Veolia Investors Will Profit Hugely From Cleaning Up "Forever Chemicals" In Our Drinking Water And Much More

Image Source: Depositphotos

Making money cleaning up our polluted planet

That is the thesis for this article. I have also based many of my articles in the past on it on by featuring companies doing real things to that end rather than pretending and thus rendering ESG talk little more than waffle. I do it via my investments and via my articles on the companies I am invested in.

I used Make Money Cleaning Our Polluted Planet as the title for the article under that link. In there I featured French company Air Liquide - AI:PAR on the Paris exchange or (AIQUY) on the NYSE - for its work with hydrogen as a clean fuel. In the nearly four years since then the share price is up around 70% (plus a dividend of 1.76%) proving that the concept works.

More recently I invested in another French company and one that has the word environment embodied in its name. I shall say more later about the world we live in today - including highlighting the relatively unknown but very dangerous PFAS "forever" chemicals in our drinking water and the many other opportunities this company has to make money by making things better - but first will say more about the company...

Veolia Environnement (VEOEY)

Veolia is a relatively unknown company yet it is the world's largest water company, according to Morningstar. It is by far the world leader in helping clean up the water we drink daily among other things that provide huge growth potential for it cleaning up our polluted planet. A very positive concomitant of that is making money for Veolia investors. I own it on its Paris home exchange where its symbol is VIE.

The company website tells us it is active on all main continents. Quote "Veolia group aims to be the benchmark company for ecological transformation. In 2023, with nearly 218,000 employees worldwide, the Group designs and provides game-changing solutions that are both useful and practical for water, waste and energy management. Through its three complementary business activities, Veolia helps to develop access to resources, preserve available resources, and replenish them.

In 2023, the Veolia group served 113 million people with drinking water and 103 million with wastewater services, produced 42 terawatt-hours of energy and recovered 63 million metric tons of waste."

3 main businesses activities:

Water, Waste, Energy

€45,351 million in revenue, in 2023, and H1, 2024 results show the following...

STRONG GROWTH IN HALF-YEAR RESULTS, REFLECTING THE SOLIDITY OF VEOLIA’S VALUE CREATION MODEL AND THE GOOD START OF ITS GREENUP STRATEGIC PROGRAM

- Solid revenue growth of +4.4%(1) driven by Booster activities up +6.9%(1), while Stronghold activities are up +3.4%(1)

- Robust operational performance with a strong EBITDA increase of +5.7%(2)), supported by revenue growth, operational efficiency as well as synergies ahead of annual target. Current net income up +15.2%(3) to €731m

- Continued dynamic capital allocation policy contributing to value creation while preserving a solid balance sheet, with €1bn+ of non-strategic asset divestments signed in the first half, and several targeted acquisitions in priority activities

- Objectives for 2024 and GreenUp 2024-2027 fully confirmed

- Veolia, first company to obtain double validation by SBTi and Moody's for its climate trajectory, compatible with the 1.5°C ambition

End quote.

More details can be found on the company website. I find that past information useful because it shows strong foundations to exploit the future opportunities that I am more interested in and will expand on below. Part of that future will come from successful implementation of Veolia's 2024-2027 strategic programme called "GreenUp". That new 24-27 strategic program aims to make Veolia the missing link in ecological transformation. "Veolia is paving the way for a more sustainable and desirable future by accelerating the deployment of solutions that already exist and innovating to create those of tomorrow. Drawing on its expertise in water, energy and waste, Veolia intends to decarbonize, depollute and regenerate resources through three growth boosters, supported by investments of 2 billion euros."

It has plenty of cash to finance that according to those HI results that say;

| Net cash-end balance/reserved for future use | E7,242 million |

|---|

Added to that will be the proceeds from the sale of a part that no longer fits future plans announced on July 31 - the sale of its sulphuric acid regeneration business in North America to private equity firm American Industrial Partners for $620M.

More about the company can be found in this excellent SA article by Daria Naumova titled Veolia Environnement: A High Quality, Hidden Gem In France and in this one by Wolf Report titled The Upside In Veolia Is Non-Trivial Here

I will expand more in the following on where we are and where we are going environmentally. First a look into the "insanity" that got us to where we are today...

"Insanity"

I will write at some length on this as unless some official bodies are completely restructured our polluted environment will become unliveable in and in economic terms too. For example, when the ESG movement started many investors did not see a conflict between doing good and doing well. That soon became apparent with "greenwashing" via useless, bureaucracy costly carbon credits and carbon offsets given priority over doing good by many companies.

