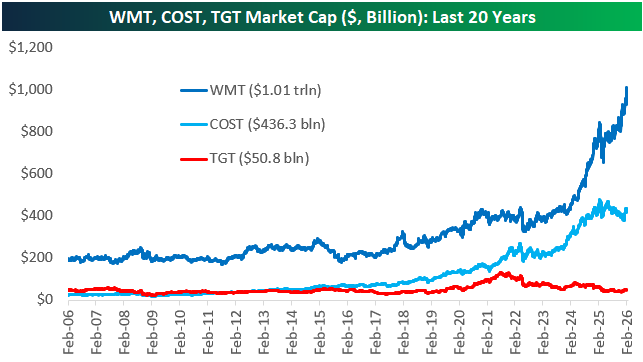

Walmart (WMT) has had an amazing run so far during the 2020s, with its market cap rising from a little more than $300 billion in early 2020 to more than $1 trillion today.

Costco (COST) has seen huge gains during the 2020s as well, while another major player in the big box retail space -- Target (TGT) -- has gone in the opposite direction lately.

Twenty years ago in early 2006, Walmart had a market cap of $189 billion versus $48.3 billion for Target.

Target's current market cap of $50.8 billion is just $2.5 billion more than it was twenty years ago, while WMT's market cap is up 433% to more than $1 trillion.

While WMT was just 3.9x bigger than TGT twenty years ago, it's nearly 20x as big today.

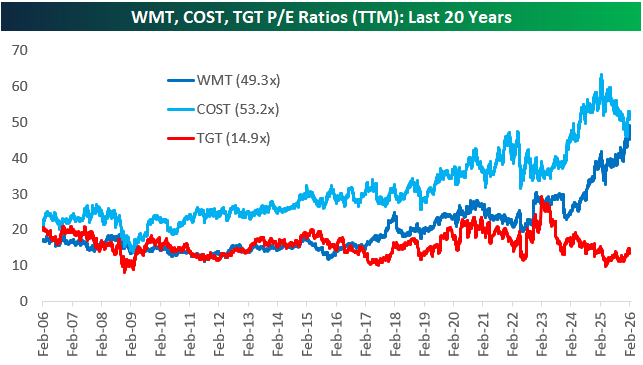

Walmart's run has been accompanied by EPS and revenue growth, but share price has definitely risen a lot more, causing multiple expansion.

As a trillion dollar company, Walmart also now trades at 49.3 times its trailing 12-month EPS. That sounds more like a high-growth Tech stock multiple rather than a big-box Consumer Staples stock.

Target (TGT), in the meantime, has seen its P/E multiple fall down to just 14.9x, while COST's P/E of 53.2x is even higher than WMT's.

More By This Author:

Precious Search InterestSoftware Bear Market

3rd To Last Powell Fed Day

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more