Uber Q3 Preview: Rebound Quarter Inbound?

The Zacks Computer and Technology Sector has struggled to find its footing in 2022 amid a hawkish pivot from the Fed, down more than 30% and widely lagging behind the S&P 500.

A popular company residing in the realm, Uber Technologies (UBER) , is on deck to unveil quarterly earnings on November 1st, before the market open.

Uber Technologies provides a platform that allows users to access transportation and food-ordering services.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a D.

How does company stack up? Let’s take a closer look.

Share Performance & Valuation

UBER shares have sailed through rough waters in 2022, down more than 30% and widely underperforming the general market.

(Click on image to enlarge)

Image Source: Zacks Investment Research

However, UBER shares have enjoyed a stellar run over the last three months, up more than 17% and crushing the S&P 500’s performance.

(Click on image to enlarge)

Image Source: Zacks Investment Research

After a tough start to the year, it seems that buyers are finally stepping up.

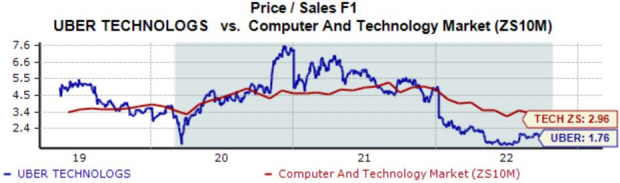

The company’s forward price-to-sales ratio sits at 1.8X, a fraction of its 4.3X median since IPO and representing a 44% discount relative to its Zacks Computer and Technology sector.

Image Source: Zacks Investment Research

Quarterly Estimates

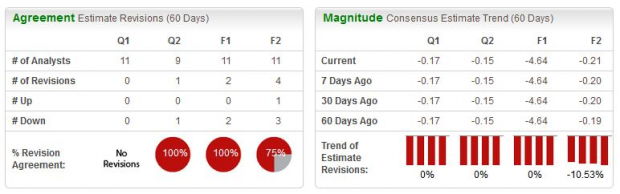

Analysts have been silent for the quarter to be reported over the last several months, with no earnings estimate revisions coming in. Still, the Zacks Consensus EPS Estimate of -$0.17 suggests Y/Y earnings growth of more than 25%.

Image Source: Zacks Investment Research

UBER’s top-line is also in solid standing; the Zacks Consensus Sales Estimate of $8.1 billion suggests a Y/Y uptick of more than 65%.

Quarterly Performance & Market Reactions

Uber has fallen short of earnings estimates as of late, posting back-to-back bottom-line misses. In its latest quarter, the company fell short of earnings expectations by more than 400%.

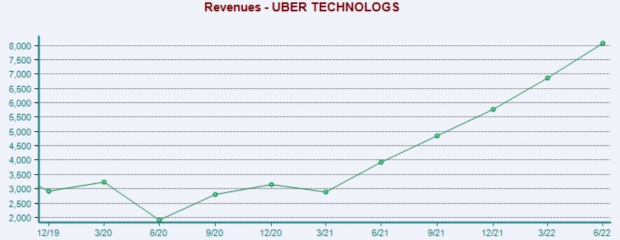

However, revenue results have been much more positive; the company has chained together five consecutive sales beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Additionally, the market cheered on its latest earnings release, with shares climbing roughly 20% following the report.

Putting Everything Together

UBER shares are in the red YTD but have gone on a strong run over the last three months, indicating that the selling has slowed down.

The company’s forward price-to-sales ratio sits well below its median since its IPO and its Zacks sector average.

Analysts have been silent for the quarter to be reported, but estimates suggest solid growth within both revenue and earnings.

The company has struggled to exceed bottom-line estimates as of late, but revenue results have been consistently strong.

Heading into the release, Uber Technologies (UBER Quick QuoteUBER - Free Report) carries a Zacks Rank #3 (Hold) with an overall VGM Score of a C.

More By This Author:

Amazon's Q3 Earnings Fall Y/Y, Sales Miss Estimates

Should Investors Buy CVS Stock Before Q3 Earnings?

Making Sense Of Big Tech Earnings After Amazon And Meta Tumble

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more