Is It A Good Time To Invest In BP P.l.c.?

This might be a great time to invest in BP (BP), as I firmly believe that the company’s upcoming 4Q19 earning results (that will be released on February 4, 2020) will support its stock price. BP, which operates through its three major segments – Upstream , Downstream and Rosneft, is among the most preferred energy stocks in the market today. Although BP’s 3Q19 earnings of $2.25 billion looked weak compared to the first two quarters of 2019, it was still higher than the market expectations of $2 billion. In fact, BP reported better than expected results for the 11th consecutive time in 3Q19. This is something that no other energy major has been able to achieve! With this, let us look at the factors that will have an impact on BP’s stock price in the coming time.

BP’s 4Q19 earning results will support its stock price

BP’s stock price had fallen by 3% after its 3Q19 earning results were announced on October 29th , 2019. The biggest reason behind this fall was BP’s 3Q19 earnings that declined by 41% YoY and its upstream production that remained flat at 2.56 million barrels. However, these numbers are expected to improve in 4Q19. Investors must note that BP’s earnings may grow substantially in 4Q19 -thanks to its upstream production which is expected to increase because of the completion of seasonal maintenance and turnaround activities. The downstream earnings may disappoint (yet again) because of lower refining margins and low turnaround activity. BP was trading at $38.8 at the time of writing this article. The stock has declined by almost 1.3% in last two months. I expect the stock price to cross $40 after its 4Q19 earning results are announced on February 4th. New investors must note this.

Oil prices and U.S. – China trade deal may support BP’s stock performance in the coming time

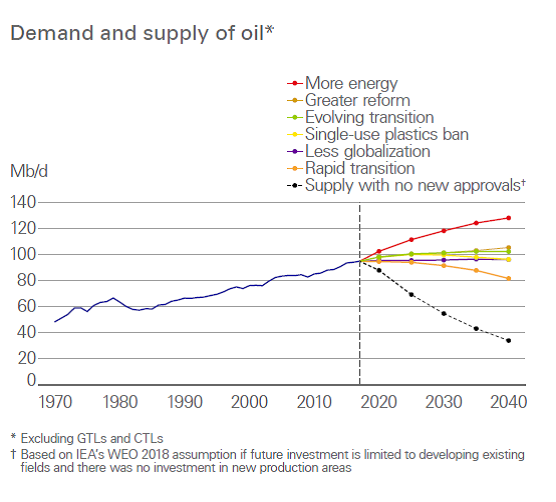

Image Source: BP Energy Outlook 2019

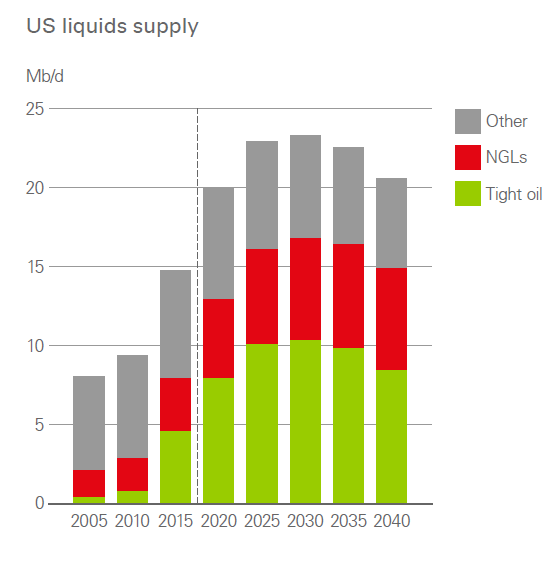

Although BP has a well-diversified portfolio that is not entirely dependent on oil prices, it is still an oil and gas company that can benefit from higher oil prices. High oil prices will increase BP’s upstream earnings, which will directly have a positive impact on its stock price. The million-dollar question is, where are oil prices headed? Despite rising U.S oil production, oil prices are currently supported by geopolitical tensions in the Middle east and U.S- China Phase-1 trade deal. As mentioned by me in my previous article on Exxon Mobil, if oil remains above $60 in 2020, then it will support BP’s upstream earnings and stock price in the coming time. However, a supply glut of 0.6 to 0.7 million barrels till March 2020 will continue to put pressure on oil prices till the first quarter of 2020. WTI was trading at $58.03 at the time of writing this article.

BP is trying to build Unicorns to strengthen its low carbon business

BP is one of the few energy companies having a sizeable alternative energy portfolio which comprises of renewable fuels, renewable power and renewable products. In 3Q19, Lightsource BP ( in which BP holds 43%) bagged a few solar power projects in Brazil and U.S. However, what excites me more is the fact that BP has created a subsidiary through which it plans to create at least 5 Unicorns worth $1 billion each by 2024. “We are trying to build unicorns in the energy business. It’s a bit of a cliché, but the term is a proxy for scale. Without this, you are not able to maximise impact and accelerate the energy transition. We needed to augment the capability we already have to build our own new businesses”, said Stephen Cook, who is chief commercial officer of BP’s technology division. This shows that BP is already taking the right steps towards strengthening its sustainable - low carbon business, which can reduce its dependency on oil in the coming time. Interesting!

Conclusion

It can be clearly seen that all the above-mentioned factors will support BP’s stock price in the coming time. The only risk to this is oil price slump, but BP’s dependability on oil price is lower when compared to its peers such as Chevron (CVX) and Exxon Mobil (XOM). Besides, investors must note that BP is trading at a lower valuation and higher dividend yield compared to Exxon Mobil (XOM) and Chevron (CVX). With an ongoing asset divestment program, a strong operating cash flow and sustainable business development initiatives, I expect BP to reach $45 by 4Q20. Investors must note this.

Very thorough.

Thanks.