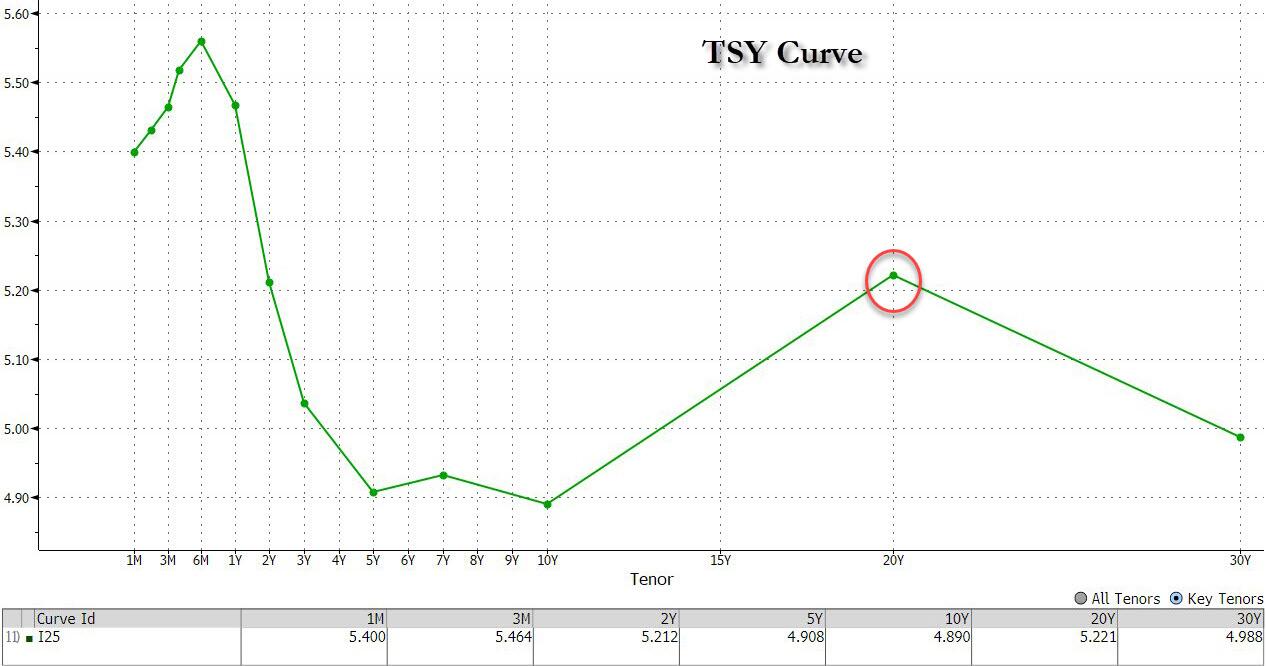

Market Rejoices After Solid, Stopping Through 20Y Auction Isn't A Disaster

After last week's catastrophic 3/10/30 year auction and following today's latest blow out in yields that pushed the 10Y to 4.92%, it's safe to say that not many were looking with much excitement to today's 20Y auction. Well, they should have been because moments ago the Treasury sold $13 billion in a 20-year reopening (19-Year 10-month) which saw stellar demand for the hunchback outlier...

(Click on image to enlarge)

... of the Treasury's "camelback" curve.

The details: the high yield of 5.24% was of course the highest on record for the tenor that was launched in May 2020 when the US needed to rapidly issue trillions in new debt... and still does. The yield was a whopping 64bps higher than September's 4.592% but it stopped through the When Issued 5.257% by 1.2bps, the biggest stop through since June.

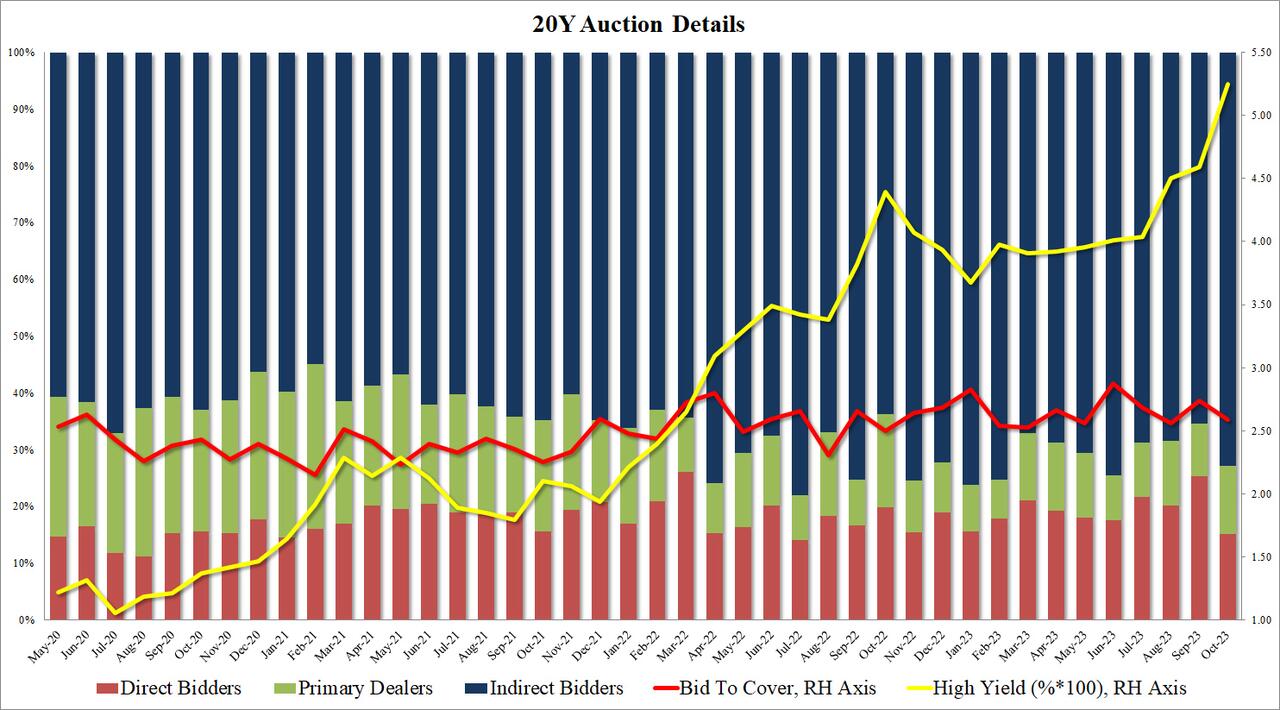

The bid to cover of 2.59 was subpar, below last month's 2.74 and below the recent average of 2.68, so nothing to write home about.

The internals were decidedly better with Indirects taking down 72.9%, the highest since February and well above the six-auction average of 69.4%; and with Directs awarded 15.2%, the lowest since July 2022, Dealers were left with 11.9%, just above the recent average of 10.2%.

(Click on image to enlarge)

The stronger than expected auction is just what the jittery market needed, and it sent 10Y yields - which had been on the verge of exploding toward 5% - sliding...

(Click on image to enlarge)

...and S&P spiking sharply higher and erasing almost all of the losses since the cash open.

(Click on image to enlarge)

More By This Author:

Housing Starts Slump In September; Rental Permits Plunge As Homebuilder Confidence CrumblesOil Surges After Iran Calls For Oil Embargo Against Israel

WTI Extends Gains After API Reports Across-The-Board Inventory Draws

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more