The UN invented the ESG label and itself has made the environment filthier with its 28 annual giant COP (Conference of Parties) jamborees around the world that thousands of delegates attend polluting the air with their planes - many single occupant private planes for the important people - and the air conditioned hotels and vast meeting halls that house them on the ground. The only things they agreed on at the last one - COP28 - was where the next such jamboree should be held and the vague ambition of "accelerating the transition away from fossil fuels". The UN has itself become a leader in greenwashing!

In addition to the un-talked about environmental cost of those meetings there is an undisclosed huge financial cost. There were 83,884 participants at COP28 plus around 17,000 support staff - total 100,884. I cannot find a calculation of the financial cost anywhere so presumably that is left hidden as is the environment cost so I will take Canada's government sponsored published cost of $16,500 per person as the average cost for all thus indicating an unimaginable sum - according to my computer - of $1,664 trillion! For a comparison COP1 in 1995 involved just 3,969 participants. The vast amount of damage to the environment by those "savers" of it is immeasurable and unimaginable.

Elsewhere a recent study by the US National Library of Medicine and others shows that only 63 out 1500 climate policies implemented in the past two decades have proved worthwhile - a mere 4.2% of the total, meaning 95.8% were worthless. That shocking 95.8/4.2 performance comes nowhere matching Pareto's already frightening 80/20 rule. He made that rule in 1896 long before the establishment of today's vast government and non-government agencies that have grown like cancers in economies so perhaps a 96/4 rule is more appropriate now!

Prior to the UN's "invention" in 2005 of the grand Environmental, Societal and Governance ambition a chapter titled Corporate Responsibility in the 21st Century in a book titled The World Through Our Eyes by Brigitta Natasha Hanshaw (then aged 21) covered all in far fewer words. That book, covering many world fixing ways recommended by young people, was published in 2003 and is perhaps even more valid today than then. A must read! (Disclosure: Brigitta Natasha Hanshaw is my daughter!).

Continuing with this farce proves correct the old wisdom - attributed to Einstein - that “Insanity is doing the same thing repeatedly and expecting different results.” One wonders what word describes these people who do the same thing repeatedly but only expect the same repeated failure?!

Stop the polluting "insanity" - let us use our people/investor power and show the way forward. There is evidence of such a counter-trend. Many stopped investing in ESG funds in a big way for the past three years. US funds that are explicitly committed to ESG have suffered seven straight quarters of net outflows, and total assets at $34bn, are well below their 2021 peak at $140 bn, according to Morningstar Direct. The following shows more...

Pareto's 80/20 Principle - even if too mild today - should be applied to the UN and the many ineffective, vast non-government bureaucracies like it.

There are an estimated 10 million non-governmental organisations worldwide (Source: The Global Journal) and If NGOs were a country, they would have the 5th largest economy in the world (Source: John Hopkins University, Center for Civil Society Studies). Many, such as the UN, were established around 80 years ago and have not had their rules changed in a world that has changed hugely since then.

To add perspective to my point - the US Fed employs 23,000 people including 400 PhD economists in order for a handful of non elected heads to occasionally tinker with interest rates to get inflation below 2%. Despite that expertise they cannot even keep their own costs below their 2% inflation target - On December 15, 2022, the Board approved the 2023 Reserve Bank operating budgets totalling $5.646 billion an increase of $308.2 million, or 5.8 percent increase, from the 2022 forecasted expenses. A few IT experts using today's AI could do better!

The money we tax payers give them without a vote should be cut by 80% and those cash burners made to use the other 20% to pay for the 20% of what they do that is worthwhile! That requires a huge restructuring of all. The money saved would pay down the dangerously large US debt mountain, reduce taxes for all plus leave plenty to fix outdated education systems and overloaded infrastructures.

Unfortunately that requires political leadership that is lacking but hopefully the US will make a start and then the rest will create a tsunami of followers.

I hope my words on those long neglected, un-restructured non government and government matters are useful and will now move on with investment opportunities and specifics.

The nascent counter trend now includes big US banks saying they will not attended COP29 to be in Azerbaiijan (a petro-state!) and the number of green banks in the US increasing from less than a dozen in 2019 to nearly 50 now. That group will help utilise the $20bn in grants directed at US green banks and regional lenders in the IRA climate law. The White House has predicted that could have a multiplier effect that attracts $7 in private lending for every federal dollar spent.

The US is also leading with some other things - including the PFAS and PLASTICS clean up mentioned below - that will directly benefit Veolia.

