Tuesday Talk: Up Or Down, Today?

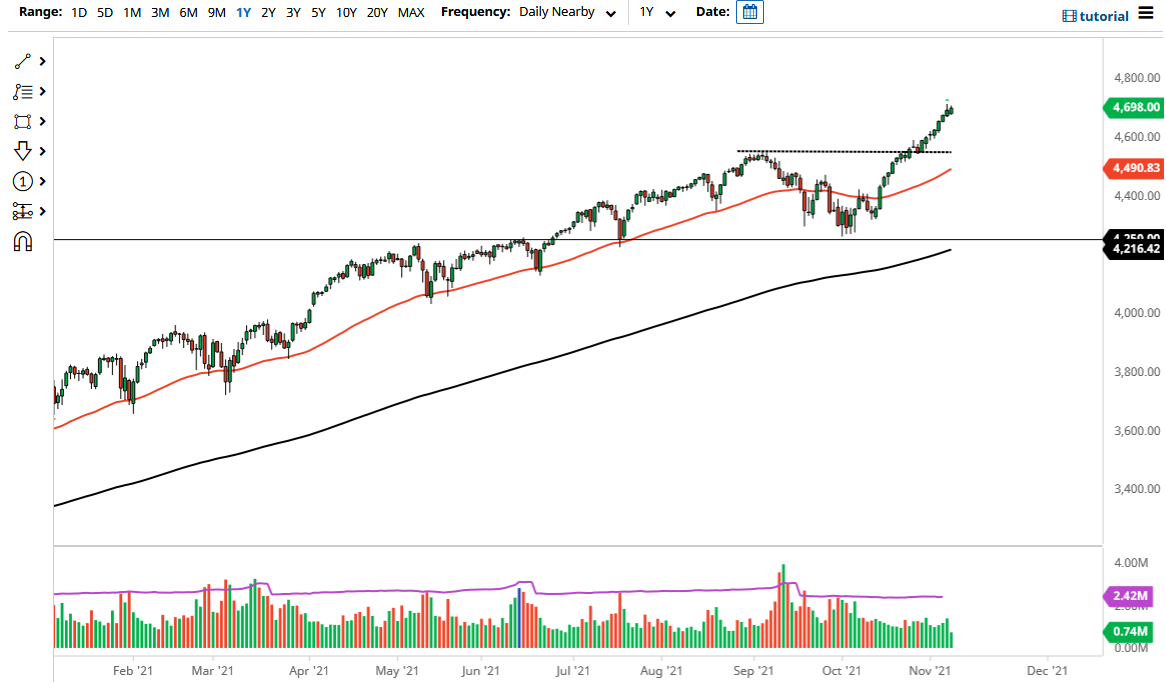

The market has been climbing since the middle of October and one wonders when it will reach the apex of its current climb. Yesterday, both the S&P 500 and the Nasdaq Composite seemed to pause mid-rise, though the Dow climbed over 100 points.

The S&P 500 closed at 4,702, up 4 points, the Dow closed at 36,432, up 104 points and the Nasdaq Composite closed at 15,982, up 11 points. Currently market futures are mixed, S&P futures are up 1 point, Dow futures are down 49 points and Nasdaq 100 futures are up 57 points.

Contributor Michael Kramer notes that Stocks Rise On November 8 Ahead Of Take’em Down Tuesday and makes the following observations:

"Stocks did a lot of nothing today (Monday, Nov. 8), with the S&P 500 finishing the day higher by nine bps. That is two doji’s in a row; I guess there is a lot of indecision up here. Given that the index has rallied in a straight line higher since the middle of October, there should be. I have pointed out the potential train wreck in the making building over the past couple of days. It seems that finally, all of the ingredients are now in place for a take ’em down Tuesday."

"The VIX, VXN, and VVIX traded higher today as implied volatility rises. It doesn’t matter to me why they are rising, put buying, or excessive call volume. In the end, the outcome may very well be the same; stocks should trade lower. If the VIX is rising on call volumes, it is an even worse sign of things to come because once implied volatility gets too high, all that call volume will disappear, which means market makers will need to unwind their hedges by selling stock. Pick your poison."

Kramer also has these notes on PayPal (PYPL), Amazon (AMZN) and Advanced Micro Devices (AMD):

"PayPal is rising after reporting quarterly results that weren’t too impressive. The company also said people would be able to use Venmo on Amazon. The stock has been pounded, and when companies provide weak guidance and are growth companies, they tend to go down. That is just how it is supposed to work. The stock dropping to roughly $210 seems like a very real possibility...I guess now there are no more questions about whether Amazon will fill the gap at $3575 because it was filled today. I still fully expect this stock to be dead money for some time to come and for the shares to drop back to $3300...AMD joined gammamania today, jumping by 10%. Nothing more, nothing less. Maybe it goes to $160 before the unwind begins."

See the full article for the stock and indices charts.

TalkMarkets contributor Christopher Lewis seems to think that enough is enough in his latest post, S&P 500 Forecast: Index Continues To Pressure To Upside.

"I am not willing to buy this market anymore, at least not until we get some type of clarity, and I think you need to find value to get that clarity. The S&P 500 (SPY, SPX) has shown itself to be bullish yet again on Monday, but I am a bit concerned about the overall attitude of the market as it has been straight up in the air for a while. In other words, this is a market that is probably overbought on just about any metric you use. Nonetheless, you clearly cannot be a seller, as it has been so strong...Yes, we are in the midst of earnings season and it is likely that we will see plenty of noisy behavior, so you need to be cautious but look for signs of support after pullbacks in order to take advantage of any fluctuations in this market. Markets do not go in the same direction forever, so please keep that in mind."

