TSLA Shares Rise On AI & Cybertruck Optimism After Top- & Bottom-Line Miss

Tesla disappointed investors with its Q3 earnings report, missing on top-line, bottom-line, and margins as the company's focus on reducing cost (and price) per vehicle impacted the numbers:

- Tesla 3Q Adj EPS 66c, Est. 74c

- Tesla 3Q Rev. $23.4B (Up 9% Y/Y), Est. $24.06B

- Tesla 3Q Gross Margin 17.9%, Est. 18%

Though arguably, maintaining margins amid this massive price war is noteworthy (though it was down from 25.1% a year ago).

“We continue to believe that an industry leader needs to be a cost leader,” the company said.

“During a high interest rate environment, we believe focusing on investments in R&D and capital expenditures for future growth, while maintaining positive free cash flow, is the right approach.”

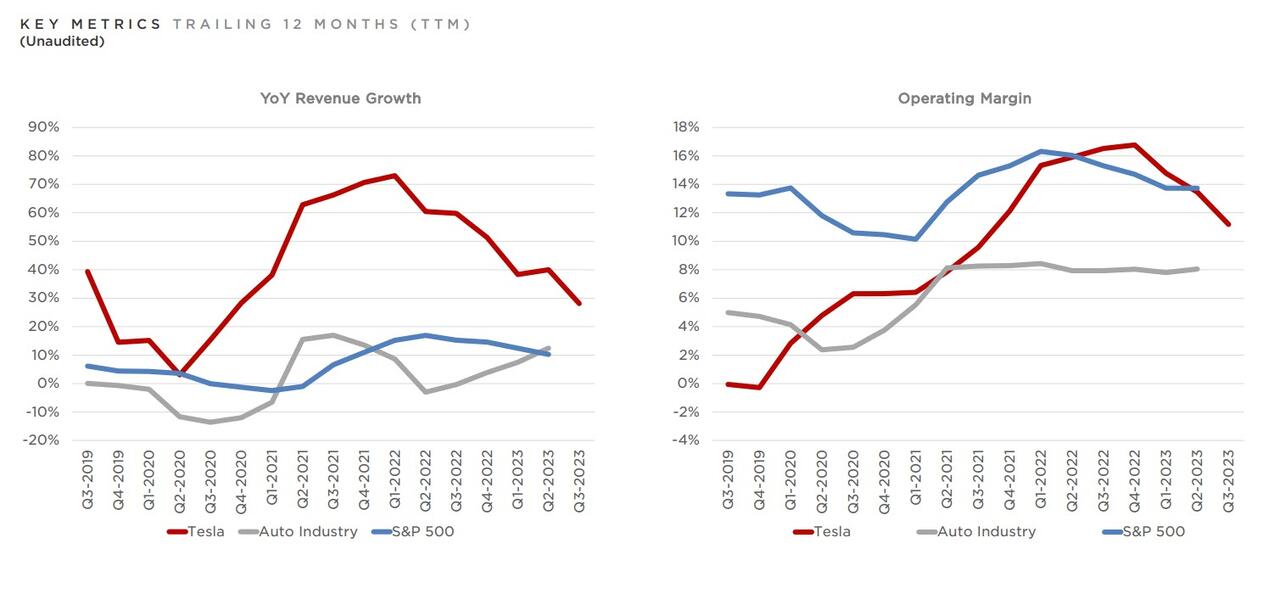

As the RHS chart below shows, Tesla still has considerable edge over the industry with regard to margins.

(Click on image to enlarge)

Revenue was impacted by the following items:

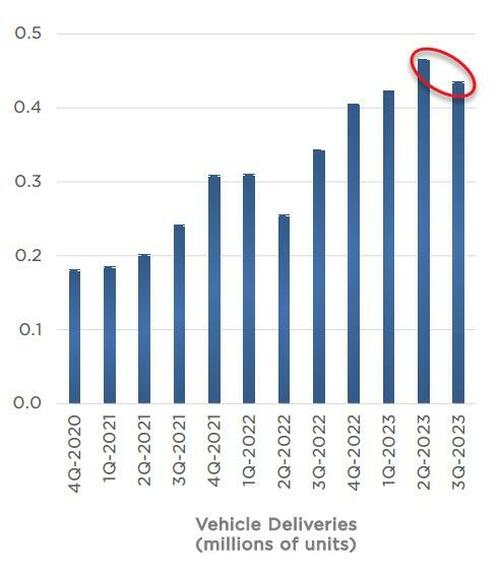

+ growth in vehicle deliveries

+ growth in other parts of the business

- reduced average selling price (ASP) YoY (excluding FX impact)

- negative FX impact of $0.4B

Free cash flow disappointed at $848 million, well below the estimate of $2.59 billion.

And Tesla still sees production 1.8 million vehicles this year (in line with the estimate of 1.82 million).

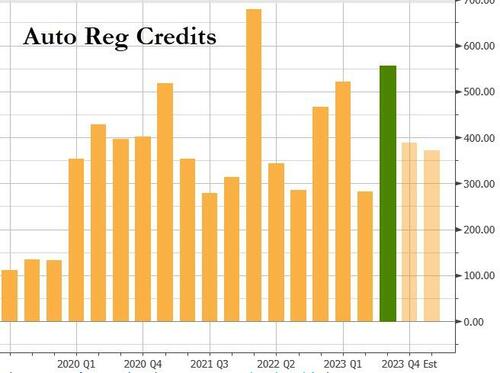

Tesla’s automotive gross margins ex-regulatory credits for the quarter was 16.3% (below expectations of 17.7%) and that was helped by a boost in regulatory credits...

Tesla noted that while deliveries rose YoY, they declined sequentially...

The electric vehicle manufacturer says its sequential decline in volume was caused by planned downtimes for factory upgrades.

BUT, a positive spin was offered as Tesla said they had more than doubled the size of their AI-training compute.

We have more than doubled the size of our AI training compute to accommodate for our growing dataset as well as our Optimus robot project. Our humanoid robot is currently being trained for simple tasks through AI rather than hard-coded software, and its hardware is being further upgraded.

We have commissioned one of the world's largest supercomputers to accelerate the pace of our AI development, with compute capacity more than doubling compared to Q2.

Our large installed base of vehicles continues to generate anonymized video and other data used to develop our FSD Capability features.

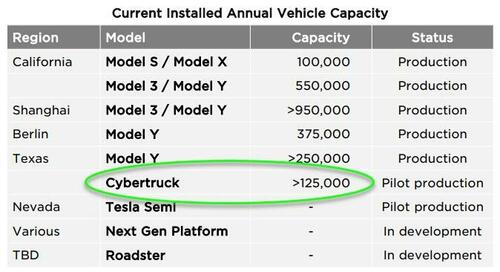

And an additional highlight is that Tesla says that “Cybertruck deliveries begin in November 2023” but without a lot of context as to what kind of volume we are talking about here.

Tesla is now tweeting that:

“Cybertruck production remains on track for later this year, with first deliveries scheduled for November 30th at Giga Texas.”

TSLA shares initially puked on the miss but bounced back above the close...

(Click on image to enlarge)

Though TSLA was down around 5% on the day amid an ugly market.

More By This Author:

Beige Book Find "Little Change" As Outlook Turn Weaker But "Recession" Mentions Tumble

Market Rejoices After Solid, Stopping Through 20Y Auction Isn't A Disaster

Housing Starts Slump In September; Rental Permits Plunge As Homebuilder Confidence Crumbles

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more