We can also show the way in our personal behaviour - people/investor power - including the companies we choose to invest in. Making money is nice byproduct of that! Some companies have long led the way. I am not a green fanatic and do have some investments in natural gas but try to ensure my choices do their best environmentally. They include Antero Resources (AR) that uses Veolia's technology in its closed loop fracking water system. I wrote about AR in this article a couple of years ago. The picture remains as sound today as then. Antero Resources Is A T'Winner For 2023 And Beyond. Maybe they and others will aid Veolia's expansion into carbon capture and methane leak control.

As can be seen following those COPs and other events too little real action is taken by those bodies to clean the air. Even less done about water...

Water is just as important to us as the air we breathe!

Our waters are shockingly contaminated with plastics that break down into minute particles and get into our food supplies. In some countries water supply companies intentionally pour raw sewerage into rivers and oceans. The Guardian reported that "water companies in England have faced a barrage of criticism as data revealed raw sewage was discharged for more than 3.6m hours into rivers and seas last year in a 105% increase on the previous 12 months".

Others have been dumping into our waters "forever chemicals" technically known as perfluoroalkyl and polyfluoroalkyl substances or....

PFAS

These chemicals do not break down naturally and are increasingly found in people, animals and at the bottom of oceans via their use in household products ranging from upholstery to food packaging, shampoos and electronics. They have been found to lower immune responses to vaccinations, and damage liver functions and fertility. I learned that about PFAS from this article in the Financial Times headed The lucrative business of cleaning up "forever chemicals".

That article also states that 3M has agreed to pay a $10.3bn settlement to public water companies that had detected PFAS in drinking water that 3M had allegedly hidden the dangers of and in April this year the US Environmental Protection Agency - EPA - adopted the first US rules for PFAS levels in drinking water. Removal of PFAS to reach those levels is estimated to have a potential cost of $250bn and up to $3bn annually to maintain compliance with those rules, ultimately trillions. In an interview in New York mentioned in that article Estelle Brachlianoff, the chief executive of French water company Veolia, said PFAS removal in the US was a big opportunity for the company “and is growing fast.” Veolia, she said, wanted to be a “one-stop shop” from the diagnosis of PFAS in drinking water to the treatment solution. Water treatment accounts for nearly half of Veolia’s earnings, Morgan Stanley noted in a June 28 report and the company was “ideally positioned” to win business “in PFAS pollution mitigation.”

Importantly there is no political risk. In the US there a rare political bipartisan consensus on this environmental issue that should mean PFAS removal - and thus Veolia - will present an opportunity for investors who might otherwise face political risks to their portfolios.

In the European Economic Area - EEA - that comprises 30 countries including the 27 EU countries the annual health related costs from PFAS are estimated to be Euros 52bn - Euros 84bn and the cost of remediating the water and soil in contaminated areas is likely to run into trillions according to this letter in the FT by Anne-Sofie Bäckar, Executive Director at Chemsec, Sweden. The EEA is not well known but - to add context - it has a population of around 450 million compared to 330 million in the US. That helps show the scale of the problem and the opportunity plus there is the rest of the world too. Veolia covers much of the world.

PLASTICS

As far as I know the UN has no summits or other jamborees ( perhaps fortunately!) over plastics but plastics are major polluters. Our rivers and oceans are full of waste plastics and they get into our food via the fish we eat, etc. The US produces the most plastic waste per capita. The average American is estimated to be responsible for about 130kg of plastic waste a year, the most per capita in the world. This is followed by the UK, South Korea and Germany. And despite political efforts to reduce plastics use - making up 50% of petrochemical demand - they showed the strongest production growth of all bulk materials over the last decade. The industry’s current growth trajectory is exponential and plastic production is expected to double or triple by 2050 according to Berkely Lab with the plastics industry expected tomorrow account for 10% of global emissions by 2050 and - according to the IEA - be the "single largest contributor" to oil demand growth just in the next four years. Some US political actions are leading the way towards fixing this with AP reporting that California is suing ExxonMobil, alleging the oil giant deceived the public for half a century by promising that the plastics it produced would be recycled. New York's attorney-general has sued PepsiCo demanding it reduce its plastics pollution and pay for damages.

The OECD estimates that only around 10% of plastics is currently recycled and estimates investment in recycling must reach $1 trillion by 2040, up from less than $20bn today.

Some of that will add to Veolia's profitable growth. More work will also come Veolia's way via...

