VistaGen Is Prepared For 2021 Fueled By Recent Analyst Upgrades And Large Institutional Buyers

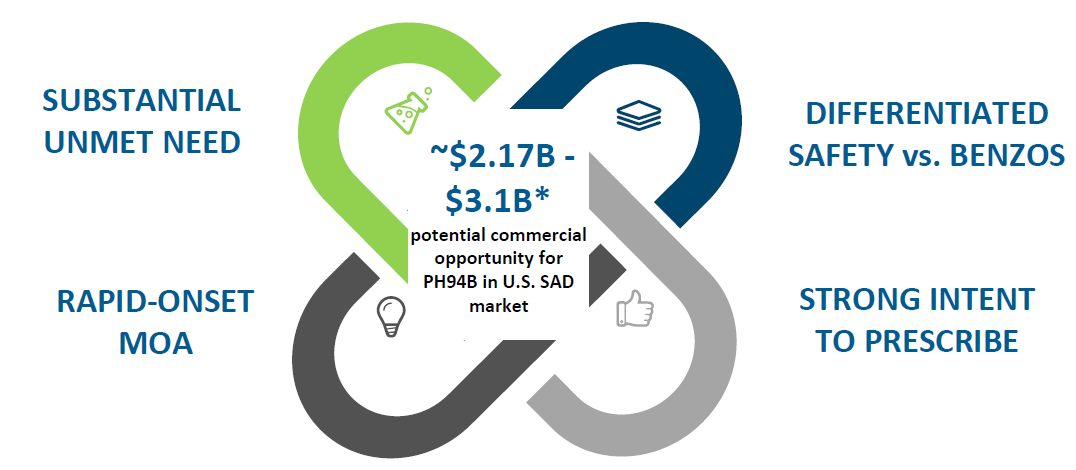

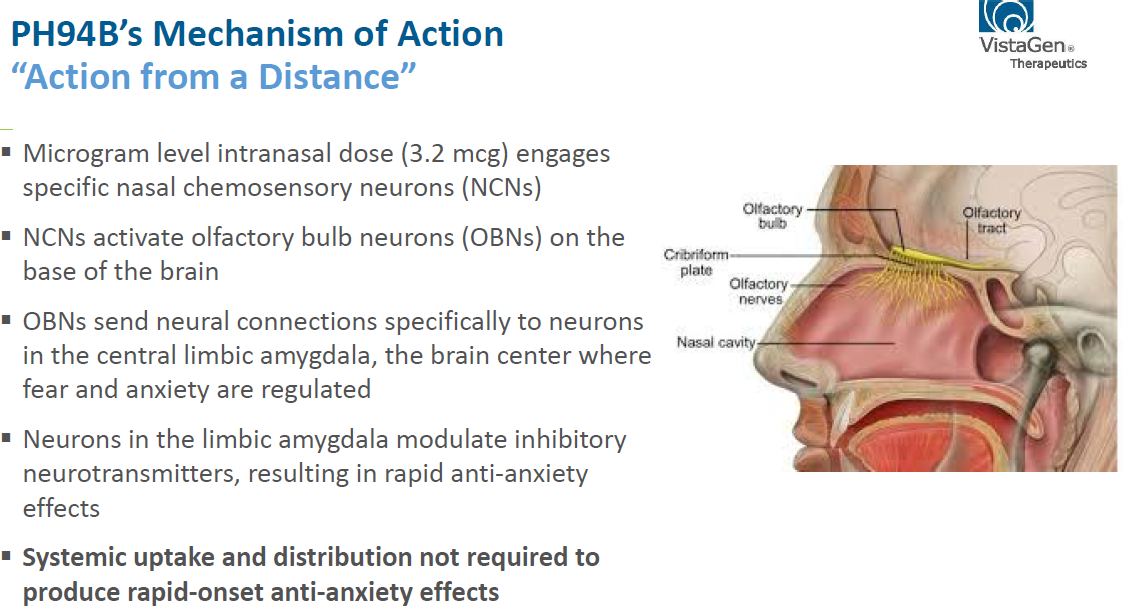

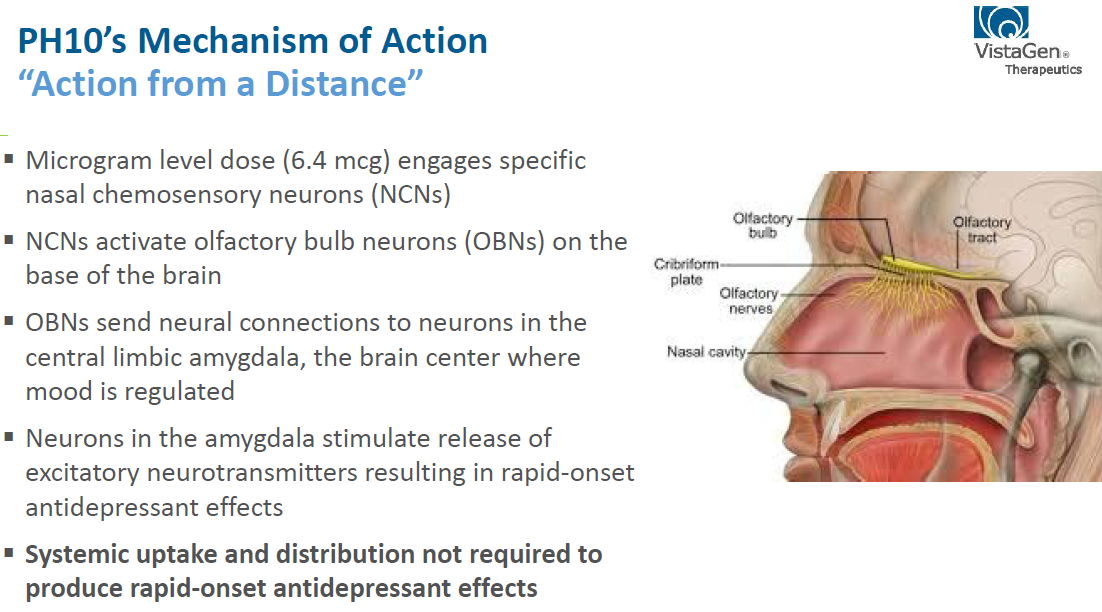

There is a lot of action moving into major depression disorders. It has been known that ketamine has had a lot of adverse effects on patients for a long time, however, lack of a good substitute, low visibility, and difficulty in achieving any sort of breakthrough in this segment seemed to have stalled major advancements. That said, VistaGen’s