U.S. Stocks: IonQ, Inc.

IonQ, Inc. (IONQ) – Elliott Wave Analysis (Daily Chart)

Technical Analysis Overview – Trading Lounge

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Corrective

POSITION: Wave A of y

DIRECTION: Downside in Wave C

DETAILS: Price targeting $25 and then $20 as Wave C nears completion

In the daily timeframe, IonQ, Inc. (IONQ) is advancing through the final stages of its corrective structure. Wave C, within Wave y, is leading the price toward the $25 level, and potentially to $20. This movement suggests the conclusion of a larger corrective phase may be near. As Wave B finishes, a decline in Wave C is likely to follow, setting up a possible short-term bearish opportunity.

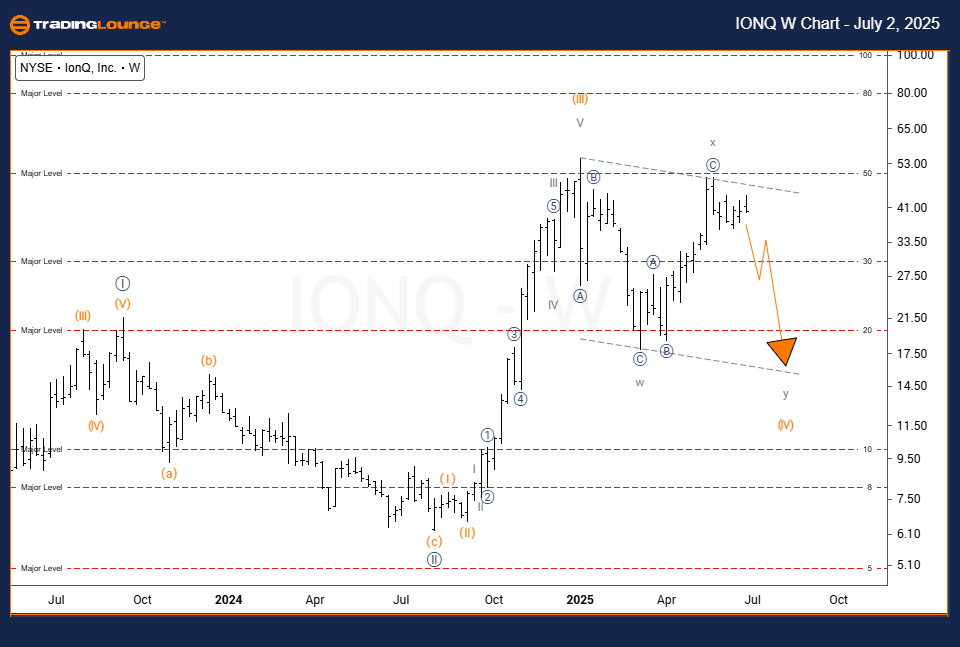

IonQ, Inc. (IONQ) – Elliott Wave Analysis (Weekly Chart)

Technical Analysis Overview – Trading Lounge

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Corrective

POSITION: Wave y of (IV)

DIRECTION: Downside into Wave y

DETAILS: Wave y has reached 100% of Wave w’s length, indicating maturity

The weekly chart for IonQ shows a mature corrective structure forming as Wave y of Wave (IV) nears completion. The stock has achieved a price extension equaling 100% of Wave w, a common threshold signaling a possible end to the correction. While the overarching trend remains bullish, this area could mark a short-term bottom. Traders should monitor price behavior for potential support and signs of a new impulse move.

Technical Analyst: Dhiren Pahuja

More By This Author:

Unlocking ASX Trading Success: Mineral Resources - Wednesday, July 2

Elliott Wave Analysis: British Pound/U.S. Dollar - Wednesday, July 2

Elliott Wave Technical Analysis TASI Index - Wednesday, July 2

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more