Tilray Inc. Corrects Despite Much Improved Q3 Financial Results

Tilray Inc. (TLRY), a constituent in the munKNEE Pure-Play Pot Stock Index, focused on the research, cultivation, production, and distribution of cannabis and cannabinoids, sells products in 15 countries on 5 continents. It announced its Q3 financial results today for the period ended September 30, 2020. The highlights are as follows:

Q3 Financial Highlights (All results are presented in USD and compared to the previous quarter.)

- Total Net Revenue: +2% to $51.4M

- Cannabis Revenue: +4% to $31.4M

- Adult-Use: +13%

- Medical: -11%

- Int'l: -3%

- Hemp Revenue: -1% to $20.0M

- Cannabis Revenue: +4% to $31.4M

- Gross Margin: increased to 7% from (11)%

- Cannabis: increased to 27% from 10%

- Hemp: decreased to 43% from 50%

- Net Profit (Loss): improved to $(2.3)M from $(81.7)M

- Net Profit (Loss)/Share: improved to $(0.02) from $(0.66)

- Adj. EBITDA: loss reduced by 87% to $(1.5)M

- Cash on hand: $155.2M

Operational Highlights

- Production Cost/g of Dried Cannabis: +105.3% to $4.23/g

- Average Net Selling Price/g of Dried Cannabis: increased 133% to $6.15/g

Management Commentary

Brian Kennedy, CEO, said:

- "We remain focused on our goal of achieving break-even or positive Adjusted EBITDA in the fourth quarter of 2020.

- Looking to 2021 we are optimistic about the prospects for our core businesses including:

- Canada Adult Use – we see continued opportunities to leverage our Kindred partnership structure and focused selling strategy to grow market share and revenues.

- International Medical – the completion of our Portuguese facility and our brand strength will allow us to strengthen our International footprint and position Tilray for “first mover” advantage as new international markets legalize medical and/or recreational cannabis.

- Hemp Products – our market reach will allow us to leverage the plant based food trends in the United States and broaden our product offerings to include CBD once the FDA provides guidance on a nationwide basis.

- Our diversified product offerings and geographical footprint set Tilray apart. These strategic advantages provide us a foundation from which we see ample and continued opportunity to strengthen our position as the most trusted cannabis and hemp company during 2021."

Stock Performance

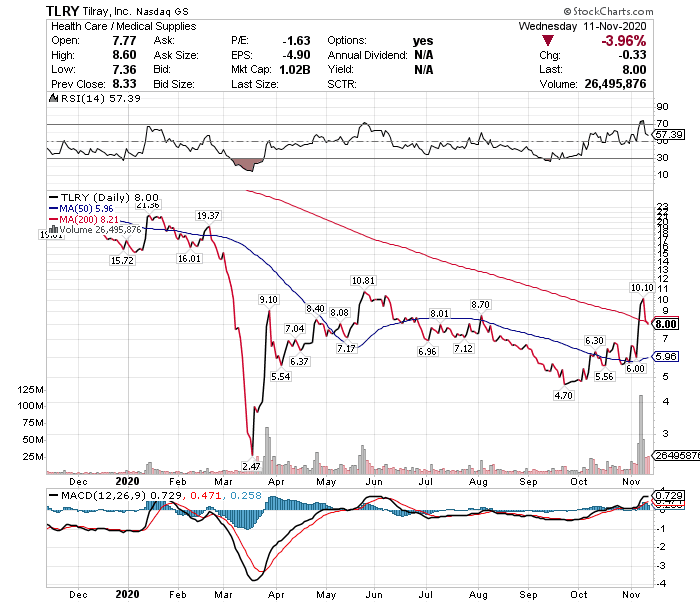

While the Tilray stock price is DOWN 51.4% YTD, as of yesterday, it is showing considerable improvement of late going UP a dramatic 45.9% since the end of October although it has gone DOWN 20.8% since Monday as can be seen in the chart below.

(Click on image to enlarge)

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

An educational article.