Logic Is With The Bears, Animal Spirits With The Bulls; NFLX Earnings

(Click on image to enlarge)

The S&P 500 broke out to new all time highs above 4800 Friday and the bulls were celebratory. Michael Antonelli – Market Strategist at Baird – reminded us that pessimists sound smart while optimists make money. Another financial advisor quipped “bears are poor”. But these are cliches not arguments.

(Click on image to enlarge)

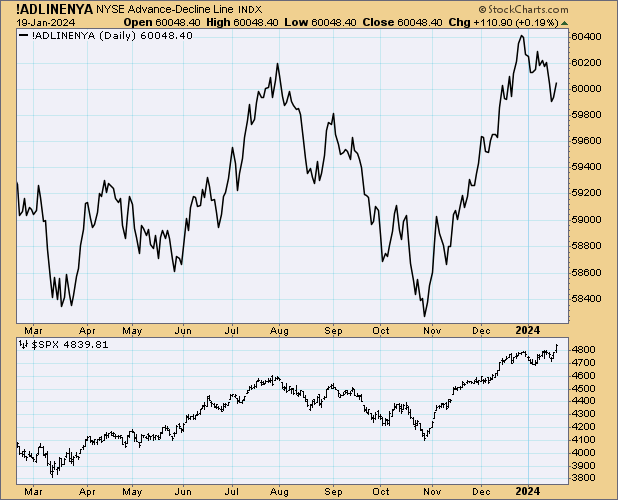

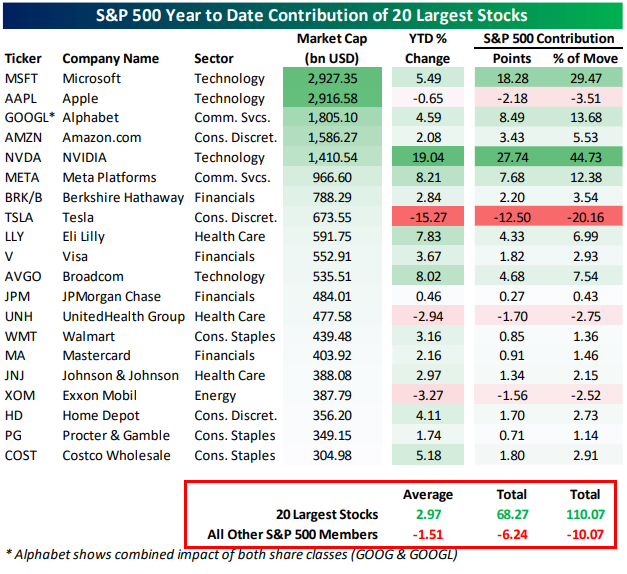

While the S&P made new highs on Friday, the Russell 2000 – which was supposed to play catch up this year as the rally broadened out – is about 20% below all-time highs and down almost 3% this year. The NYSE Advance-Decline line started to head south at the end of last year, meaning more stocks are falling than rising. Microsoft (MSFT) and Nvidia (NVDA) account for 75% of the S&P’s gains so far this year. The top 20 stocks in the S&P account for 110% of the YTD gains while the other 480 have been a drag on the index. In other words: This is an extremely thin market. The only stocks really working are The Magnificent 7 – and they represent little fundamental value.

(Click on image to enlarge)

One interesting upcoming test is Netflix (NFLX) earnings on Tuesday afternoon. NFLX has rallied about 40% since its last earnings report and analysts expect it to add 8.8 million paying subscribers in 4Q23 (“Netflix Has Its Own Tough Act To Follow”, Dan Gallagher, WSJ Jan 22). NFLX is trading for ~35x current year earnings but revenue growth has been in the single digits for the last 7 quarters. Stocks don’t have to follow fundamentals but they usually do over the long term. I think NFLX is 50% overvalued with an intrinsic value of $300.

More By This Author:

Markets Recalibrate Fed Rate Cut Expectations, DFS: Haves And Have Nots

Three Books That Changed My Life

Marginal Fluctuations: December CPI, KBH Earnings