Don't Ignore These Companies' Cash-Generating Abilities

Image: Bigstock

It goes without saying that searching for stocks can be challenging, especially with an extensive list of options available. However, one way to cut out the bad apples is by focusing on stocks with strong free cash flow. But what is free cash flow, and why does it matter?

In its simplest form, free cash flow is the amount of cash a company keeps after paying for operating costs and capital expenditures. A high free cash flow allows for more growth opportunities, a greater potential for share buybacks, consistent dividend payouts, and the ability to pay off debt easily.

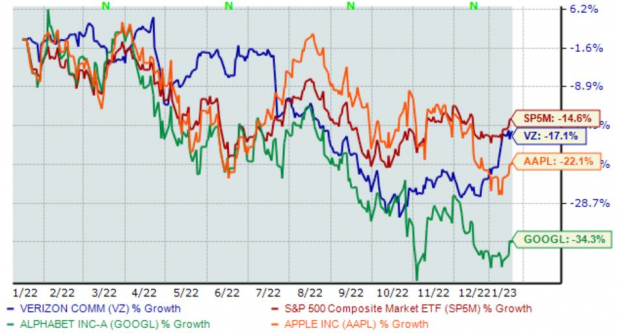

Three companies – Apple (AAPL - Free Report), Alphabet (GOOGL - Free Report), and Verizon Communications (VZ - Free Report) – all generate substantial cash. Below is a chart illustrating the performance of all three stocks over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Apple

We’re all familiar with the legendary Apple, the company that’s entirely changed the mobile phone landscape, among many others. Currently, the company is a Zacks Rank #3 (Hold).

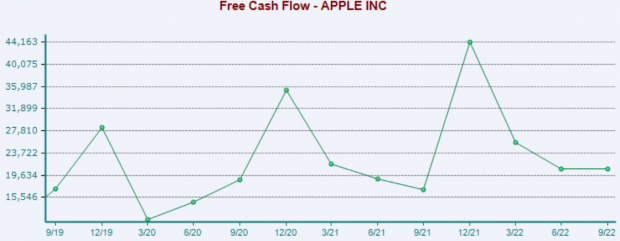

Apple is one of the biggest cash generators within the S&P 500; in its latest release, the company posted free cash flow of a sizable $20.8 billion, reflecting a sizable 23% year-over-year change.

Image Source: Zacks Investment Research

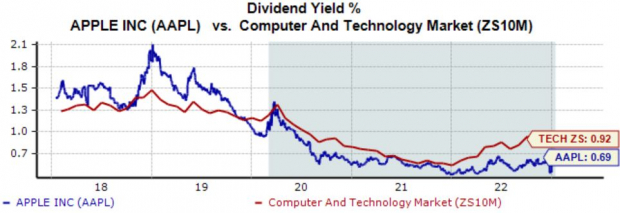

In addition, the company pays a small dividend, currently yielding 0.7% annually. While the yield is on the lower side, Apple’s 6.8% five-year annualized dividend growth rate helps to bridge the gap.

Image Source: Zacks Investment Research

Verizon Communications

Verizon, one of the largest wireless carriers, offers communication and data services in various forms. As it stands, VZ is a Zacks Rank #3 (Hold).

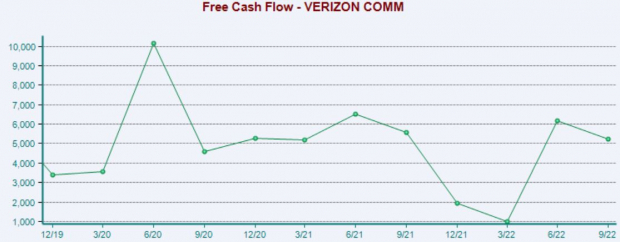

In Verizon’s Q3, the company generated $5.2 billion in free cash flow. As we can see in the chart below, the company’s free cash flow has started to recover from 2022 lows.

Image Source: Zacks Investment Research

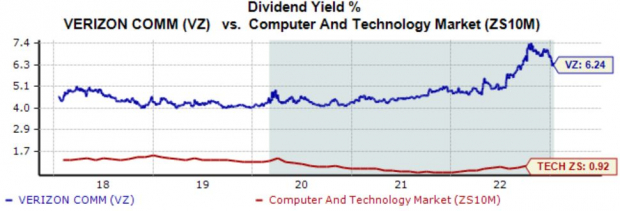

A significant perk of VZ shares is the dividend; Verizon’s annual dividend yields a sizable 6.2%, well above its Zacks Computer and Technology average. And over the last five years, the company’s payout has grown by 2%.

Image Source: Zacks Investment Research

Alphabet

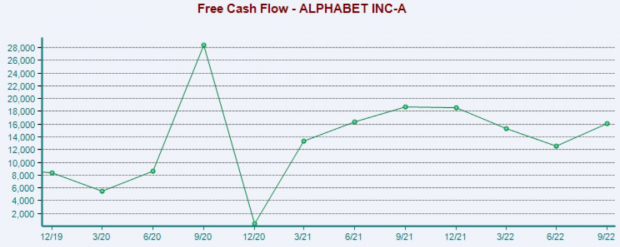

Another legendary company operating in the Zacks Computer and Technology sector, Alphabet, has quickly become an investor favorite. GOOGL is currently a Zacks Rank #4 (Sell). The Google parent generated $16.1 billion in free cash flow in its latest quarter, good enough for a sizable 28% sequential increase.

Image Source: Zacks Investment Research

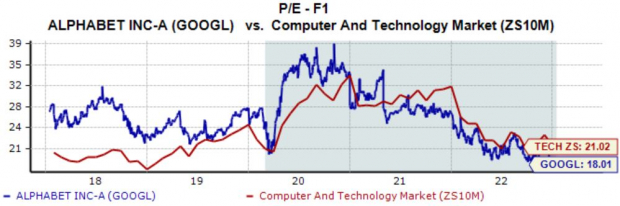

In addition, the company’s valuation multiples have pulled back extensively; GOOGL shares currently trade at an 18X forward earnings multiple, nowhere near the 26.3X five-year median and nicely beneath its Zacks sector average. Alphabet carries a Style Score of “B” for Value.

Image Source: Zacks Investment Research

Bottom Line

Searching for stocks can be overwhelming, with way too many options to sort through. However, focusing on a company’s cash-generating abilities is a great initial screen for those interested in filtering out companies with a weak financial standing.

All three stocks above – Apple (AAPL - Free Report), Alphabet (GOOGL - Free Report), and Verizon Communications (VZ - Free Report) – carry remarkable cash-generating abilities.

More By This Author:

3 Financial Mutual Funds To Buy As Fed Continues To Hike RatesCitigroup Q4 Earnings Lag Estimates

JPMorgan Chase & Co. Beats Q4 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more