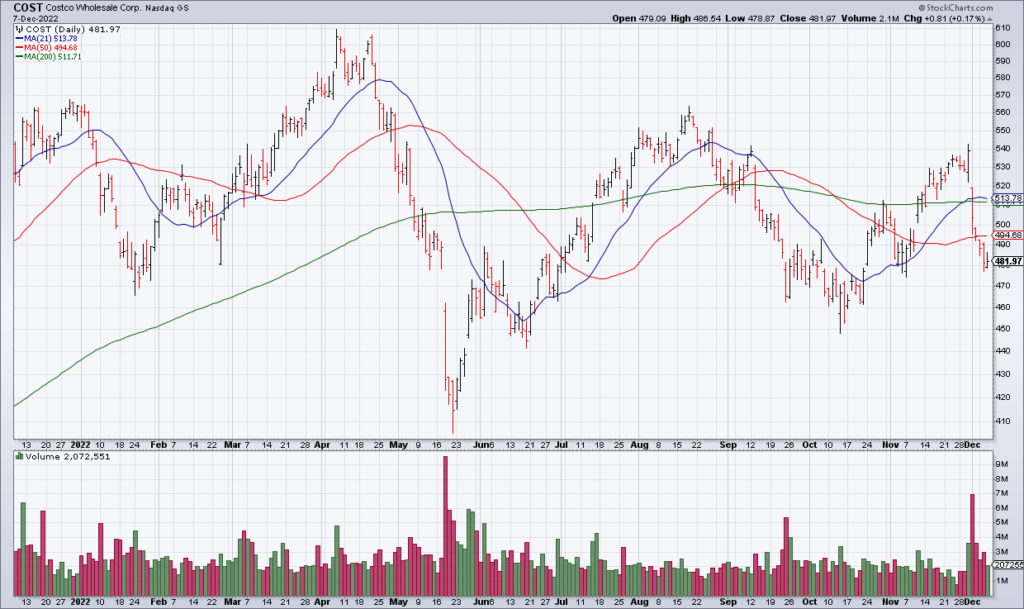

Don’t Worry About COST

(Click on image to enlarge)

Costco (COST) has dropped $60 over the last five sessions in response to weaker than expected November sales. November Adjusted Comps were +5.3% while Ecommerce was -8.9%. Investors seem to be worried that consumers cutting back on discretionary items will hurt COST. However COST remains a price leader at a time when money is tight for many. Business is likely to remain strong for them for the foreseeable future and the drop probably represents a buying opportunity.

The problem with COST stock has always been valuation. COST earned $13.14/share in their fiscal year ended August 28, 2022. My estimate is that they’ll earn $15/share in their current fiscal year. That means that COST is trading at a 32x forward P/E.

While I generally wouldn’t pay that multiple for a consumer staples company COST is an exception. That’s because the quality of the business is so high. COST is a legendary company that always seems to deliver and its stock is custom made for the tough times we’re going through. I plan to acquire a small position, buying half today ahead of earnings and half after.

More By This Author:

CPB Will Go Higher But Wait For A PullbackSpeculating On CPB Earnings

Speculating On DOCU Earnings