Time To Buy CVS Or Oak Street Health Stock On Potential Acquisition?

Image: Bigstock

News of CVS Health (CVS - Free Report) potentially acquiring Oak Street Health (OSH - Free Report) for $10 billion broke this week and highlighted what could be another lucrative acquisition in 2023. For Oak Street Health, the possibility of a $10 billion buyout would see shares valued at around $40 and 33% above current levels of $30 a share.

While it continues to expand its reach into primary healthcare, let’s see if it’s time to buy CVS stock or shares of its potential acquisition target Oak Street Health.

Wall Street Believes the Acquisition Makes Strategic Sense

After acquiring health insurance giant Aetna in 2018, CVS is strategically increasing its footprint in primary healthcare. More recently, CVS announced the $8 billion acquisition of Signify Health (SGFY - Free Report) which is expected to be completed in the first half of 2023.

With many Medicare-Advantage plans supporting members with evaluations by Signify Health’s licensed clinicians, acquiring Oak Street Health would continue CVS’s expansion with their primary care centers for adults on Medicare.

Oak Street Health operates over 100 primary care centers in the U.S., and Signify Health’s platform and advanced analytics would support the combination of CVS’s growing healthcare spectrum.

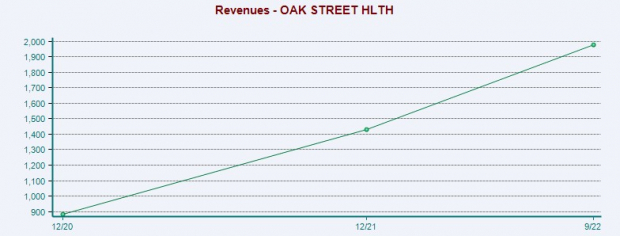

Growth & Outlook

In terms of revenue growth, the possibility of CVS acquiring Oak Street also makes sense as OSH sales are expected to climb 50% for its current fiscal 2022 and jump another 42% in FY23 to $3.06 billion. Fiscal 2023 would be a 456% increase from pre-pandemic levels, with sales at $557 million in 2019.

Image Source: Zacks Investment Research

After being founded in 2012, this top line growth is impressive and is much needed as the company adjusts to operating costs and as it is still below the profitability line. Oak Street earnings are now expected to be -$2.26 per share for 2022, but analysts foresee a smaller adjusted loss of -$1.60 a share in FY23. Even better, earnings estimates have continued to trend higher over the last 60 days.

Pivoting to CVS, sales are forecasted to rise 7% for fiscal 2022 and rise 3% in FY23 to $321.87 billion. Fiscal 2023 would represent 25% growth from pre-pandemic levels, with 2019 sales at $256.77 billion. On the bottom line, CVS earnings are now expected to be up 2% for FY22 and rise another 2% in FY23 at $8.83 per share. Earnings estimates have trended higher for FY22, but they are down for FY23.

Image Source: Zacks Investment Research

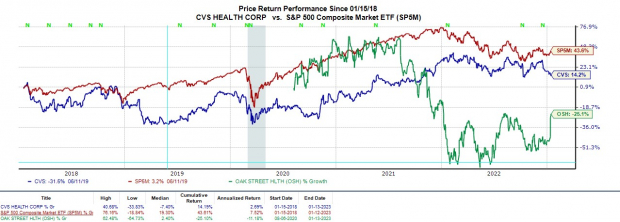

Recent Performance & Valuation

On Tuesday, Oak Street Health shares skyrocketed +27% on news of the potential acquisition while shares of CVS fell -1%. In the last year, OSH is up +36%, mostly attributed to this week’s spike, which easily tops CVS’s -15% and the S&P 500’s -16%. However, over the last five years, CVS is still up +14% to beat OSH’s -25% with both underperforming the benchmark.

Image Source: Zacks Investment Research

Trading at nearly $90 a share CVS trades at just 10.1X forward earnings. This is above its industry average of 8.1X but 53% below its decade high of 21.8X and a 20% discount to the median of 12.6X.

While the traditional P/E valuation can’t be used for Oak Street Health as it is still on the path to portability, taking a look at the company’s price to sales in recent years is beneficial. In this regard, we can see that OSH stock trades at 3.5X P/S, which is closing in on the optimum level of less than 2X.

Image Source: Zacks Investment Research

Even better, OSH stock trades well below its two-year high of 16.1X sales and nicely beneath the median of 4X. In comparison, CVS is below the optimum level at 0.3X and slightly below its high of 0.5X and the median of 0.4X during this period.

Take Away

In the short-term, the possible acquisition by CVS could lead to more momentum in Oak Street Health’s stock if there is some validity to a potential deal that values the company at $10 billion and roughly $40 a share. This is on top of earnings estimates revisions trending higher to land OSH a Zacks Rank #2 (Buy) at the moment, alongside its stellar top-line growth.

As for CVS, the stock is starting to look attractive near its 52-week lows, with the company expected to sustain top and bottom-line growth in addition to its attractive valuation. For now, CVS lands a Zacks Rank #3 (Hold) and should benefit long-term if it were to acquire Oak Street Health, especially in terms of added revenue and expansion into primary healthcare.

More By This Author:

Don't Ignore These Companies' Cash-Generating Abilities

3 Financial Mutual Funds To Buy As Fed Continues To Hike Rates

Citigroup Q4 Earnings Lag Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more