Top Infrastructure Stocks To Invest In 2022

Infrastructure is costly to build and maintain. The Biden government took a big step in this direction in 2021 by passing a $1.2 trillion infrastructure bill. This has led to increased investor interest in the infrastructure industry is seeking companies that will benefit the most from this.

List of Top Infrastructure Stocks to Invest in 2022

We have compiled a list of ten companies that are on our watch for top infrastructure stocks to invest in in 2022.

| Sr. | Name | Symbol | Market Capitalization | Price (As of 14th March 2022) |

| 1. | Caterpillar Inc. | CAT | $ 115.45 billion | $ 215.44 |

| 2. | American Tower | AMT | $ 107 billion | $ 234.84 |

| 3. | Enbridge | ENB | $ 88.96 billion | $ 43.92 |

| 4. | Crown Castle | CCI | $ 75 billion | $ 172.77 |

| 5. | Enterprise Products Partners LP | EPD | $ 53.5 billion | $ 24.58 |

| 6. | Vulcan Materials | VMC | $ 23.63 billion | $ 177.92 |

| 7. | Martin Marietta Materials | MLM | $ 23.44 billion | $ 375.59 |

| 8. | Brookfield Infrastructure Partners | BIP | $ 18.4 billion | $ 60.39 |

| 9. | Fluor | FLR | $ 4 billion | $ 28.31 |

| 10 | BlueLinx Holdings | BXC | $ 795.84 million | $ 81.78 |

Caterpillar Inc. (CAT)

Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. The company has dealers in more than 190 countries and has more than 20 brands under its name.

CAT recently publishes its full-year earnings report for 2021:

- Revenues were $50.9 billion, representing an increase of 22% compared with 2020

- Profit was reported to be $6.8 billion, representing a 51%, increase from 2020

The retail new business increased by a substantial 22%, which contributed towards the increase in the revenue. Also, the company’s manufacturing costs declined this year, leading towards a whopping 51% increase in profitability.

Moving forward in 2022, CAT has a CAPEX planned for $1.4 billion. Also, manufacturing costs are expected to rise but they are anticipated to be covered by an increase in product prices.

CAT has a market capitalization of around $115.4 billion. The share of the company is trading at a price of $215.4. The stock of the company has been on a bullish trend for the past two years. During mid-2021, the bullish run halted and the company’s stock maintained its price after a small drop from $244 to $208. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

American Tower

American Tower is a global provider of wireless communication infrastructure. They are spread across 6 continents and 25 countries.

The company recently published its earnings report for 2021:

- Revenue was reported to be $9,110, representing a 14.5% growth

- Liquidity was reported at $6.1 billion

The company has a very disciplined capital allocation approach which leads towards long-term growth. Also, the infrastructure company has had an average annual dividend per share growth of more than 20% since 2012.

The company has grown due to huge fund generation from operations. Since the consumption of data on cellular networks increased, the operations of the company have improved. In the future, with the deployment of 5G, this is expected to further rise. Hence the company’s stock is also expected to rise. By using the stock signals, you can avoid hours of technical analysis to understand the market.

American Tower has a market capitalization of around $106 billion. The share of the company is currently trading at a price of $233.5. the company’s stock is on a bullish run for more than two years. Despite multiple dips, the stock did not lose its bullish run.

(Click on image to enlarge)

Enbridge

Enbridge, Inc. engages in the provision of gas and oil businesses. It operates through the following segments: Liquid Pipelines, Gas Distribution, Gas Transmission, and Midstream, Green Power and Transmission and Energy Services. The company operated about 30% of the crude oil produced in North America; it transports nearly 20% of the natural gas consumed in the U.S.; and operates North America’s third-largest natural gas utility by consumer count. Solar energy stocks have led this quarter’s stock market gains.

