Upside For The Market Is Limited

Image Source: Pixabay

SPX Monitoring purposes; Sold long 9/13/24 at 5626.02= gain 2.23%; Long SPX on 9/5/24 at 5503.41.

Sold SPX on 8/19/24 at 5608.25 = Gain 8.14%gain; Long SPX on 8/5/24 at 5186.33.

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

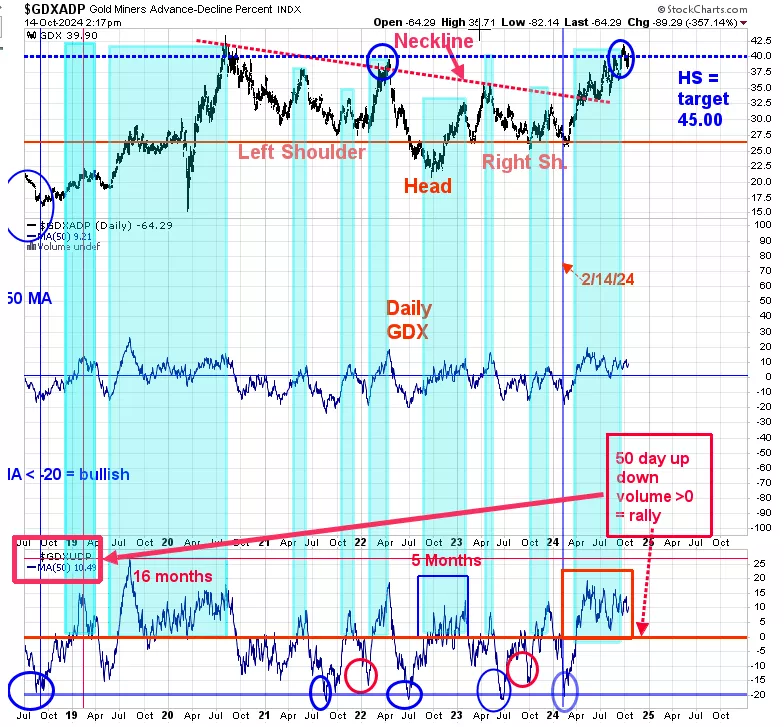

Monitoring purposes GOLD: Long GDX on 10/9/20 at 40.78.

We are up over 28% this year so far; SPX up around 20%. Above is the SPX/TLT ratio with its RSI (top window) and next lower window is the daily SPX. The RSI for the SPX/TLT ratio has reached bearish level of 82 today (noted previous RSI readings >70 with blue dotted lines) suggesting upside for the market is limited. Seasonality wise market hits a high around mid October and declines into the Election. Ideally we would like to see the RSI reach near 30 on the SPX/TLT ratio for a bullish setup going into the 2024 Election. Both previous Elections lows in 2016 and 2020 where Trump was a candidate, produced RSI near 30 and it’s likely it will happen this time around.

The top window is the weekly SPX and next lower window is the SPX/VIX ratio. Negative divergence is present when the SPX makes higher high and the SPX/VIX ratio makes lower high (noted in shaded pink).The current divergence started in July.Normally a corrective wave starts around mid October and declines into the election which is November 5 and the SPX/VIX divergence suggesting this potential decline is likely.

(Click on image to enlarge)

The bottom window is the 50 day average for the up down volume percent for GDX. GDX is considered in an uptrend when the 50 day moving average is above “0” (current reading is +10.49).We shaded in light green the times when this moving average is above “0”. This indicator first closed above “0” back in early April and remains in bullish territory.

More By This Author:

Upside For The Market Was Limited

Bearish For The Short Term

New Highs Later This Year

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more