Seasonality, Or Something Else?

Image Source: Unsplash

Can we blame scary seasonality for today’s declines, or might the blame lie elsewhere? As with most things market-related, the explanation incorporates several factors. Global bond woes, renewed tariff confusion, and nascent concerns about a government shutdown are all weighing on today’s mood. But we’ve seen investors shrug off similar concerns before. Today’s activity reflects a somewhat unexpected return of risk aversion.

There is indeed truth to the “September Scaries”, but data show that a decline in September is far from pre-ordained.Yes, September is statistically the worst month of the year for the S&P 500 (SPX). It is only one of four that show net declines over the past 25 years, but it is by far the worst.(According to Bloomberg data, January has averaged -0.19% this century; February -0.46%, June -0.25%, and September 1.51%).Yet over that period, the likelihood of a September decline is only slightly greater than that of a coin flip: 12 of the past 25 Septembers have seen positive returns for SPX. Furthermore, last September brought a +2.02% return, though it broke a nasty five-year losing streak for the benchmark.

While seasonality is far from foolproof, it does feel as though there was a reassessment of traders’ attitudes toward risk today.Markets of course rely heavily upon investor psychology, meaning that enough of them believe that something will occur, then it can become self-fulfilling.It would not be surprising if investors became more reflective about the balance between risk and reward as they perceive that the year is closer to its end than beginning.This year so far has been a wild but generally satisfying ride for most investors in US equity markets.After a nasty period of risk aversion this spring, dip buying and risk assumption became the lifeblood of the subsequent rally.It is not abnormal for investors to question the longevity of that approach.

And yes, there were some valid reasons for a reassessment about the balance between risk and reward.After Friday’s close, we learned that a federal appeals court struck down the President’s use of emergency powers to justify the administration’s tariffs, but left them in place until October 14th.Considering that stocks rallied even as the tariffs took shape and were then implemented, one could assert that markets had begun to prefer clarity about tariff policy to the uncertainty that prevailed before.The court ruling might prove favorable to many companies, but uncertainty-loathing markets just received a significant dose.

