Should Investors Buy CVS Stock Before Q3 Earnings?

Trading 15% from its highs, CVS (CVS) is set to report Q3 earnings on Wednesday, November 2. CVS has held up better than the broader market and is part of a top-rated industry at the moment. Investors hope the company can capitalize on its ambition to sustain itself as an industry leader as the Retail-Pharmacies Drug Stores Industry is currently in the top 18% of over 250 Zacks Industries.

CVS has continued to innovate and is far from the glorified local pharmacy store that it used to be. The company has integrated offerings across the entire spectrum of pharmacy care and includes insurance and health care benefit services after the acquisition of Aetna in 2018.

CVS’s structural realignment began back in Q1 2019. Investors now want to focus on growth in the company’s four business segments: Pharmacy Services, Retail/Long Term Care (LTC), Health Care Benefits, and Corporate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Wall Street will be looking for growth and the ability to lower operating costs in the Pharmacies Services segment. It is important to note that the mail order and specialty pharmacy operations of Aetna were moved to this area of the business from the Health Care Benefits segment.

Stronger performances among the Pharmacies Segment will highlight the boost its traditional core business is receiving from the $70 billion consolidation of insurance-giant Aetna. This could also help increase CVS’s better-than-average performance over the last year.

Overview

Last quarter, CVS revenue was up 11% from Q2 2021 at $80.6 billion. However, earnings were down -1% at $2.40 per share as the company dealt with a challenging economic environment. The company was able to generate $9 billion in cash flow from operations which should help and it posted growth in all of its business segments.

Most importantly, the Pharmacy Services segment increased total revenue by 11.7% to $42.81 billion. This accounted for more than half of the company’s revenue, and operating income increased 5.7% year over year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

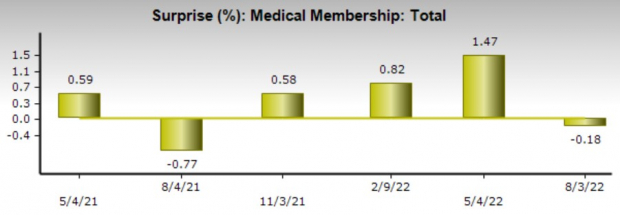

It is noteworthy that medical memberships in the Health Care Benefits segment increased by 922,000 from Q2 2021 to 24.4 million members. This left the expected members added virtually flat for the period as shown in the chart above, despite the tougher operating environment. Revenue also increased 11% and operating income was up13.4%.

Investors hope that growth from all of CVS’s segments continued during Q3 as the company slightly raised its 2022 full year EPS and cash flow guidance range to $8.40 -$8.60, and $12.5 billion-$13.5 billion, respectively.

Q3 Outlook

The Zacks Consensus Estimate for CVS’s Q3 earnings is $1.99 per share, which would represent a +1% increase from Q3 2021. Sales for Q3 are expected to be up 4% at $76.53 billion. Earnings estimates for the period have slightly declined from $2.01 at the beginning of the quarter.

Year over year, CVS earnings are expected to be +1% and rise another 8% in FY23 at $9.20 per share. Top line growth is expected as well, with sales edging up 7% this year and rising another 5% in FY23 to $328.07 billion.

Performance & Valuation

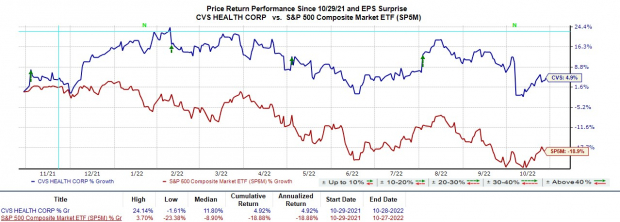

Year to date CVS is down -9% to outperform the S&P 500’s -21%. This has also outperformed the Retail-Drug Stores Markets -16% and its peer group’s -47% with notable competitor Walgreens Boots Alliance (WBA).

(Click on image to enlarge)

Image Source: Zacks Investment Research

Even better, over the last two years, CVS’s total return which includes its strong dividend is +75% to crush the benchmark. This also beat its Zacks Subindustry’s +51% and its peer group’s +18%. Investors will be hoping a strong Q3 could help CVS stock get back to this stellar performance.

Trading around $94 a share, CVS has a P/E of 10.8X. This is above the industry average of 7.9X but CVS has proven to be the leader in the industry. Plus, CVS trades at a discount to its decade-high of 21.8X and below the median of 12.8X. And CVS still trades at a discount relative to the benchmark despite widely outperforming the market over the last few years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

CVS currently lands a Zacks Rank #3 (Hold). While this year and FY23 earnings estimates have gone up, revisions are slightly down for Q3. However, CVS does offer longer-term investors a solid 2.37% dividend yield at $2.20 a share. And the average Zacks Price Target offers 30% upside from current levels.

Investors will be hoping for continued growth among CVS’s business segments and that it can lower operating costs despite a challenging operating environment. Wall Street will also want to see the company reaffirm its full year guidance going into Q4 and offer some outlook for FY23. This along with a strong earnings beat could get some momentum going in the stock.

More By This Author:

Making Sense Of Big Tech Earnings After Amazon And Meta Tumble

4 Chemical Stocks Poised To Outshine Q3 Earnings Estimates

Key Factors To Know Ahead of UBER's Third-Quarter Earnings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more