deal with Pherin Pharmaceuticals to develop PH-94B as an on-demand treatment for social anxiety disorder and PH-10 as a fast-acting antidepressant neuroactive nasal spray has positioned the Company to grab a healthy share of,

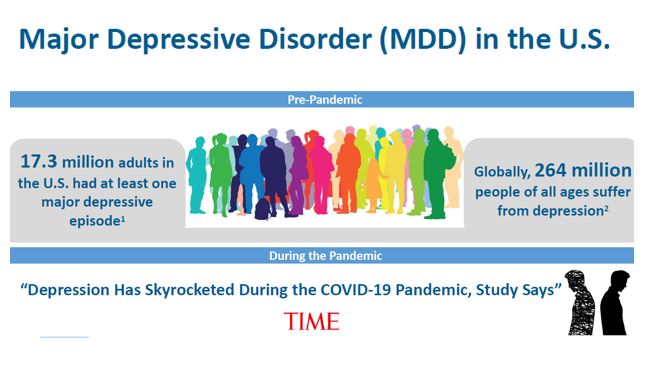

There is little question this is a burgeoning market with major depression increasing along with Covid for obvious reasons. However, even barring growth due to Covid, the market for a better drug treatment is ample to provide for decent revenue for Vistagen’s drugs such as PH10, PH94B, and AV-101.