The company recently shared its full-year earnings report for 2021:

- Total revenues were reported to be CAD 26.87 billion (Approx. $36.65)

- Total operating income was reported to be CAD 7.8 billion (Approx. $6.08)

- Earnings per share were reported at CAD 2.87 (Approx. $2.24)

2021 has been a remarkable year for the company and has allowed significant financial flexibility. Enbridge is able to invest in new growth opportunities and expects up to $6 billion in growth in the future. The company has set a diversified secured capital program that will support growth for the next 3 years.

The company has a market capitalization of around $89 billion. Its share is trading at a price of $43.92. the company’s share is on a bullish run for the past two years. The stock appreciated by 22% during the year 2021. The stock kicked off the year 2021 at a price of $31.99 and closed off the year at a price of $39.08.

(Click on image to enlarge)

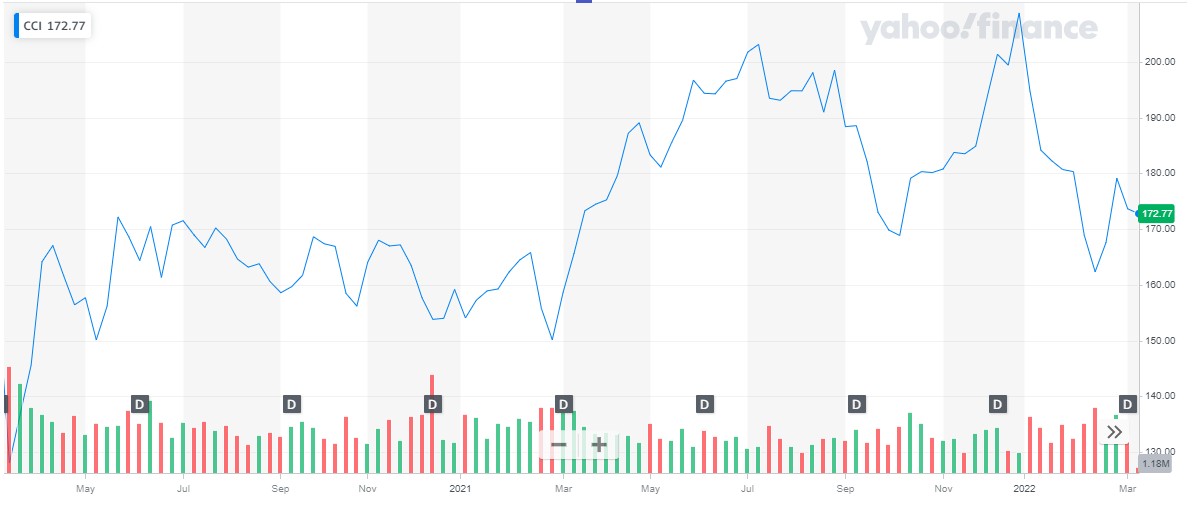

Crown Castle

Crown Castle is the nation’s largest provider of shared communications infrastructure—cell towers, small cells, fiber; connecting people and businesses to data & technology. the company has a presence in every major US market. Crown Castle has a comprehensive infrastructure portfolio that consists of more than 40,000 cell towers, approximately 115,000 on-air or under-contract small cell nodes, and approximately 80,000 route miles of fiber. The company aims for 43 billion devices, sensors, and transmitters to be connected by 2023. Get to know everything about high frequency trading.

The company recently shared its full-year earnings report for 2021:

- Total rental revenues were reported at $5.7 billion, representing an 8% increase from last year

- Income from operations was reported at $1.16 billion, representing a 10% increase from last year.

The company expects elevated levels of tower leasing to continue in 2022. Moreover, continued on the expected growth levels and increased operations, Crown Castle expects to lead the industry with the highest U.S. tower revenue growth in 2022. In addition to it, the company earned commitments for more than 50,000 new small cell nodes during the last twelve months, which equates to approximately 70% of the total small cells Crown Castle has booked in its history prior to 2021.

Crown Castle has a market capitalization of over $75 billion. The company’s stock is currently trading at a price of $172.77. the stock of the company has exhibited high volatility in the past two years. The stock started the year 2021 at a price of $159.19 and concluded at a price of $208.74, representing an appreciation of approx. 31%. During the current year, the stock has experienced a huge dip in price and has depreciated by 17% year-to-date.

