Today’s Rally Is Based On A Whisker

Image Source: Unsplash

Stocks are in full-on rally mode this morning thanks to an “all-clear” signal from the CPI report. On a month-over-month basis (why look at a yearly change that has 11 months of old data?), we got a miss on the headline CPI but got an in line reading on Core CPI.The latter is perceived as reinforcing the likelihood of a rate cut next week. But what few people seem to realize is that thanks to favorable rounding of the Core index, we were 0.004% away from a vastly different market reaction.

All eyes were on the CPI release as the last data point that could reaffirm the potential for a rate cut by the Federal Reserve next week.A higher reading might have been perceived as derailing the FOMC.We did indeed get one, with headline CPI for August rising by 0.4%, ahead of the 0.3% consensus estimate.Uh-oh, right?Nope, the more important Core CPI came in with an as-expected 0.3% rise.Whew…

It is important to keep the Consumer Price Index (CPI) in perspective.We commonly think of CPI as measuring inflation, but it actually measures the level of prices in the economy.Instead, it is the change in that index over time that measures inflation.It is better to think of the CPI like the S&P 500 (SPX).SPX is a measure of the level of stock prices.When SPX rose by 0.3% yesterday, we didn’t say that stock price inflation was 0.3%, but we could have.It is the same idea, except that we like stock price inflation (“socially acceptable inflation?”).

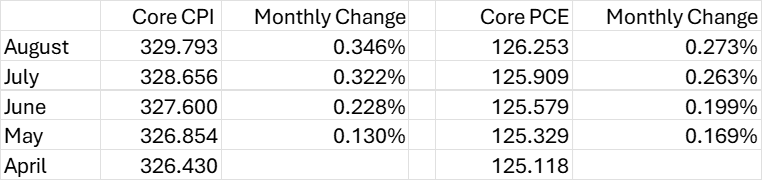

With the prior concept in mind, it makes it easy for non-economists (like me) to dig deeper into the actual report.We can compare the index on a month-to-month basis to get a more granular detail than the one-digit percentage change that is frequently reported.On that basis, we find that Core CPI rose by 0.346%, which is indeed a bit more than 0.3%, even if it rounds to the latter figure.

That also means that we were a whisker away from the monthly data rounding to 0.4%! [(329.793 – 328.656) / 328.656 * 100 = 0.346%]

(Click on image to enlarge)

![That also means that we were a whisker away from the monthly data rounding to 0.4%! [(329.793 – 328.656) / 328.656 * 100 = 0.346%]](https://www.interactivebrokers.com/campus/wp-content/uploads/sites/2/2025/09/image-38-1100x373.png)

Source: St. Louis Federal Reserve

Using the data from the linked website above, we see that on a granular basis, Core CPI is moving in the wrong direction and so is Core PCE:

Sources: St. Louis Federal Reserve, Interactive Brokers

You might be thinking, “big deal”?Well, if an even tinier change would have caused different rounding, would stocks have rallied like they are today.I think not.Also, it is important to put the FOMC’s Statement on Longer Run Goals into perspective. As we noted on Tuesday, while investors understandably fixated on Chair Powell’s emphasis upon the softening labor market, he also unveiled a revision to the FOMC mission that tied the Fed’s inflation goal more tightly to 2%.It was 2%-ish before.Those numbers do not jibe with that goal.

And by the way, despite the obvious perception that the Fed is understandably more focused at present upon the “maximum stable employment” portion of the dual mandate than the “stable prices” part,the statement of goals implies that they view stable prices as a prerequisite for stable employment. From the statement:

The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory maximum employment and price stability mandates. The Committee judges that longer-term inflation expectations that are well anchored at 2 percent foster price stability and moderate long-term interest rates and enhance the Committee’s ability to promote maximum employment in the face of significant economic disturbances. [emphasis added]

Along those lines, some have attributed at least some of today’s rally to today’s higher than expected weekly jobless claims (263k vs. 237k expected).Fair enough – bond traders are using it as a reason to push yields lower, with 10-years flirting with 4%.That is indeed good for stocks.But I offer two reasons to curb that enthusiasm.First, continuing claims were unchanged from last week.That’s hardly a negative.Second, if stock traders are thinking “yay, more people got laid off,” then it falls squarely into the “careful what you wish for” territory.

When I think in these terms, I am increasingly concerned that we are setting ourselves up for a significant “sell the news” reaction next week.The Fed doesn’t like surprising markets unless they absolutely need to, so we have no reason to think that a cut is not in the cards.But a “hawkish cut” is a distinct possibility, with the messaging being something along the lines of “here’s the cut you expected, but don’t expect too many more until we see that prices have stabilized.”The market might be missing the tiny incremental increases in inflation, but it’s very hard to imagine that the FOMC will.

More By This Author:

Seasonality, Or Something Else?

From A Big Event To A Yawn

Powell To Markets: “Green Flags Are Up”

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more