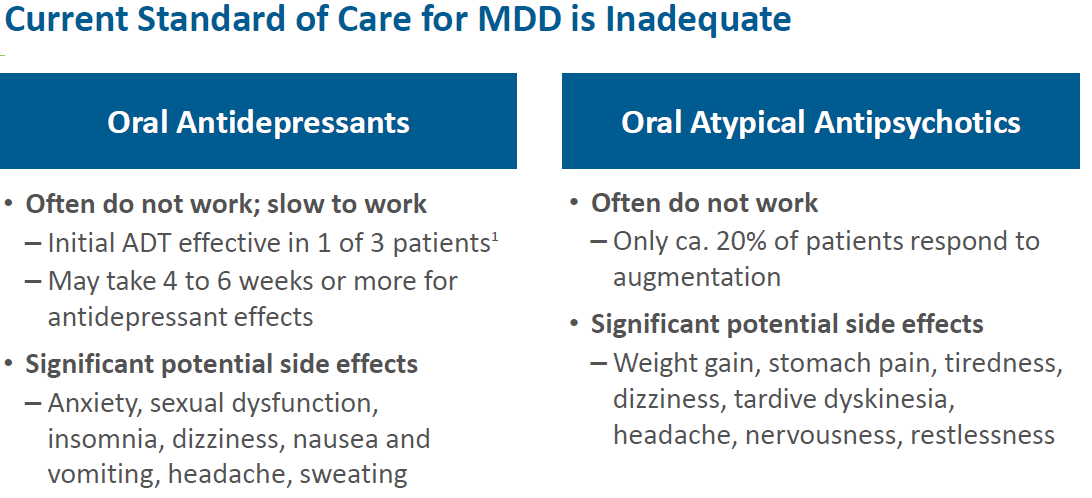

Interest in the depression market has spurred a unit of Johnson and Johnson to expand its use of Spravato nasal Ketamine-based drug to treat depression. Ketamine’s price alone is enough to cause depression costing over $1,000 out of pocket per infusion. Allergan continues to dabble with Ketamine like antidepressants and other minor players like Axome Therapeutics take nibbles at the market with varying pills.

That said, after getting PH94B fast Tracked by the FDA in 2019, VistaGen had a tremendous year in 2020 garnering $100 million investment through a major stock offering, reaching a consensus with the FDA on key aspects for PH94B’s pivotal Phase 3 study which will provide time and cost savings, and preparing for planned Phase 2B clinical development of PH10 . This is expected to catapult it into a major player in 2021. I would not be at all surprised to see strong clinical outcomes and potentially FDA approvals this year.

Clearly market investors are not waiting to place their bets. I would agree that VistaGen looks to be headed to at least the average $6 range some analysts have forecasted the stock to go to. This comes after its rise from $0.70 to $1.94 in 2020.

(Click on image to enlarge)

Although it may seem daunting to buy in after the recent ramp up, the rise comes on real substantiated news based on their successful capital raise and progress dealing with social anxiety which there isn’t an adequate drug on the market for. It doesn’t factor in final approval of their drugs and the fact that their enhanced financial clout will enable it to broaden their horizons in rapidly developing a market and pursuing other growth prospects in this market segment.

Like with PH94B, PH10 has a strong argument for approval and there is a desperate need for rapid-acting and effective treatments for Major Depressive Disorder.