(Click on image to enlarge)

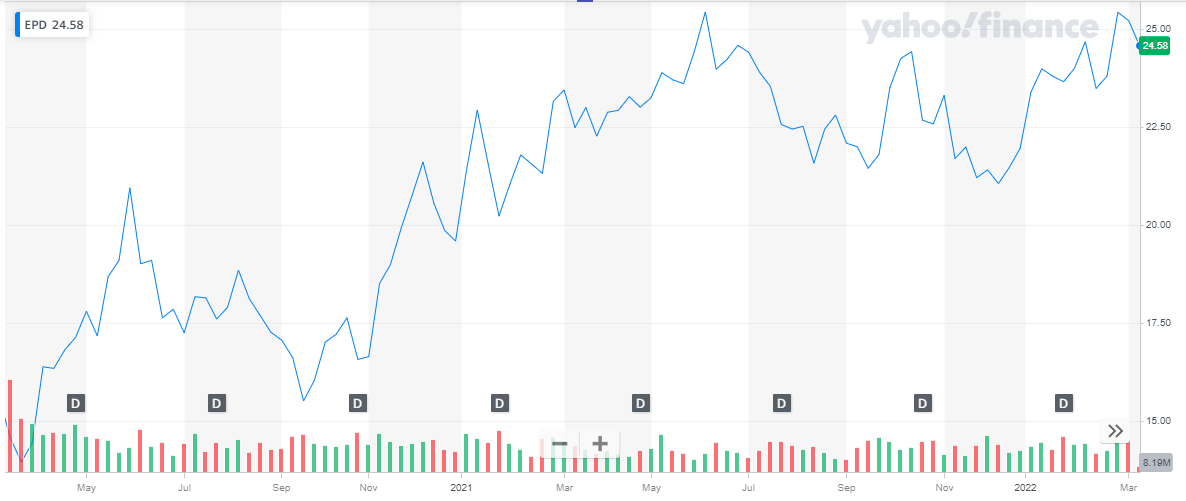

Enterprise Products Partners LP

Enterprise Products Partners is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (“NGLs”), crude oil, refined products, and petrochemicals.

The company provides services of:

- Natural gas gathering, treating, processing, transportation, and storage

- NGL transportation, fractionation, storage, and import and export terminals

- Crude oil gathering, transportation, storage, and terminals

- Petrochemical and refined products transportation, storage, and terminals

- Marine transportation business that operates primarily on the United States inland and Intracoastal Waterway systems

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

The company recently shared its full-year earnings report for 2021:

- Operating income was reported to be $6.1 billion, representing an increase of 21% from last year

- Net Income was reported to be $4.75 billion, representing an increase of 22%

In 2021, driven by the rebound in the global economy, Enterprise reported five operational records. These included ethane marine terminal exports, natural gas transportation volumes, propylene production, and refined product and petrochemical transportation volumes

Enterprise Products has a market capitalization of $53.5 billion. The share of the company is currently trading at a price of $24.58. The company’s share despite experiencing volatility has maintained its upward streak for the past two years. In the year 2021, the stock started off at a price of $19.59 and after appreciating by 12% concluded the year at $21.96. During the current year, the share appreciated by 12% year-to-date.

(Click on image to enlarge)

