U.S. Stocks Snowflake Inc.

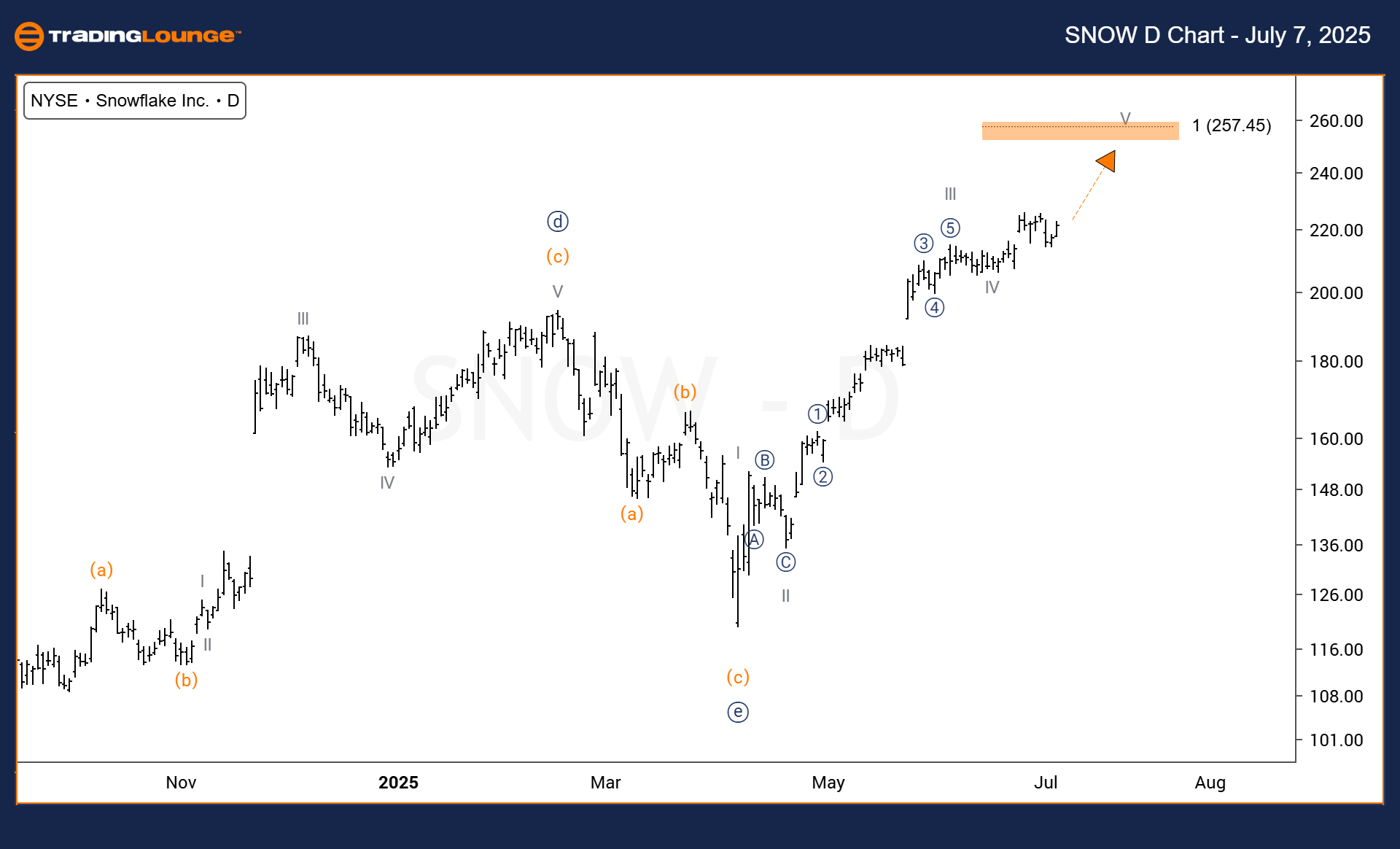

Snowflake Inc. (SNOW) – Elliott Wave Analysis | Daily Chart

Technical Analysis Overview – Trading Lounge

Function: Trend

Mode: Impulsive

Structure: Impulsive

Position: Wave V

Direction: Upside toward Wave V

Details: An impulsive rally is anticipated in Wave V, aiming for a move equivalent to 100% of Wave I.

Daily Chart Summary:

Snowflake Inc. (SNOW) remains in a bullish structure on the daily timeframe. The price continues its move higher toward Wave V. The current structure suggests the potential for a breakout above previous resistance levels, confirming underlying market strength. Since Wave III was the extended wave, Wave V is expected to target a move equal in length to Wave I. This development offers a favorable short-term setup for bullish positioning.

