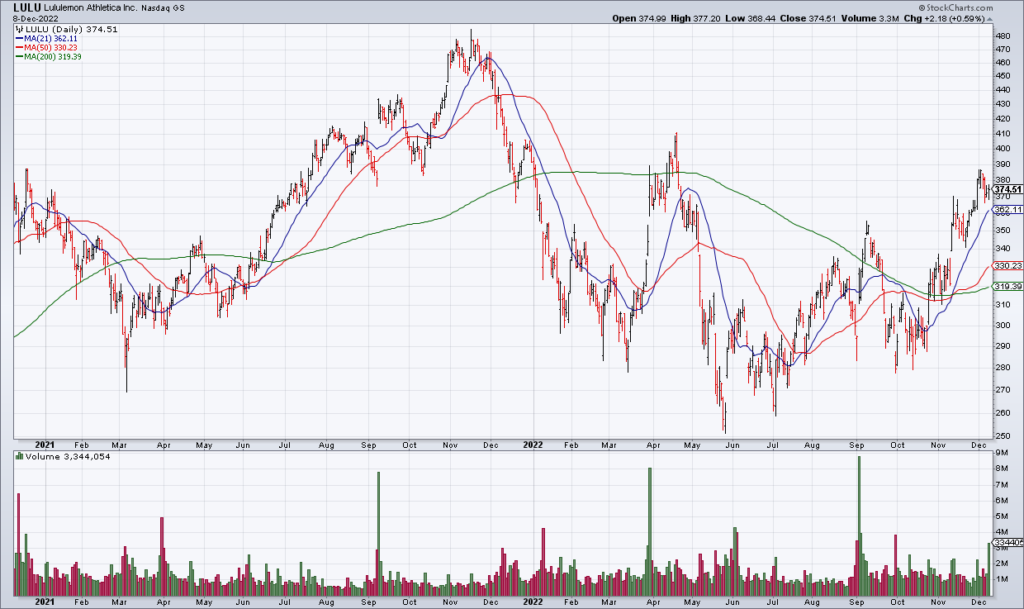

LULU Is A Great Company But Now Is Not The Time

(Click on image to enlarge)

Athletic apparel maker Lululemon (LULU) is a great company but now is not the time for the stock. LULU reported a solid 3Q22 with comps of +22% and EPS of $2.00. However, the stock is -6% in the premarket as 4Q22 guidance was a little light compared with Wall Street’s expectations.

There are two problems for LULU in my opinion that together make it a sell: the macro environment and valuation. With inflation and a weak economy squeezing consumers LULU sells exactly the kind of discretionary products that they can do without. While LULU caters to a higher-end clientele they are still not immune from the macro forces in play. As I’ve said many times before: In this economic climate, you want companies that sell necessities, not luxuries.

In addition to the macroclimate, LULU is too expensive. They are guiding full-year EPS to $9.87-$9.97. That’s 38x based on Thursday’s closing price of $374.51. That valuation leaves a lot of room for the stock to come in – especially if the business performance isn’t stellar which I suspect it won’t be because of the macro climate.

I never want to discourage women from buying spandex but I’m bearish on LULU stock for the time being.

More By This Author:

DOCU & COST Earnings Follow Up

Don’t Worry About COST

CPB Will Go Higher But Wait For A Pullback

Can you give $TSLA and $NVDA levels?