Top 3 Macro Reasons To Sell EM Equities In 2022

China drove down emerging market (EM) equities performance in 2021. So what are the main risks to EM equities in 2022 and is it safe to buy?

In the second half of the year, the rout in the Chinese equity markets affected EM equities. Despite the Taiwanese stocks outperforming due to the global demand for semiconductors, ASEAN countries underperformed, especially those that depend on tourism, such as the Philippines or Thailand.

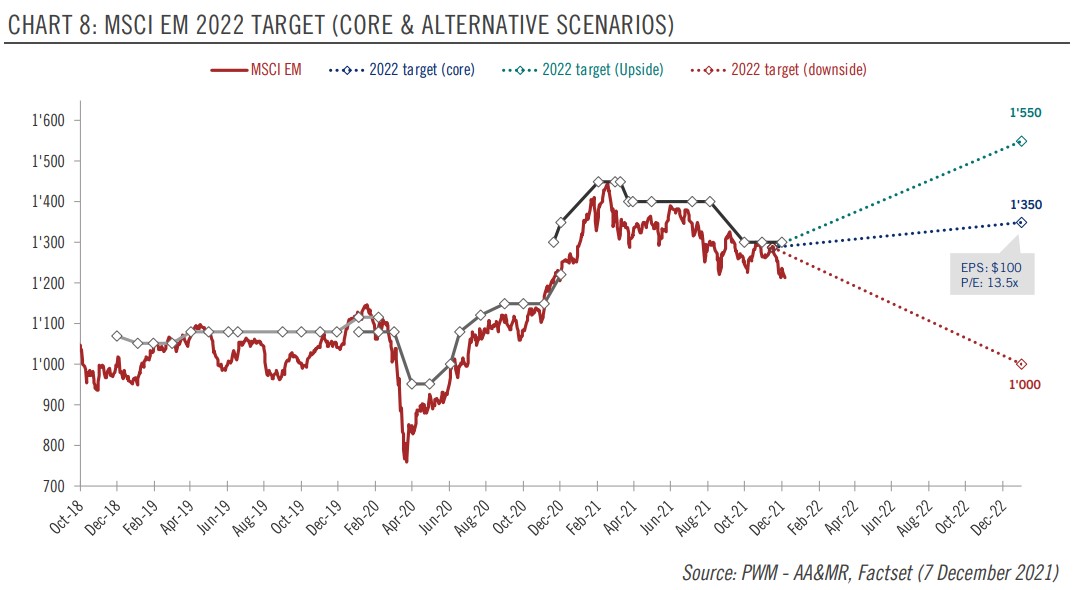

The regulatory drive in China weighed on the EM equity indices. As a result, the MSCI EM, the benchmark for EM, is down for the year, underperforming developing markets (DM) by more than 20%. Is it safe to buy EM equities in 2022? If not, what are the main factors that could drive EM equities even lower?

(Click on image to enlarge)

Dollar to remain strong

One of the main reasons why the EM equities have underperformed in 2021 was the strong US dollar. Most of the EM economies are heavily indebted in US dollars. A stronger dollar makes it more difficult to service the debt, and so it weighs on EM economies and on EM equities performance.

The dollar is expected to remain strong in the first half of next year, and so any possible rally in EM equities will likely be met with a wave of selling.

China growth to decelerate

China is set to remain a problem for EM equities. The Chinese economic growth is forecast to decelerate sharply as the zero-COVID-10 policy will be one of the key drags on growth.

Another aspect to consider is the YoY growth in Chinese imports. To many investors, this is a proxy for EM earnings growth, and after reaching high levels in 2021 the yearly growth in imports suggests flat to negative EPS by the end of 2022.

EM-DM growth differential

Finally, the EM-DM growth differential provides limited support for EM equities next year. On the one hand, we have a sharp slowdown in China. On the other hand, there is the above-potential growth in both Europe and the United States. Both lead to the US and Europe matching the growth in China, which makes EM equities unattractive.

All in all, while valuations look fair, EM equities are set to face headwinds in the year ahead. As long as monetary and fiscal stimulus persist in DM economies, the shrink in the growth differential favors DM equities.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more