Tuesday Morning Rundown

There’s not a lot going on this morning but I’ll touch on a few things to keep an eye on.

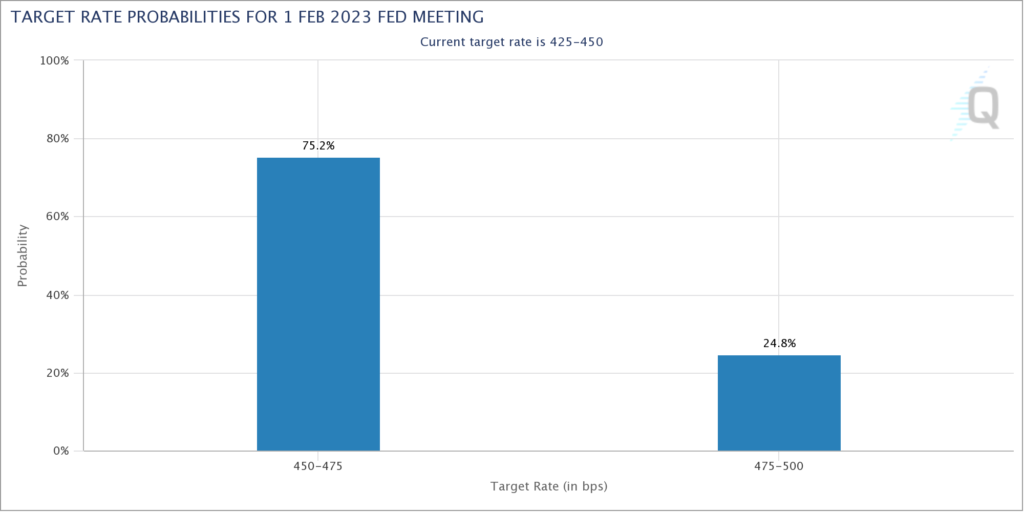

The most important event this week is the December CPI on Thursday morning at 8:30 am EST. In this morning’s WSJ, “The Fed Whisperer” Nick Timiraos profiled San Francisco Fed President Mary Daly who will likely support a quarter-point hike on February 1 as long as the inflation data on Thursday show continue cooling. Atlanta Fed President Raphael Bostic is on the same page (“Daly Sees Merits In Quarter-Point Rise” [SUBSCRIPTION REQUIRED]). Therefore I continue to believe that the CPI report could be a “bear killer”.

(Click on image to enlarge)

Lululemon (LULU) yesterday modified the current quarter guidance. Gross margin is expected to be 100-130 basis points lower than previously expected though Selling, General, and Administrative (SG&A) expenses will offset about half of that by improving 70 basis points. Revenue is also expected to be higher than expected with the upshot that EPS guidance is essentially unchanged. Nevertheless, LULU shares fell 9.29% yesterday on heavy volume and I would still stay away from them for the reasons noted last month.

Lastly, the Big 4 commercial banks report earnings Friday morning. As I noted in the “Market Preview Week of Jan 9-13”, their loan portfolios will be scrutinized for any increase in delinquencies and defaults that the weakening economy may be causing though my guess is that this will most likely not be felt until later this year.

#earnings for the week https://t.co/lObOE0dgsr$TLRY $BAC $UNH $JPM $DAL $CMC $WFC $C $AYI $TSM $BLK $BK $ACI $SNX $KBH $WDFC $JEF $FRC $AZZ $ETWO $ACCD $APLD $OGI $SAR $NTIC $RFIL $WIT $INFY $NOTV pic.twitter.com/pL9n1P9Ei8

— Earnings Whispers (@eWhispers) January 7, 2023

More By This Author:

Thursday’s CPI Could Be A Bear KillerMarket Preview Week Of Jan. 9-13

What Does CAG’s Big Quarter Mean?