WATER SUPPLY

I mentioned polluted waters above. There are also devastating floods in some parts of the world that do not need more water and there is no way of getting that flood water to where it is needed. Demand is also increasing as supply decreases in many countries due to global warming caused droughts, population growth and new sources of demand. One example of the latter: It is commonly known that data centres use vast amounts of electricity for cooling but little is said about the associated water consumption guzzling. NPR reports the average data centre uses 300,000 gallons of water a day to keep cool, roughly equivalent to water use in 100,000 homes. And AI is now hugely increasing that use. In the US this Financial Times articles reports that US tech groups' water consumption soars in "data centre valley".

Big farming country Brazil is suffering its worst drought on record. Famously wet Ireland is struggling to supply enough water to its big build up in tech. Parts of Europe including Greece and Spain plus several parts of the Middle East, Africa and Asia have severe droughts. This FT article tells more of the problem in southern Europe - Mediterranean water crises become the norm. All these flood and drought problems are linked to climate change and have an adverse affect - among other things - on our food supplies.

One solution for drought hit areas is to convert sea water into fresh water, a process called desalination. Among other water things Veolia is a world leader in making and operating desalination plants.

At present only around 1% of the world's water comes from desalination but that is increasing rapidly. That linked article above about the Mediterranean water crisis reports that "There are now 57 desalination units operating on the Aegean Islands alone, twice as many as a decade ago." There are nearly 200 plants being built in the Middle East and north Africa according to research by Global Water Intelligence. In the US $250 million the current administration has allocated $250mn to building desalination plants.

A big negative of desalination is the enormous amount of electricity energy the process needs especially if that comes fossil fuelled generators. Countries with plenty of sun are using solar. Small modular nuclear reactors will be available later in the decade. Veolia's other main activity - a more recent and expanding one - might also help. That is...

CLEAN ENERGY

The company website tells us this...

Quote - Producing local decarbonizing energy for all its municipal and industrial customers worldwide. This is Veolia's commitment, which aims to produce 8 GW of bioenergy and have a flexible installed capacity of 3 GW by 2030.

Veolia's solutions

From the production of bioenergy produced from non-recyclable waste, to the recovery of heat and cold, or energy efficiency solutions , to the capture of CO2 , the Group produces local, affordable and low-carbon energy.

Objective

With a turnover of 12 billion euros in this sector in 2023, Veolia is accelerating the development of these innovative solutions to enable Veolia customers to optimize and balance their energy mix, while accelerating the production and consumption of renewable energies.

Producing local decarbonizing energy for all its municipal and industrial customers worldwide. This is Veolia's commitment, which aims to produce 8 GW of bioenergy and have a flexible installed capacity of 3 GW by 2030.

Veolia's solutions

From the production of bioenergy produced from non-recyclable waste, to the recovery of heat and cold, or energy efficiency solutions , to the capture of CO2 , the Group produces local, affordable and low-carbon energy.

Objective

With a turnover of 12 billion euros in this sector in 2023, Veolia is accelerating the development of these innovative solutions to enable Veolia customers to optimise and balance their energy mix, while accelerating the production and consumption of renewable energies. End quote.

As with PFAS there is no political obstacle as clean energy has bipartisan support with around 77% of the $493bn in clean energy investment in the past two years flowing to Republican districts.

That brings me to ...

Threats and Opportunities

Threats include

- Soaring debt remains a major concern, as the U.S. national debt load is now past $35.3T, or close to $104,900 per American and getting worse: The U.S. federal government spent $380.0B more than it earned in August, a far greater shortfall than the -$285.7B expected and July's -$244.0B, according to the Treasury Department. That is a danger for the whole world.

- Gold. There has been a flight into gold for safety but where is it? The following is from Jensen's Economic, Precious Metals, & Markets Newsletter. Sep 02, 2024 "The heart of the problem that is the London gold and silver Over-The-Counter (OTC) cash trading market is that it is based on trading of promissory notes for immediate ownership of metal with only a tiny fraction of that metal available for delivery.

This August 24, 2024 post showed that there is an estimated 9,500 tonnes to 14,300 tonnes of standing claims in the London cash (immediate ownership) OTC gold market.

And yet, London gold vaults hold a ‘float’ of only 1,300 tonnes of gold that are not held by ETFs or the Bank of England for itself and other nations.

The large majority of the London 1,300 tonne vault float is owned by holders that do not trade gold - only a small portion of the float is available to market for settlement of these spot gold promissory notes when delivery is demanded."

