Tilray Inc. Corrects Despite Much Improved Q4 Financial Results

Tilray Inc. (TLRY), a constituent in the munKNEE Pure-Play Pot Stock Index, focused on the research, cultivation, production, and distribution of cannabis and cannabinoids, sells products in 15 countries on 5 continents. It announced its Q4 financial results today for the period ended December 30, 2020. The highlights are as follows:

Q4 Financial Highlights (All results are presented in USD and compared to the previous quarter. See details of Q3 results here.)

- Total Net Revenue: +10% to $56.6M

- Cannabis Revenue: +31% to $41.2M

- Adult-Use: +27%

- Medical: +24%

- Int'l: +44%

- Hemp Revenue: -23% to $15.3M

- Cannabis Revenue: +31% to $41.2M

- Gross Margin: increased to 29% from 7%

- Cannabis: increased to 33% from 27%

- Hemp: decreased to 34% from 43%

- Net Profit (Loss): loss increased 30% to $(3.0)M

- Net Profit (Loss)/Share: unchanged @ $(0.02)

- Adj. EBITDA: increased to $2.2M from $(1.5)M

- Cash on hand: increased 22% to $189.7M

Operational Highlights

- Production Cost/g of Dried Cannabis: declined 12% to $3.72/g

- Average Net Selling Price/g of Dried Cannabis: decreased 3% to $5.97/g

Management Commentary

Brian Kennedy, the CEO, said:

- “...We achieved our stated goal of delivering break even or positive Adjusted EBITDA in Q4 2020 and did so by generating meaningful revenue growth across our core businesses, particularly international medical and Canadian adult-use in Q4, and by reducing costs...[allowing us to] operate with a more focused, efficient, and competitive cost structure.

- We also strengthened our balance sheet and positioned Tilray for growth and success in the future in combination with Aphria.

- ...Our proposed merger with Aphria will position the combined company as a global leader with lowest cost of production, leading brands, a well-developed distribution network, and unique partnerships.

- Finally, and as previously stated, the ‘new’ Tilray will achieve over C$100 million in anticipated pre-tax synergies. The aggregate impact of these value drivers provides confidence that the ‘new’ Tilray will generate significant value for stockholders.”

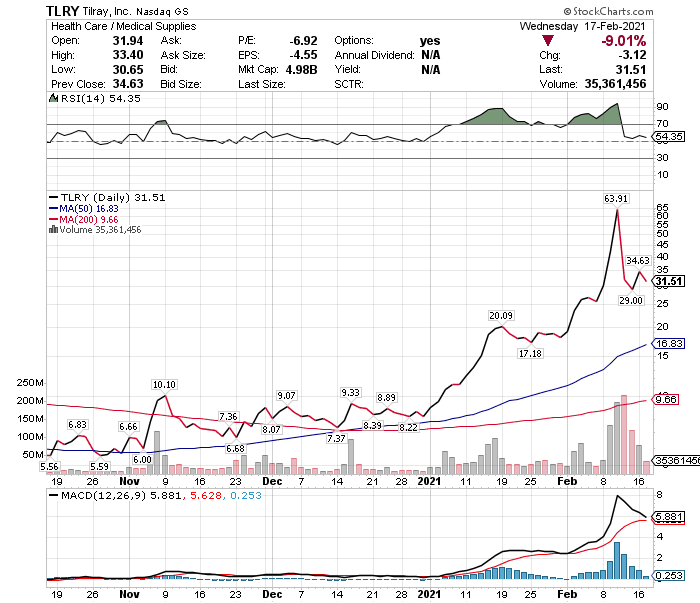

Stock Performance

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more