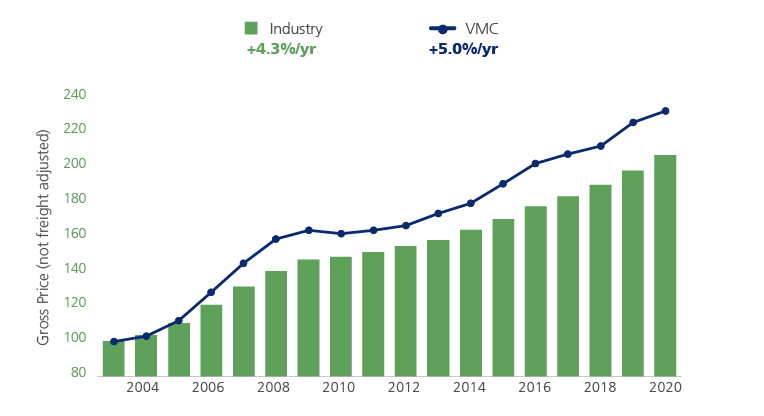

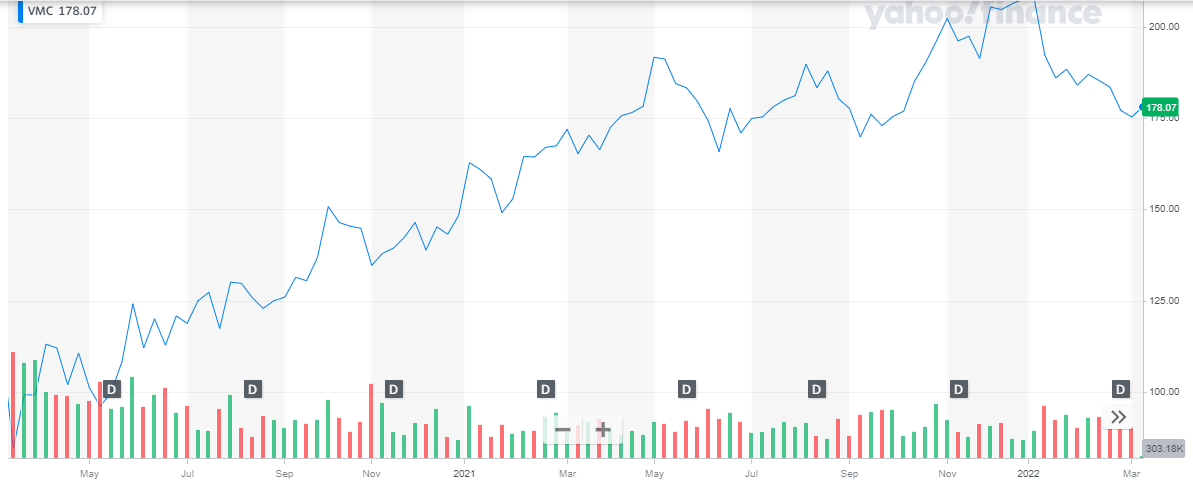

Vulcan Materials

Vulcan Materials Co. engages in the provision of basic materials and supplies for the infrastructure and construction industry. It operates through the following business segments: Aggregates, Asphalt, Concrete, and Calcium. EV stocks are one of the plenty of investment opportunities to take advantage.

The below chart shows the long history of above-average price performance.

In the recent annual report for 2021, the company reported:

- Revenues of $5,552million, representing a 14% increase from last year

- Net Income of $673 million, representing a 15% increase from last year

Vulcan has steadily been increasing its EPS, which is a positive sign of growth. This EPS growth is also in line with the revenue growth. This growth is reflected in the growing stock price of Vulcan Materials. This indicates that Vulcan Material is a good infrastructure stock to invest in.

Vulcan Materials has a market capitalization of over $23.7 billion. The stock of the company is currently trading at a price of $178. The company’s stock is on a bullish run for the past two years. In the year 2021, the stock appreciated by more than 25%, starting off the year 2021 at a price of $148 and concluding the year at $207.58.

(Click on image to enlarge)

Martin Marietta Materials

Martin Marietta is an American-based company that is a leading supplier of building materials. The company supplies aggregates, cement, ready-mixed concrete, and asphalt. The company’s network spans 30 states, Canada and the Bahamas. It supplies the resources necessary for building the solid foundations on which our communities thrive.

Martin Marietta’s Magnesia Specialties business produces high-purity magnesia and dolomitic lime products used worldwide in environmental, industrial, agricultural, and specialty applications.

