Triple Play Breaks The Downtrend For WD-40

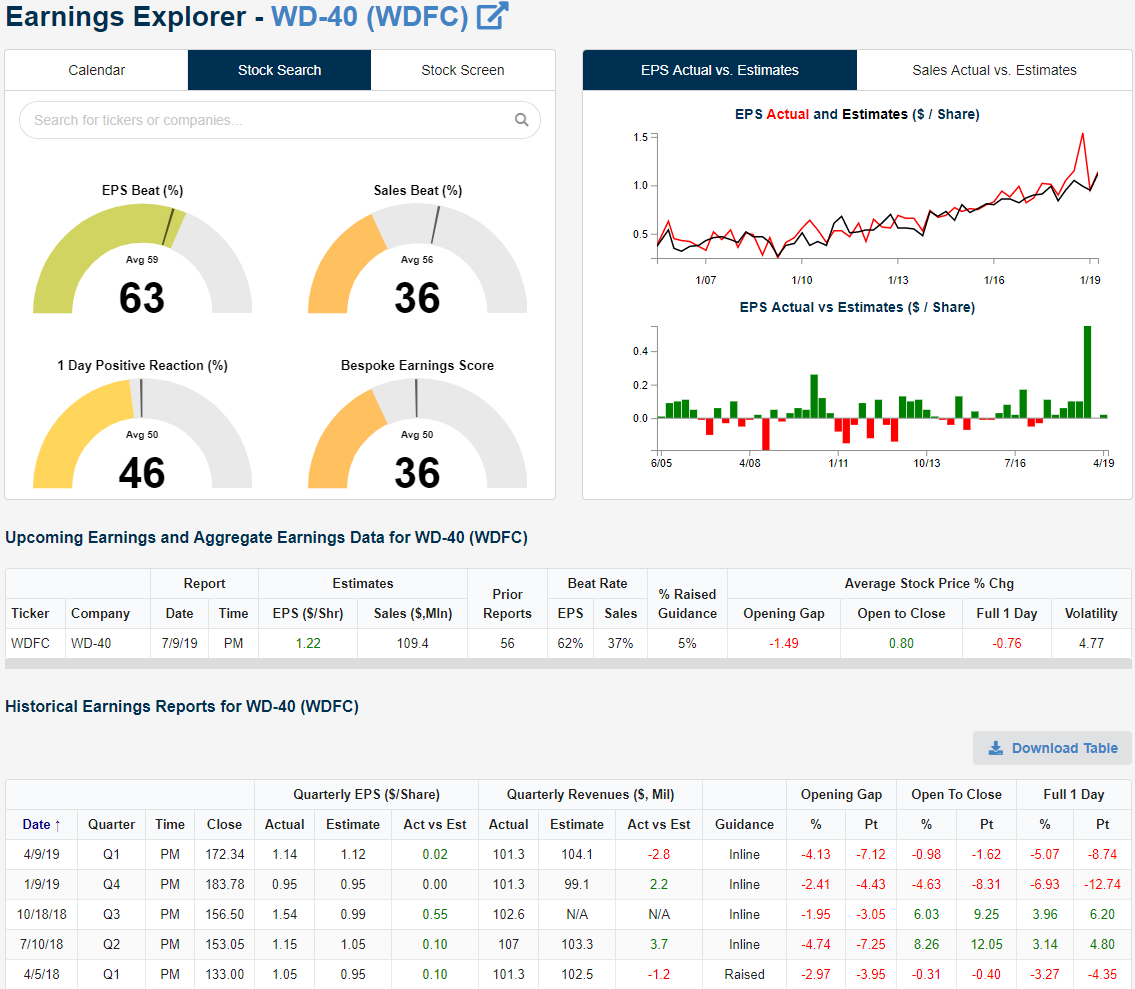

WD-40 Company (WDFC) manufactures and distributes a number of household and industrial products including its signature lubricating oil from which the company derives its name: WD-40. Perhaps as a result of an increase in squeaky door hinges this past quarter, the company reported a strong quarter last night. WDFC reported a triple play with EPS 8 cents above estimates and revenues of $114 million versus estimates of $109.4 million; a growth rate of 6.5% year-over-year. The company also raised guidance for the first time since April of last year. Raised guidance has not been a common occurrence for the company. In addition to the one last April, WDFC has only raised guidance two other times, once in 2005 and later in 2006. This is a pleasant change for WDFC which has historically not been the best stock on earnings as it has only beaten EPS estimates 63% of the time and sales 36% of the time with a full day loss of 0.76% on average.

(Click on image to enlarge)

In reaction to its Triple Play, the improvements to the technical picture have been dramatic for WD-40. Opening at $169.17 with further buying in early trading, WDFC sits over 7% above yesterday’s close in early trading. With these gains, the stock has risen above both the 50 and 200-DMA. For most of the time since April, the stock has been stuck under both of these moving averages with only a few days with brief breaks above the 50-DMA. Additionally, WDFC has been in a downtrend for all of 2019, but today’s price action has sent the stock surging out of this downtrend channel.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our Security Analysis tool, Earnings Explorer, and ...

moreComments

No Thumbs up yet!

No Thumbs up yet!