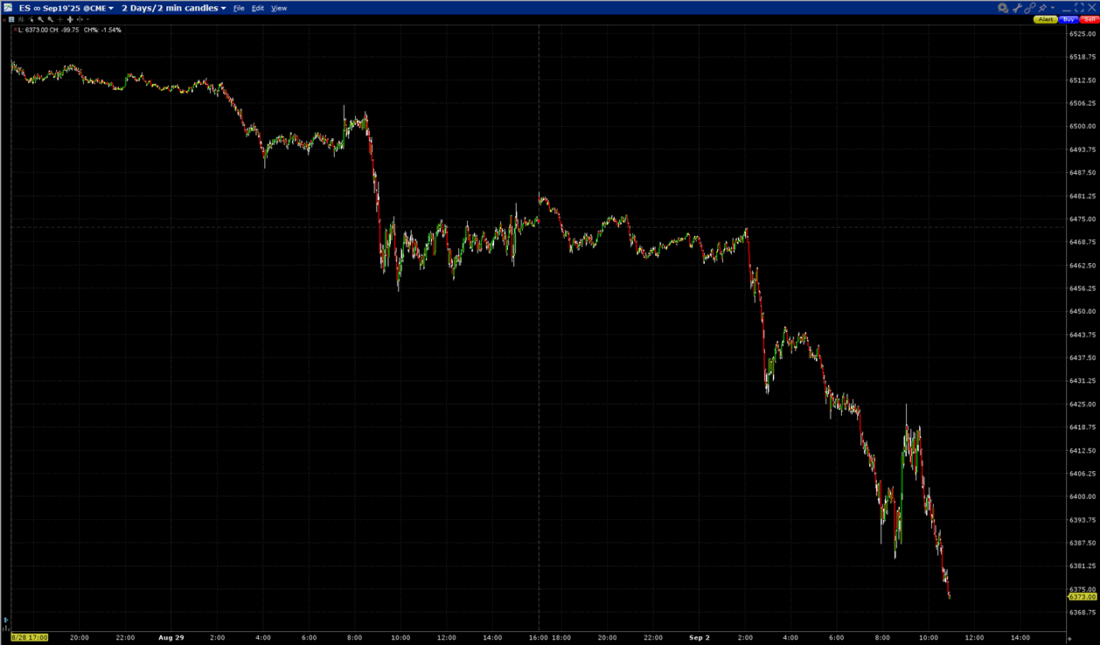

Notably this morning, we saw the initial absence, then the subsequent failure, of sustainable dip buying.Most of us in the US awoke after the long weekend to see modestly lower overnight stock index futures.That itself reflected a lack of bargain hunting after Friday’s decline, but the selling accelerated as the morning wore on.It seemed as though every few minutes brought another round of drops.As the chart below shows, there were a couple of attempts at bargain hunting – with a more sustained bounce shortly after the US open – but those were all extinguished rather quickly.Instead, we see SPX plumbing new lows as I type this shortly before noon EDT.

ES September Futures, 2-Days, 2-Minute Candles

(Click on image to enlarge)

Source: Interactive Brokers

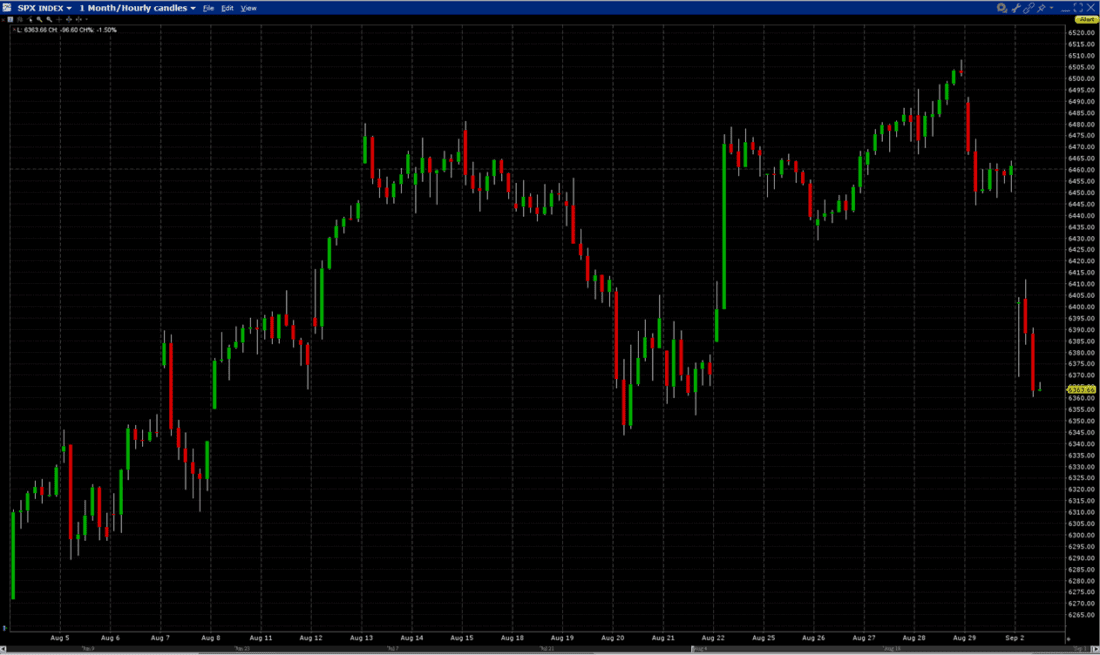

We also see SPX giving back the post-Jackson Hole rally.Even though rate cut expectations priced into CME futures improved slightly today, they still remain well below the highs that prevailed prior to Powell’s speech. (That said, expectations are more robust on ForecastEx, with a 7% “Yes” bid for a 50bp cut in September).Things seemed to be all about rate cuts recently, though less so today.

SPX 1-Month Hourly Candles

(Click on image to enlarge)

Source: Interactive Brokers

Here’s one other thing to keep in mind: perhaps the seasonality might have more about the date than the month.We have seen -1% selloffs become relatively rare, and when I checked for the last occurrence, I noticed that the prior one was on the first trading day of last month, when SPX fell -1.6% on August 1st.Interestingly, SPX fell -0.11% on July 1st.Maybe that’s something seasonal to consider?Regardless, since last month began with a relatively large drop that was swiftly erased, it will take more than a one- or two-day hiccup to proclaim that the calendar’s change to September is the reason for a major change in sentiment.

More By This Author:

From A Big Event To A YawnPowell To Markets: “Green Flags Are Up”

About That “So Far”

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx ...

more