Top Picks 2024: Cameco

Image Source: Pixabay

If investors were asked to name a conservative investment, most wouldn’t pick uranium. After all, the energy metal has been under pressure for years. But I’m here to tell you that profiting from select uranium stocks over the next few years is like shooting fish in a barrel: It’s hard to miss. One of my favorite names is Cameco (CCJ), explains Sean Brodrick, editor of Resource Trader.

The fundamentals are easy. Big stockpiles depressed the price of uranium for years. So, no one built new mines; it was too cheap to mine profitably. But stockpiles got used up. The price has been soaring. The price of uranium was at a 15-year high recently, and it’s just getting started. Supply is tight.

What’s more, the US and the European Union are both working on laws to cut or halt imports of Russian uranium and uranium enrichment services due to that country’s ongoing war in Ukraine.

Russia provides about 10% of the world’s uranium and 35% of its enriched uranium fuel. When combined with other major uranium-producing countries like Kazakhstan and Uzbekistan, which are in Russia’s sphere of influence, this means more than 60% of the world's uranium supply is controlled by Russia and its clients.

On the demand side, each 1,000-megawatt reactor uses about 27 metric tonnes of uranium per year; triple that to start up a new reactor. There are about 407 nuclear power plants currently operating, 60 new atomic plants being built, and another 110 planned.

Let’s add in that, at the recent COP28 climate summit in Dubai, 22 countries pledged to triple their nuclear power capacity by 2050. Now, it’s a race for uranium supply.

That brings us to CCJ. The company is the biggest uranium miner in the Western world. Most of its operations are in Canada’s Athabasca Basin. Its flagship assets are Cigar Lake, with 84.4 million pounds in uranium reserves, and McArthur Lake, with 275 million pounds. The company also operates the Inkai mine in Kazakhstan with Kazatomprom.

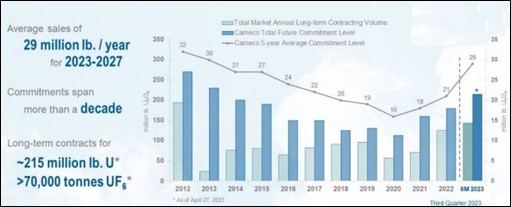

Cameco is signing more delivery contracts, and at higher prices. The company’s long-term commitments require an average annual delivery of 29 million pounds of uranium over the next five years. Compare that to the 26 million pounds reported at the end of March.

Source: Cameco

Most of those are fixed-price contracts. That means those contracts won’t benefit from rising uranium prices. However, Cameco is also signing more market-priced contracts. Those contracts offer exposure to rising uranium prices.

Recently, Cameco acquired a 49% stake in Westinghouse Electric Company, one of the leading nuclear reactor manufacturers. The remaining 51% is owned by Brookfield Renewable Partners (BEP). The deal transformed Cameco into a fully integrated uranium producer.

Cameco recently raised its earnings forecast. And yet, the price of uranium is probably going much higher. Cameco’s earnings ramp-up is really something. You haven't seen anything yet.

About the Author

In his three decades as an investment analyst, Sean Brodrick has sifted through terabytes of data and traveled tens of thousands of miles in search of companies that can make a big difference for investors. With his boots-on-the-ground experience, Mr. Brodrick has visited mines, met executives in person, discovered hidden opportunities, and revealed hidden dangers. This is why he is best known as the "Indiana Jones of Natural Resources."

Sean was also among the first to write about the commodity supercycle and to recognize major resource and tech megatrends that have transformed our world. He also edits five publications.

More By This Author:

Top Picks 2024: CTO Realty Growth

Inflation: A Deep Dive Into The Downturn – And A Look At What Comes Next

The MoneyShow Market Minute - Monday, December 25

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.