Microsoft Inc. Stocks Elliott Wave Technical Analysis - Monday, January 13

MSFT Elliott Wave Analysis Trading Lounge

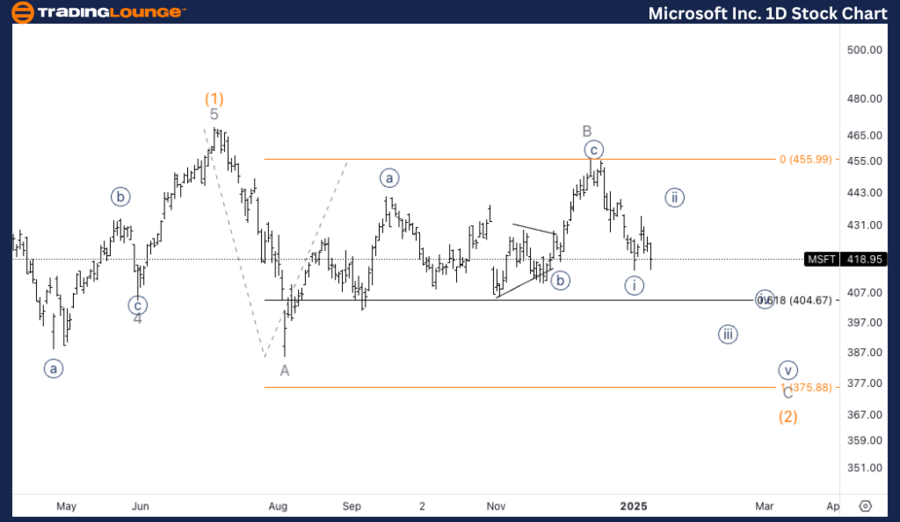

Microsoft Inc., (MSFT) Daily Chart

MSFT Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Minor wave C

DIRECTION: Downside in wave C of (2).

DETAILS: We are looking for downside into what appears to be an Intermediate wave (2). If we were to break and found resistance on top of 400$ we could expect further downside towards MG2 of 300 at 380-372-365.

(Click on image to enlarge)

Microsoft Inc., (MSFT) 1H Chart

MSFT Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave {i} of C.

DIRECTION: Downside in wave C.

DETAILS: Looking for a potential bounce in wave {ii} of C as we seem to have a five wave move completed in wave {i}. Looking for another leg higher in what could be wave (c) of {ii} and then continue lower.

(Click on image to enlarge)

This Elliott Wave analysis for Microsoft Inc., (MSFT) examines both the daily and 1-hour charts to assess its current market trend, utilizing Elliott Wave Theory to anticipate potential future movements.

* MSFT Elliott Wave Technical Analysis – Daily Chart*

Microsoft appears to be completing a wave C of the corrective wave (2). The downside pressure is evident, and a key level to watch is the $400 mark. If the price breaks and establishes resistance near $400, further downside may be anticipated towards the MinorGroup2 (MG2) support levels around $380, $372, and $365. These levels would serve as potential targets before the correction completes.

* MSFT Elliott Wave Technical Analysis – 1H Chart*

On the 1-hour chart, a five-wave decline in wave {i} seems to have been completed within the larger wave C. Currently, we are likely to see a corrective bounce in wave {ii}, potentially developing into an (a)-(b)-(c) structure. After this correction, downside is expected to continue in wave {iii} of C, confirming the overall bearish trend until support levels in the 380-365 range are tested.

More By This Author:

Ethereum Crypto Price News Today Elliott Wave Technical Analysis - Monday, January 13

Unlocking ASX Trading Success: Fisher & Paykel Healthcare Corporation Limited – FPH Stock Analysis & Elliott Wave Technical Analysis - Monday, January 13

Comprehensive Elliott Wave Analysis For SP500, Nasdaq 100, Apple, Tesla & Bitcoin

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.a1fb2e901a086ac34f3e1b6469f51e35.png)