The MoneyShow Market Minute - Monday, December 25

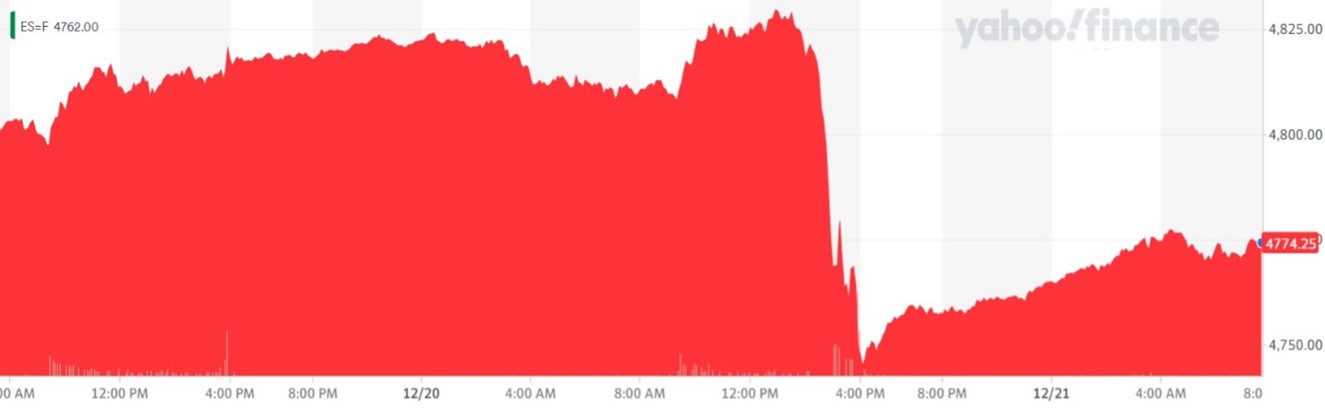

After weeks of relentlessly rallying, the S&P 500 slipped on a big banana peel yesterday. The average dropped 1.5%, its biggest one-day decline since September, with some experts blaming mechanical trading linked to wildly popular “0DTE” options for the late-day swoon.

But equities are gaining some of that ground back in the early going today. Gold and silver are mixed, while crude oil and the dollar are lower. Treasuries are flat.

If you haven’t heard, trading in “Zero Days ‘Til Expiration” (hence the acronym 0DTE) options has exploded in the last year. These allow speculators to place leveraged bets on what the market will do in just one session, rather than the longer-term timeframes of standard weekly, monthly, or quarterly options contracts.

S&P 500 Futures (2-Day Chart)

(Click on image to enlarge)

Experts disagree about the impact they are (or are not) having on market volatility and action. But the theory goes that excessive zero-day put option buying would force market makers to hedge exposure, which could exacerbate downside pressure on stocks. Regardless of the intraday action, though, it’s been a solid year for markets.

While Elon Musk’s SpaceX is the undisputed leader in rocket launches for government and private customers these days, United Launch Alliance (ULA) remains a competitor – and now, it could fetch a hefty price tag. Jeff Bezos-backed Blue Origin and private equity firm Cerberus are both reportedly bidding for ULA, a joint venture entity co-owned by Boeing (BA) and Lockheed Martin (LMT). It could be worth up to $3 billion, and hopes to compete more aggressively with SpaceX via its soon-to-launch Vulcan rocket.

More By This Author:

Four Year-End Musings On The Fed, Groupthink, Inflation, And The Magnificent SevenGold: Prospering from Powell During the Holiday Season

Kratos Defense & Security: A Drone And Defense Play That's On A Momentum Mission

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.