The company recently shared its full-year earnings report for 2021:

- Total revenues were reported at $5.4 billion

- Net earnings from operations were reported to be $702 million

- Earnings per share were reported to be $11.21

The year 2021 was marked by stronger product demand across all products.

Martin Marietta Materials has a market capitalization of $23.4 billion. The share of the company is trading at a price of $375.59. the share has been on a bullish journey for the past two years. The stock of the company started off in the year 2021 at a price of $283.97. after appreciating by 35.6%, the share concluded the year at a price of $440.52. During the current year, the stock has depreciated by 14%% year to date.

(Click on image to enlarge)

Brookfield Infrastructure Partners

Brookfield Infrastructure Partners is one of the largest owners and operators of critical global infrastructure networks which facilitate the movement and storage of energy, water, freight, passengers, and data. the company proudly owns a 100-year-old heritage and has $690 billion assets under management.

The company recently published its full-year results for the year 2021:

- Revenue of $11.5 billion was reported

- Net Income was reported at $1.1 billion

In 2021, Brookfield Infrastructure had a good financial year marked by strong organic growth and capital recycling accomplishments. Also, the deployment of significant capital into new investments and other growth initiatives took place during the year

Brookfield Infrastructure has a market capitalization of over $18.45 billion. Its share is trading at a price of $60.39. The share of the company is on a bullish run and has been steadily rising for the past two years. In the year 2021 the share appreciated by 23%, starting off the year at $49.41 and closing the year at a price of $60.81.

(Click on image to enlarge)

There are multiple paid courses and technical analysis books available which provide in-depth knowledge about Technical Analysis.

Fluor

Fluor designs and builds some of the world’s most complex projects. The company is more than 100 years old. It delivers engineering, procurement, fabrication, construction, maintenance, and project management services worldwide. Fluor serves clients in the energy, chemicals, government, industrial, infrastructure, mining, and power market sectors.

The company recently published its full-year earnings for 2021:

- Total revenues were reported to be $12.4 billion

- Net income from continuing operations resulted in a loss of $144 million

Fluor has a market capitalization of around $4 billion. The shares of the company are currently trading at a price of $28.31. The stock performance has remained volatile in the past two years. The stock experienced multiple dips in these past two years. But despite the volatility, the company’s stock steadily appreciated. The stock has appreciated approx. 14% year-to-date, starting off the year 2022 at a price of $24.77. During the year 2021, the stock appreciated by 55%.

(Click on image to enlarge)

Also read: Best 5G Stocks to Invest In

BlueLinx Holdings

BlueLinx is a leading wholesale distributor of building and industrial products in the United States with over 50,000 branded and private-label SKUs, and a broad distribution footprint servicing 40 states.

The company recently posted its full-year result of 2021:

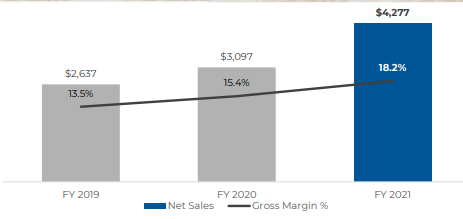

- Net sales were reported to be $4.3 billion, representing a 38% increase from last year

- Gross Margins were reported at 18.2 %, during 2020 it was 15.4%.

- Net income was reported to be $296 million, an increase of more than 200% from last year

- Earnings per share were at $29.99

(Click on image to enlarge)

In 2021, the company reported an all-time high gross profit margin, earnings per share, and EBITDA.

BlueLinx has a market capitalization of over $795 million. The share of the company is currently trading at a price of $81.78. The stock of the company is on a bullish run since 2020. The stock kicked off the year 2021 at a price of $29.26 and concluded the year at a price of $95.76. in the year, the stock appreciated by a whopping 227%. The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

(Click on image to enlarge)

Conclusion

Infrastructure has huge growth potential. The above companies have been selected after looking at their future outlook and growth potential, along with the continued investment the company is making towards its growth. Based on these factors, the above listed are the top ten infrastructure companies to invest in in 2021.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more