Unlocking ASX Trading Success: Fortescue Ltd - FMG Elliott Wave Analysis & Elliott Wave Technical Forecast - Tuesday, January 14

ASX: FORTESCUE LTD - FMG Elliott Elliott Wave Technical Analysis TradingLounge

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with FORTESCUE LTD - FMG. We see ASX:FMG about to move very high with wave 3. Today’s in-depth analysis gives you all the important data, including specific visual price levels to know when the bullish uptrend starts and when it reaches its highest probability, as well as invalidation points to know when we will be wrong.

ASX: FORTESCUE LTD - FMG 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey

Details: Wave 2-grey has completed a Double Zigzag at the 17.20 low and wave 3-grey is probably unfolding to push much higher. A push above 18.86 would be the first step to add weight to this bull market view.

Invalidation point: 15.88

Confirmation point: 18.86

(Click on image to enlarge)

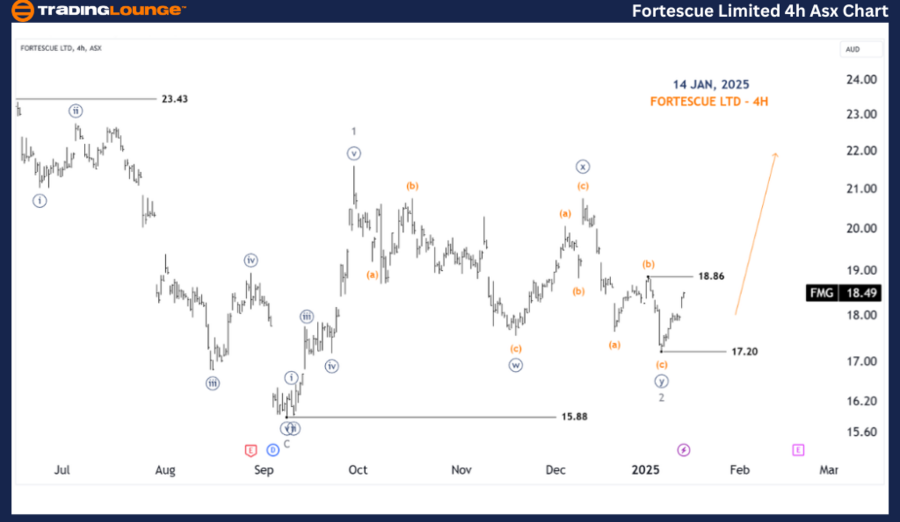

ASX: FORTESCUE LTD - FMG 4-Hour Chart Analysis

Function: Major Trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey

Details: Nothing has changed, it details the wave 2-grey, which is a Double Zigzag labeled ((w))((x))((y))-navy, yes it has enough waves, and it is over. Now wait a little more and everything will be clear. And we can take a Go Long position when the 20.00 level becomes tested support, and that is also the best position we can take.

Invalidation point: 17.20

Confirmation point: 18.86

(Click on image to enlarge)

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: FORTESCUE LTD - FMG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

More By This Author:

Elliott Wave Technical Analysis: AAVE Crypto Price News For Tuesday, Jan 14

Microsoft Inc. Stocks Elliott Wave Technical Analysis - Monday, January 13

Adani Ports And Sez Indian Stocks Elliott Wave Technical Analysis - Monday, January 13

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.fdd5f717f6311107c9af6eda55485a72.png)