Three History Lessons Frame Expectations

Lesson 1: Hockey Stick Growth

In the 110 year history of the US stock market, the first 67 years were flat – zero return. Surprised? Me too.

Since then, it’s been straight up. The most recent 43 years has produced a 1390% return. It’s been a good 43 years, leading to a currently expensive stock market.

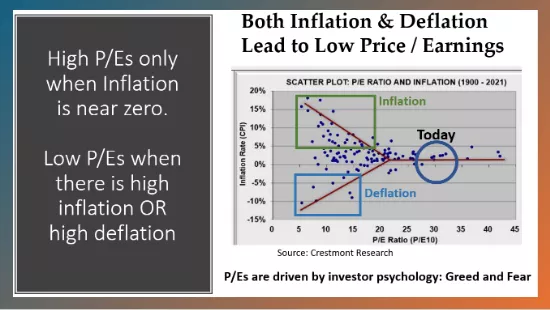

Lesson 2: Low P/Es when inflation is not low

Price/Earnings Ratios are very high. It’s a very expensive market. Historically, high P/Es have happened when inflation was near zero. When we’ve had either deflation OR inflation, P/Es were low. If P/Es decrease, stock prices will fall. Will inflation stay near zero? Can it?

Why are P/Es low when inflation is not? Fear.

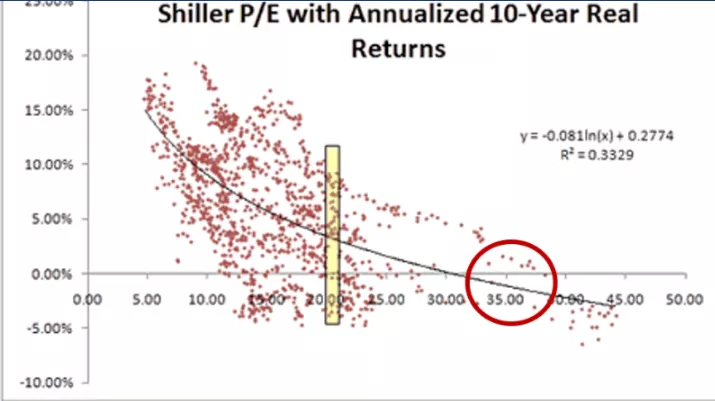

Lesson 3: Low returns follow high P/Es

Regarding high P/Es, Howard Marks observes that "It shouldn’t come as a surprise that the return on an investment is significantly a function of the price paid for it.” As shown in the following from My Money Blog, the greater the P/E the lower the subsequent return, and the higher the likelihood of posting a lower return. In other words, high P/Es are usually followed by reductions in P/E – regression toward the mean.

The Shiller P/E is currently 35, which is near the highest ever. Focusing on the red circle in the exhibit, when P/Es have reached 35 in the past, stock markets have returned near zero in the subsequent decade. And when P/Es have been above 35, stock markets have suffered losses in the subsequent decade every time.

So, increasing stock prices decrease subsequent returns. To state this in an obvious way, overpaying for something reduces your subsequent profit. In this case, a multiple above 35 has always preceded investment losses, so rising prices portend future losses.

Conclusion

Prices can continue to rise, until they don’t. The Roaring 2020s could repeat the painful lesson of 100 years ago, following the Roaring 1920s.

Has Artificial Intelligence changed history? Of course. So did dot.com and other innovations. AI companies make up about 50% of the S&P500, so they are the great hope. Time will tell.

History repeats technological advances and irrational exuberances.

More By This Author:

A Good Start To 2025; Now What?

The Math Behind Earnings Growth Supporting High Stock Prices

Life Without ZIRP Spells RIR: Rising Interest Rates