Likewise in the US where no one seems to know how much gold is really held in Fort Knox, if any. Garfield Refining tells us that "Few people – even U.S. presidents – have actually seen the gold reserves. The actual structure and content of the facility is only known by a few people, and no one person knows all of the procedures to open the vault. President Franklin D. Roosevelt was the only person outside of normal security personnel permitted to see the gold reserves up until 1974, when a group of journalists viewed the vaults. The journalists were granted access to quell persistent rumors that all of the gold in Fort Knox had been removed. (It hadn’t.)". That is long ago and before today's US debt mountain existed. Today central banks and official institutions keep buying gold and one wonders where they are getting real, physical gold from - if at all! An almighty crash for almost all assets could happen if it proves the gold all are "buying" does not actually exist. If readers have more knowledge on this it would help us all if they share that in comments at the end of this article,

- Competition. There are many water treatment companies but few are large and none, to my knowledge, cover the whole spectrum of treatments as does Veolia. This is list of leading water treatment companies. Clean Harbours (CLH) is a US leader in some things. Its share price is now around 5 times what it was 4 years ago thus showing the possibilities for Veolia that remains very underpriced by comparison. The market growth is huge meaning there is plenty of room for all and Veolia only needs to maintain its current market share to ensure its future growth but I think its plans will also increase its market share.

- Politics are normally the biggest problems for companies but the need to fix water is agreed by all. For Veolia the French political system has been in a vacuum for months and now there will be be tax increases on companies with sales of more than E1 bn. Veolia's sales are over E 40bn. How much of a problem that will be is still unknown but hopefully it will not derail Veolia's "GreenUp" programme.

Opportunities include

- Major NGO and GO restructurings. A few positive things are happening and these long overdue changes will release vast sums of money and rid the world of outdated rules and stifling bureaucracies that have crushed productivity and caused chronic underinvestment in virtually everything needed for future growth. Stock markets will go orbital and there will definitely be...

- No landing! "Experts" have been questioning for several years whether or not the US economy will have a hard or soft landing. There was the Covid crash of 2020 that no one could foresee but otherwise the US economy has kept safely aloft despite a crash in the EU - led by Germany - and a big slowdown in China.

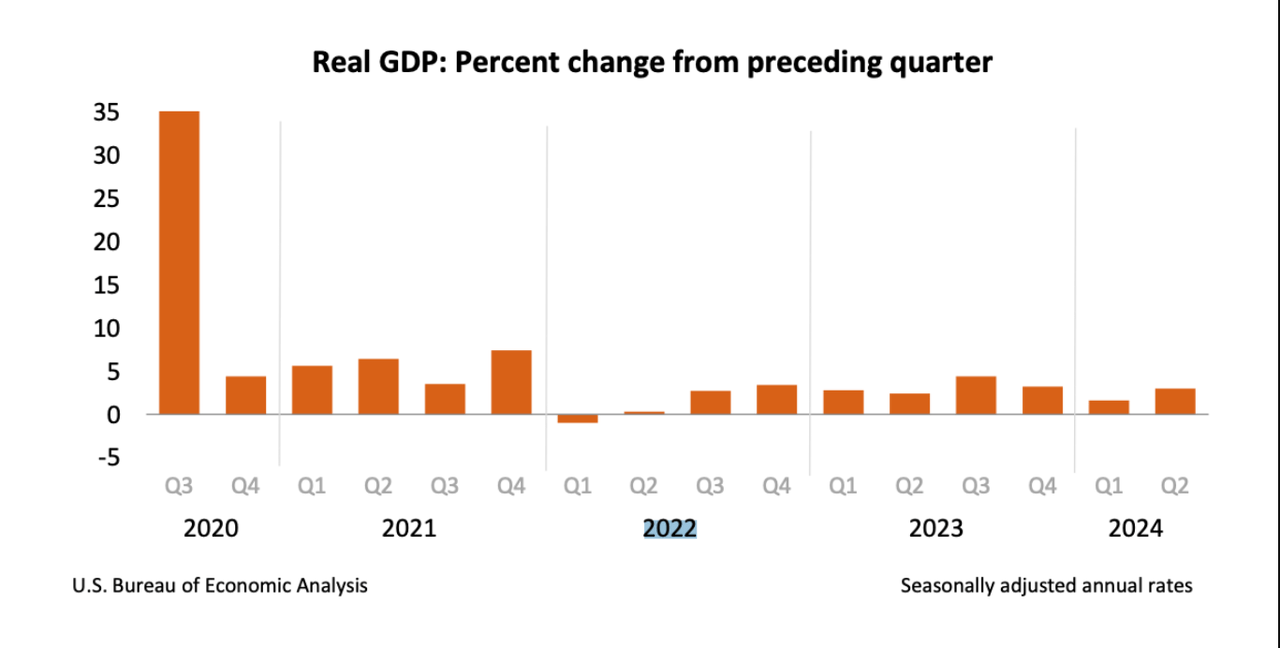

Despite weakness in manufacturing and the important house construction sector in the US things have gone quite well and we should see the economy heading to higher altitudes for some time yet. This chart shows things nicely...