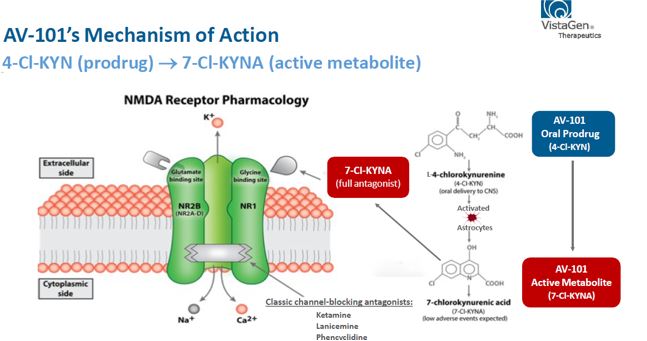

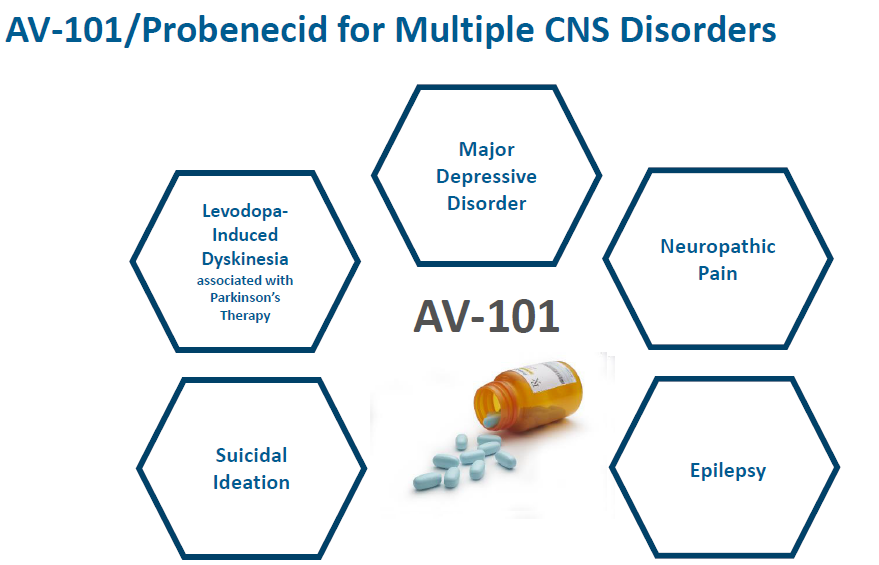

Last AV-101 in Combination with Probenecid is compelling in its own right with its potential for dealing with a variety of depression disorders.

As many know, I tend to get excited at pharmaceutical companies that have multiple chances at success and have the ability to grow beyond a single success and become a leader in a field. I believe that VistaGen meets both criteria and although it comes at a premium, the good news is the table is already set and the banquet is just starting.

Ever Insight/CBC Group are championing them in Asia. OrbiMed, Venrock Healthcare Capital Partners, Acuta Capital, New Enterprise Associates, and others were involved in the recent offering and will likely be around to support the company as it grows. I believe this is just the start for this company and it is more than ready to garner new partners and institutional investors in 2021. It is a good company that is delivering on its promises with a slate of very promising drugs. As one says about good investments, what’s not to like.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

Here are some article to help look at the news in perspective:

insiderfinancial.com/.../181182/

Sounds impressive to me.

Thanks, I agree there are good prospects for this company and the price will likely continue to rise.

Good article, thanks. Totally unrelated but what do you think about $AZN? I know Pfizer and Moderna have the head start on the vaccine, but it sounds like AZN's drug will be almost as effective at 90% efficacy (if they can replicate their initial test where they accidentally gave a quarter of the participants a 1/2 dose). And at $2 per vial instead of $200, I would think it will be the drug of choice for populous, yet poor nations like India, and Africa. Plus there will be no need for specialized freezers.

I'm not that big on the vaccines. As you know they mutate and they all get around 80-90% effectiveness. I'd play drugs that cure or help the infected. I wrote on one of them but there are also others. The vaccine effort was most heavily pushed by the Trump administration and people played it for the free money given out for development mostly.

That said, not using freezers is a big benefit. In Africa the spike has already changed so it is clear that Covid can change its spike potentially evading modern vaccines like the flu. This would be my biggest concern about the viability of vaccines.

Thanks for your thoughts. Makes a lot of sense.

Great read. The price is low enough I picked up a few shares.

It's great to hear from you. I'm glad you enjoyed it.

Good stuff.