Triple Plays Chart Update

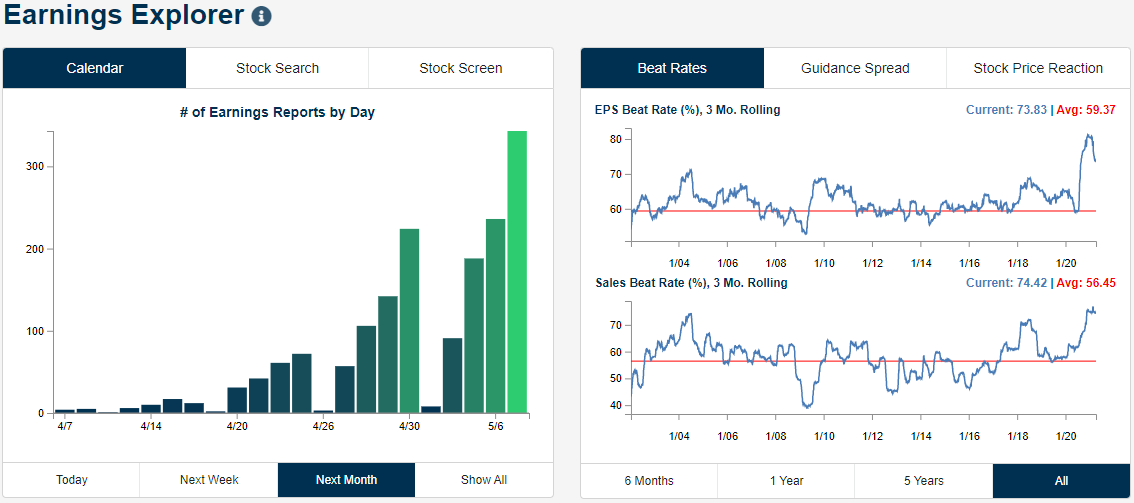

The earnings calendar has been quiet, and it will remain that way until the second half of the month when the Q1 earnings season really kicks into gear. When it comes to earnings, the 3 month rolling EPS beat rate and guidance spread have pulled back significantly over the past few months. Granted, both of these as well as the sales beat rate remain at levels well above typical levels. As such, there have been a huge number of triple plays over the past three months, 268 of the total 2048 reporting companies to be exact. A triple play is when a company reports better than expected sales and earnings while also raising guidance. Typically, this can be viewed as a sign of fundamental strength for a company.

(Click on image to enlarge)

Looking over those triple plays, the average stock that has reported a triple play over the past three months rose over 3% on its earnings reaction day with 64% finishing the day in the green. That positive performance has tended to continue in the weeks after earnings although there have been some that have recently been consolidating. In the charts below, we show a handful of these. Some like Abbott Labs (ABT) and Perficient (PRFT) have been in short-term downtrends that have brought them back down to support around their 50-DMAs. Others like Analog Devices (ADI), Broadcom (AVGO), and Crocs (CROX) have been stuck under resistance over the past several weeks but have made attempts to break out in the past few days. For all of these, there has yet to be a decided move either to the up or downside.

There are some other stocks that have been in similar setups but have successfully managed to break out to the upside. For example, CommVault Systems (CVLT), Generac (GNRC), and WD-40 (WDFC) experienced similar consolidation to previously mentioned stocks like PRFT, but each of these has managed to end their recent downtrends after finding support at their 50-DMAs.Others like Crown (CCK), Fortune Brands (FBHS), and Masco (MAS) finally managed to break out of multi-month resistance in recent days. Although they have broken out, these are also generally elevated above their 50-DMAs meaning they could be due for a pullback. There are actually a couple of others that have already taken that step like MKS Instruments (MKSI), Otis (OTIS), and Procter & Gamble (PG). Looking at the broader universe of recent triple plays of the past three months, there are around 100 stocks that have pulled back within their uptrends and now earn a “good” timing score in our Trend Analyzer. In other words, there are plenty of interesting setups among the last quarter’s triple plays.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more