TalkMarkets contributor Bill Smead says the current state of the market reminds him of the premise of the film "Blithe Spirits", in his article Blithe Stock Market Spirits. The article is both pithy and insightful, especially his look back at prior "episodes of financial euphoria", as he puts it. Here are some of the things he has to say:

"The main character, (in the movie) is visited by his dead ex-wife... At first, she charms her widowed and re-married husband, but then she haunts him and his new wife, leading to their ultimate death. This is exactly how bull markets work. They start out inexpensive and fundamentally advantageous, then they charm investors with attractive and many times spectacular returns. However, in the process, they lead investors down a rabbit trail which ends up taking them off a cliff. Ironically, that is how the writer’s second wife dies. Her husband’s deceased wife sabotages the gas pedal and she plunges off a cliff on the coast of England."

"...several well known euphoria episodes got names in their aftermath: the Roaring 1920s, the Go-Go 1960s and the late 1990s DotCom bubble. What did they have in common and what did their blithe spirits look like? They all included innovation, meteoric returns, stretched valuations and participation by investors who don’t normally participate...we don’t have to wonder if public participation matches extremes of the last 100 years. Today’s motley fools have their own chat rooms with names like Reddit, their own brokerages like Robinhood, and their own new forms of insanity like Special Purpose Acquisition Companies (SPACs) and meme trades. Meme trades are where motley and other sorts of fools go to gang up on short sellers and temporarily drive up low quality stocks with big short positions through the roof...Joe Kennedy made a fortune in the 1920s and decided to sell out when the shoeshine boy was giving him stock tips. Peter Lynch knew the end of the bull market was near when people he met in social situations were giving him tips on what to buy. We have had that happen so many times this year that its depressing."

To counter this, Smead suggests investors look for value oriented issues. Check out the full article.

Elsewhere contributors Bert Colijn and Inga Fechner wonder When Will Supply Chain Frictions And Input Shortages Abate?

"Expect disruptions to last well into 2022, which will result in higher trending goods inflation and production hiccups dampening the recovery in production...the industry is dealing with widespread supply chain frictions and shortages on a global scale. This, in turn, is causing frontloading by worried businesses, which is exacerbating the problem across supply chains and resulting in large increases in backlogs, production hiccups, and even shutdowns, as well as large price pressures. The most significant problems still stem from 1) transportation problems and 2) semiconductors, with the container crisis causing larger disruptions in the US, while semiconductor shortages are having a bigger impact in Europe."

"Factors arguing in favor of easing in the short-term are still limited. Extending operating times up to 24/7 to ease cargo congestion, as done in the US, helps to a certain extent, but with problems along supply lines, such as missing truck drivers, won’t untie the many knots hampering smooth world trade."

"What if the current situation reverses and we are faced with overcapacity, either because of a drop in economic activity or because of an oversupply in ships? To react to recent capacity bottlenecks, carrier ship orders surged strongly. However, lead times to build new vessels are long, meaning that the ships now being manufactured will only become available to a large extent in 2023. Therefore, it's unlikely to be a pressing issue before this date. In addition, with demand expected to remain robust overall, the container flow will remain solid and bottlenecks are set to continue for some time. Even if there were a sudden drop of economic activity, clearing existing orders will take months as it will take time for things to return to normal all along the supply chain."

"The main downside risk (to economic growth) is around more drastic production cuts when shortages morph into real bottlenecks. That could lead to more significant output shocks and put the growth recovery at risk. With services still recovering at a fast pace though, there is a solid base under the global growth recovery at the moment, making the supply chain problems more of a fly in the ointment for the outlook right now."

Read the full article for a more detailed picture.

I'll close out today's purview with contributor James Picerno, who remarks that US Inflation Outlook Continues To Run Hot.

"Anyone looking for convincing signs that inflation’s peaking via tomorrow’s CPI report for October (Nov. 10) looks set to be disappointed. Economists are projecting that pricing pressure will turn higher, based on Econoday.com’s consensus point forecast. Headline consumer inflation is on track to rise 5.8% on a year-over-year basis, up from September’s 5.4% increase. If correct, the gain will mark a new pandemic peak, posting the hottest headline inflation since 2008 (using unadjusted data)."

Not one to bear just more bad news (though caveated by "perhaps") Picerno closes out his article with this:

"Some analysts see some light at the end of the tunnel. Julian Howard, director of multi-asset solutions at GAM, says there are signs that the “rate of ascent” in inflation is starting to ease. “So I see an easing of inflation across the board and I think that the Fed will have been proved right to keep stalling and stalling on rate rises because the data will eventually bail them out on this, and I think Jerome Powell’s been extremely sensible on the matter.”"

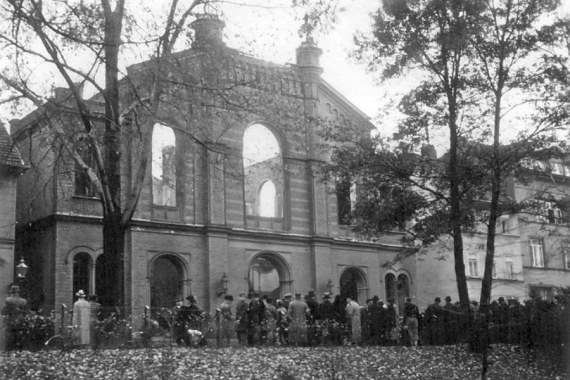

Today commemorates the 83rd anniversary of Kristallnacht. Below is a photograph of the burned out synagogue of the Jewish community of Erfurt which was set on fire that fateful night.

May we always be mindful of the perils of fascism and may we continue to live healthy, productive and free lives.

I'll be back on Thursday.