Any landing was soft and in H1, 2022. Manufacturing will improve as more and more production starts from re-shoring investments and lower interest rates will propel the even more important housing sector higher. Eye on Housing tells us this: "Housing's share of the economy rose to 16.1% in the first quarter of 2024. The share remained below 16% for all of 2023 at 15.9% in each of the four quarters. This increase to above 16% marks the first-time housing's share of GDP is above 16% since 2022." Importantly, US consumer spending has stayed sound.

Elsewhere - the ever declining EU has probably bottomed out and the Chinese emperor is desperate to keep China on a 5% growth path. China is hardly dead anyway as equalling a mere 2% growth in China would give the UK - the world's 5th largest economy - a growth rate of 5.4% instead of less than 1%. Equalling China's 5% target would mean around 13.5%! India - now the world's 4th largest economy - grew more than 8% in the past year. The World Bank expects India’s medium-term outlook to remain positive. Growth is forecast to reach 7 percent in FY24/25 and remain strong in FY25/26 and FY26/27. Vietnam's economy expanded 7.4% in the third quarter. Indonesia's economy grew by 5.05% yoy in Q2 of 2024.

- Money Market Funds in the US continue to grow due to political and economic uncertainty. According to JP Morgan "A Record $6.47 Trillion Is Piling Up in US Money-Market Funds." Investors added another $11 billion in week ended Oct 9, 2024. Some of that will pour out into stock markets when investors realise making money in those is more certain.

- Growing confidence in the US economy caused a record $93bn to flow into fixed income exchange traded funds in the last quarter as part of a long delayed rotation off the sidelines and into those and equities. That will benefit many stocks including Veolia.

- Veolia is anyway recession proof as water distribution is non cyclical and most of Veolia's activities are badly needed recession or no recession with PFAS clean up possibly being the most urgent as is the aftermath of...

- Extreme weather events. These are becoming more frequent as can be seen by that back to back hurricanes that recently hit the US south east. Water needs massive and urgent clean up after those.

That brings us to...

Veolia's Valuation

The French political vacuum that I mentioned earlier has left Veolia flatlining this year. That situation appears to be stabilising but anyway does not affect Veolia's water activities in France that go on regardless. More income from stronger currency countries such as the US and outside the eurozone will enhance profits when translated into euros for accounting purposes. Veolia pays a nice safe 4.2% dividend. I mentioned partial competitor Clean Harbours above - it does not pay a dividend.

Veolia is active worldwide while Clean Harbours is confined to North America and is growing its activities in sectors Veolia has got out of including by acquiring Veolia’s U.S, industrial cleaning business in 2018. Its PE is 36. Veolia's is 20. Its profits are better but the valuation gap is too great in my opinion. This shows in the 5 year share price performance and possibly where Veolia will go as it catches up...

Analysts suggest the following...

Share price forecast in EUR

The 16 analysts offering 12 month price targets for Veolia Environnement SA have a median target of 35.00, with a high estimate of 45.30 and a low estimate of 29.90. The median estimate represents a 17.45% increase from the last price of 29.80. No one suggests it will go lower.

Being an optimist I expect it will do even better than the median and since Einstein and Pareto were both right and both lived in Switzerland that is a sign I will be right because I live in Switzerland too!

If we take the median estimate anyway and add the 4% plus dividend Veolia we have a nice safe 20% plus gainer for the coming year and similar thereafter. The concomitant environmental improvements also gives a new meaning to earning Greenbacks!

More By This Author:

How To Make Real Money In A Tesla Typified Make Believe World

Now Boarding - The India Money Making Train

Making Returns In The Roaring Twenties In Asia

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Thank you! Please share any points you consider important with others as we - the people - are the only ones that will fix many of those things.

Too true!

Wow, I did not know about any of this.

Hope it helps. Thanks for the comment. James