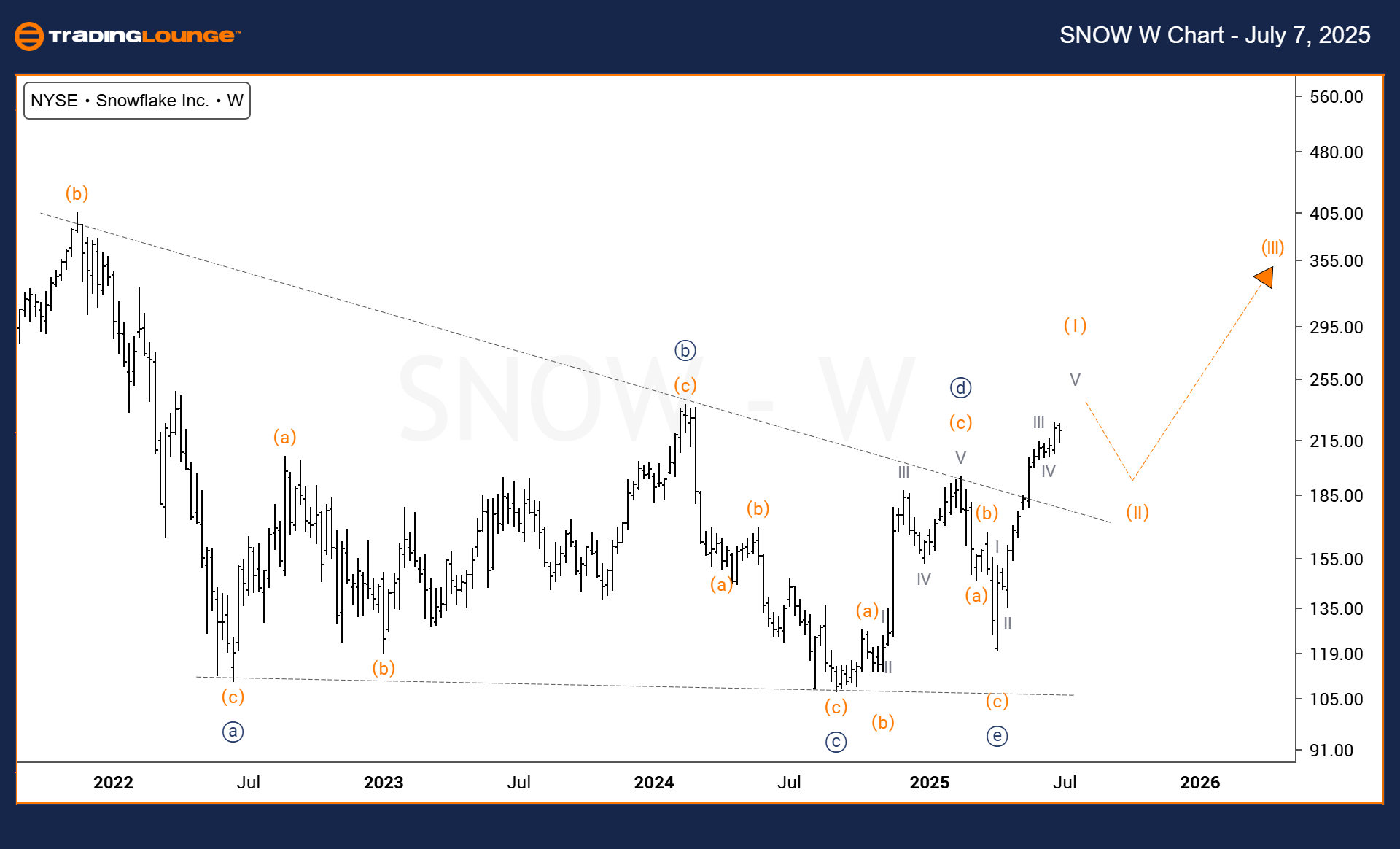

Snowflake Inc. (SNOW) – Elliott Wave Analysis | Weekly Chart

Technical Analysis Overview – Trading Lounge

Function: Trend

Mode: Impulsive

Structure: Impulsive

Position: Wave (III)

Direction: Upside toward Wave (III)

Details: After a breakout from triangle consolidation, Wave (I) has concluded. A sharp advance is projected in Wave (III) once Wave (II) finishes.

Weekly Chart Summary:

On the weekly chart, SNOW is advancing in a strong impulsive trend within a broader bullish framework. Wave (I) has already completed following a breakout from a consolidation triangle. Currently, the market is moving through Wave (II), and once this corrective leg ends, a strong Wave (III) is anticipated. Wave (III) typically carries significant momentum, representing a key opportunity. Traders should observe resistance and potential consolidation areas before the upward continuation resumes.

Technical Analyst: Dhiren Pahuja

More By This Author:

Unlocking ASX Trading Success: BHP Group Limited - Monday, July 7

Elliott Wave Technical Analysis: Australian Dollar/U.S. Dollar - Monday, July 7

Elliott Wave Technical Analysis: Russell 2000 - Monday, July 7

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more