TSLA Is Still Expensive But It’s A Long Term Winner

Image Source: Unsplash

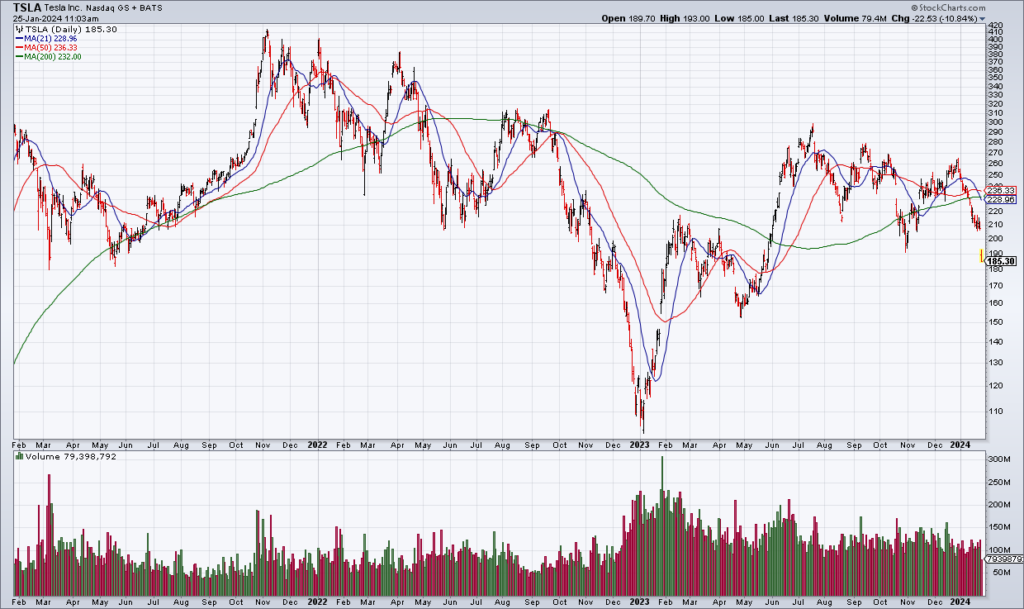

Tesla (TSLA) reported a disappointing quarter after the close Wednesday and shares are currently -11%. I like trading TSLA because it’s a high-quality company whose shares fluctuate far more than its intrinsic value.

For example, at the end of 2022, I recommended buying TSLA shares at the bottom at $109 based on valuation. The stock started to explode higher almost immediately and I took profits. I then shorted TSLA at $287 in the middle of the year and I just covered 70% of that short position for a 35% gain.

As I said in the blog at the end of 2022, I believe TSLA will be a long term winner as the secular move to EVs rolls on. The stock had historically been too expensive for me and that was the first instance when I felt like it was substantially undervalued. But that undervaluation didn’t last and even though the stock has taken a big hit of late, it is still not cheap.

TSLA earned $3.12 in 2023 and based on their outlook it appears they will earn less this year. That means the stock is trading somewhere around 70x current year earnings. I think shareholders with an extremely long term time horizon will do fine, but shorter term I think there is a bit more downside which is why I am holding on to a stub of my short position.

(Click on image to enlarge)

More By This Author:

Logic Is With The Bears, Animal Spirits With The Bulls; NFLX Earnings

Markets Recalibrate Fed Rate Cut Expectations, DFS: Haves And Have Nots

Three Books That Changed My Life