TrustCo Bank A Solid Buy Under $8

Summary

- We believe that if shares dip below $8, it is a good time to get back into the name, with $7.50 being a great price.

- This is a well-run regional bank, paying a near 3.5% dividend yield.

- We are pleased that the bank continues to grow both loans and deposits over time.

- Interest rate cuts and special promotions combined to result in a weaker 2019 versus 2018, but 2020 is setting up for margin expansion.

TrustCo Bank Corp. (TRST) is a name we have covered many times over the years and have, recently, felt was setting up for another buy. The company reported earnings yesterday, and the results have sparked some selling. We believe that if shares dip below $8, it is a good time to get back into the name, with $7.50 being a great price, in our opinion, based on valuation and the chart. Although shares have come a long way since they were yielding 5%, we remain bullish on the name, long term. This comes despite shares facing pressure in mid-2019 along with other banks. That said, we want to continue our coverage of this regional bank by honing on the critical metrics that investors should be focused on.

Recent price action

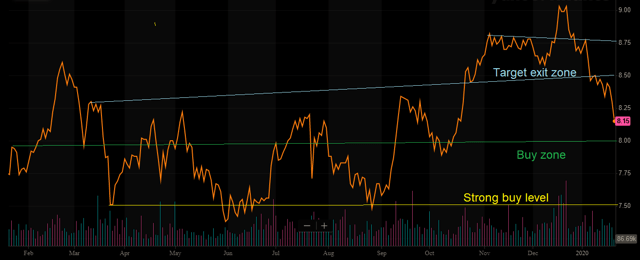

The stock has dipped under $8 and touched that attractive $7.50 level a few times this year, and astute traders have capitalized on the swings:

Source: BAD BEAT Investing

It is our opinion that with the stock heading below $8.00, you should likely wait to add to holdings, but we are definitely bullish on the name as we move forward. This is a well-run regional bank, paying a near 3.5% dividend yield. The key metrics have some notable strengths and weaknesses to be aware of, but we think a great trade sets up to buy under $8, buy more at $7.50 and hold to the $8.50-8.75 zone.

Discussion

This regional bank is focused entirely on traditional bread and butter banking. By this, we mean that the company takes in deposits and makes loans. Increased loan activity, as well as overall higher returns on assets, helped lead to revenue expansion. The return on average assets and return on average equity came in at 1.06% and 10.41%, respectively. Investors saw this as a bit of a red flag and are selling because this is a decrease from last year, which saw 1.30% and 13.18% on these metrics, respectively. This led to lower revenues (down 5%) and lower earnings per share ($0.143 vs $0.166). Is the party over? Why are we bullish? Because it is not about where the company has been it is about where it is going. Loan growth and stabilizing the cost of funds as a result of federal interest rate cuts have put the bank in a good position as we move forward.

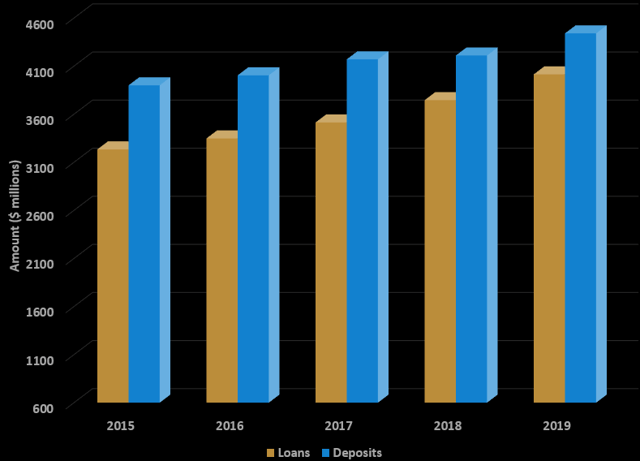

More loans and deposits

Loans and deposits are especially critical for small regional banks such as TrustCo. We are pleased that the bank continues to grow both loans and deposits over time:

Source: SEC Filings, graphics by BAD BEAT Investing

Continue reading at Seeking Alpha.

Looking for more stock ideas like this one? Get them exclusively at BAD BEAT Investing. Get started today »