US Back On Top (Sort Of)

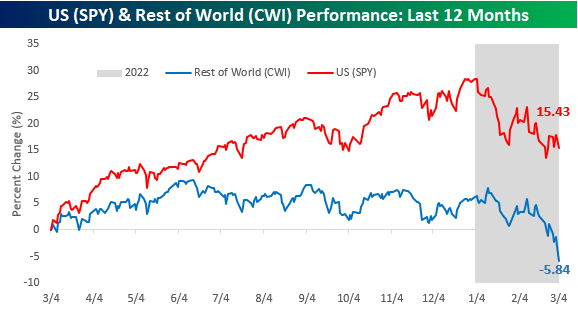

Heading into 2022, there was a ton of optimism towards international stocks. After years of underperformance, the feeling was that valuations had become so skewed in favor of international stocks that they were due for their day in the sun. When the calendar finally did flip, international stocks came out of the gate positively, and as US stocks pulled back, international stocks held up much better. The resilience of international stocks didn’t last long, though. As the Russia-Ukraine war has escalated, investors have been ditching international equities en masse, while US stocks have actually held up relatively well. Over the last year now, US stocks, as measured by the S&P 500 tracking ETF (SPY) are up over 15%. International stocks, on the other hand, as measured by the SPDR MSCI ACWI ex-US ETF (CWI) are now down over 5%!

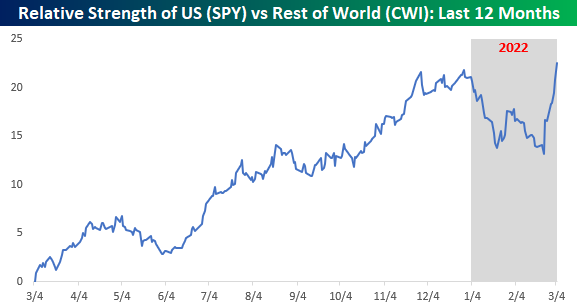

The relative strength picture between US and international stocks really illustrates how international stocks appear to have had their 15 minutes come and go. When 2021 ended, the relative strength of US stocks versus the rest of the world was right near a 52-week high. Once 2022 kicked off, though, US stocks saw a big slide in relative performance bottoming out on 2/23 – the day before Russia invaded Ukraine. Since that invasion, US relative performance has spiked higher and is right back to levels it started the year at. Investors have clearly fled to the relative safety of US stocks given the geo-political turmoil, so as long as these conditions remain, international stocks are subject to headwinds. If tensions do start to de-escalate, though, international equities may find themselves back in the spotlight again.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more