Time To Accumulate BP

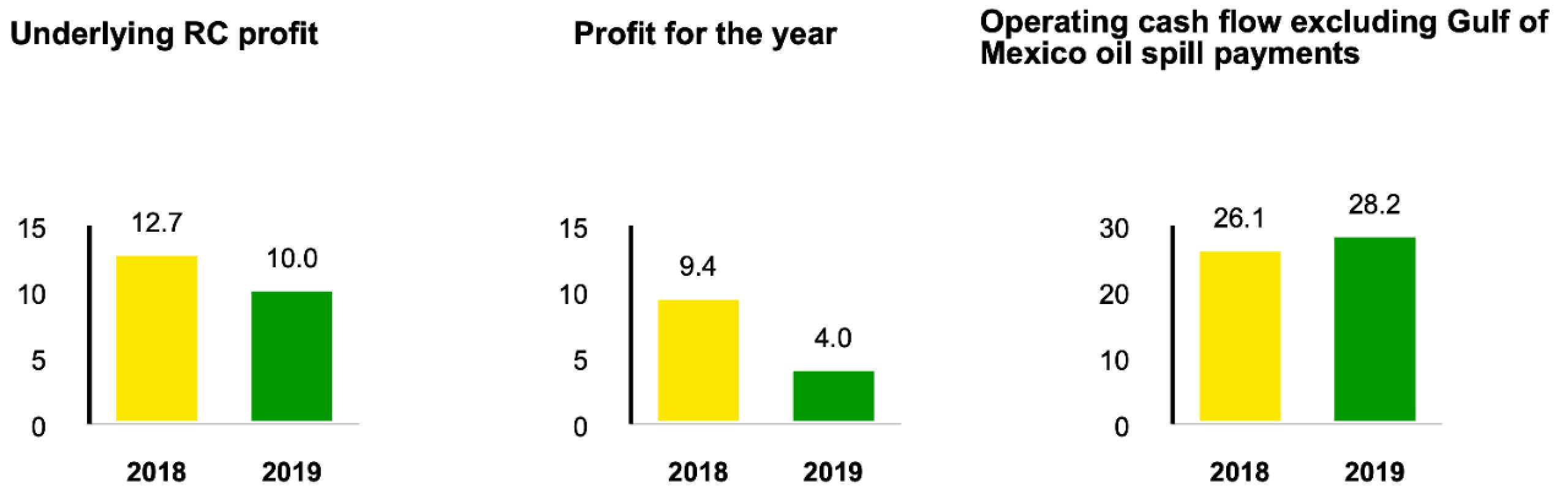

I firmly believe that this may be the right time to buy and accumulate BP Plc.(BP). The entire world is reeling under the impact of COVID-19 and international oil companies like BP Plc. have been one of the biggest victims of this global pandemic. Their downfall has been attributed to oil prices (WTI) that have crashed from $65 per barrel in January to $20.61 per barrel as on 1st April 2020. Investors must note that BP Plc. had reported better than expected 2019- financial results on February 4th, 2020, and its stock had appreciated by 4% that time because of positive investor sentiments, but that’s history now. From its 52- week high of $45.38, BP was trading at $24.39 during the time of writing this article.

Why I have faith in BP’s potential?

(Click on image to enlarge)

Image Source: BP Website

Despite all the negativity floating around energy stocks, I still have faith in BP’s growth potential, as it is one of the few energy companies that is ready to embrace change and adapt itself to complex business environment. Investors must note that BP’s stock performance is not completely dependent on oil prices. The proof lies in the fact that since 2017, the company has consistently delivered better than expected financial results, thereby defying cyclicality of oil prices.

Investors must also understand that the current plunge in BP’s share price is the result of a ‘one in lifetime’ pandemic that has created a war like situation around the world. Consumers across the world have reduced their energy consumption, but this trend won’t last forever. The world will eventually recover from the effects of COVID-19, the only question is how sooner. What still works for BP Plc. is that it has a strong operating cash flow and $15 billion asset divestment program (to be completed by second half of 2021) that will reduce its debt and improve cash flows. However, the fate of this asset sale program depends a lot upon the movement of crude oil prices in the coming time. Although oil prices will remain under pressure because of the ongoing oil price war between OPEC and Russia and COVID-19, things will improve from 3Q19 once the effect of COVID-19 weakens and global oil demand revives again.

BP is looking to increase its focus on renewable investments

In my earlier articles on BP Plc., I have stated that BP Plc. needs to focus on expanding its alternative energy business. Since last year, BP’s management team has often spoken about its ‘energy transition’ phase which consists of investments in Biofuels, solar power projects, EV charging stations and other renewable products. Now with COVID-19’s global outbreak, BP Plc’s focus on renewable investments will definitely increase.

“Some people have also questioned how the current circumstances affect our purpose and net-zero ambition. I can understand why they might ask that. World needs a rapid transition to net-zero emission, the carbon budget is finite and running out fast. We expect to invest more in low carbon businesses — and less in oil and gas — over time. The goal is to invest wisely, into businesses where we can add value, develop at scale, and deliver competitive returns” , stated BP’s recently appointed CEO Bernard Looney. Investors must note that BP will roll out more detials of its ’renewed strategy’ in September 2020, which I firmly believe will support its share price in long term.

Conclusion

Paris based International Energy Agency (IEA) has predicted that renewables will contribute around 40% to the total global energy demand within the next 20 years from now. By setting a target of becoming a ‘net zero emissions company’ by 2050 or sooner, BP Plc. has reaffirmed the need to reinvent itself in the wake of the ongoing COVID-19 crisis. Besides, reducing its dependability on oil prices is indeed a smart ‘long- term’ move by the London Based energy major. Even if BP defers its current dividend pay-out, investors can still expect an upside of around 50% in the coming time, as the company’s fundamentals remain strong.