A Good Start To 2025; Now What?

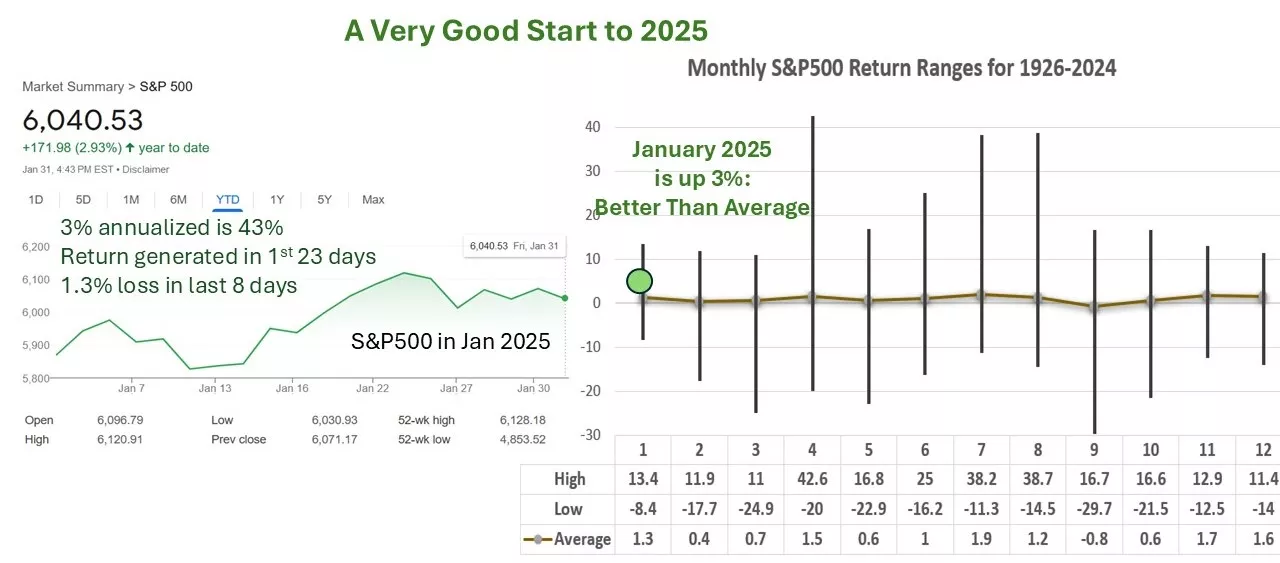

As shown in the following, the US stock market started 2025 very well, with a 3% return.

The January Barometer holds that “as January goes, so goes the rest of the year,” so this year’s 3% January return bodes well for the year 2025. But a closer look reveals that January did not end well, losing 1.3% in the last few trading days. Did the Barometer change its mind?

As shown in the following, the 16-year bull market has extended its run into 2025, rebuffing the concern that “if something cannot go on forever, it will end.”

What lies ahead

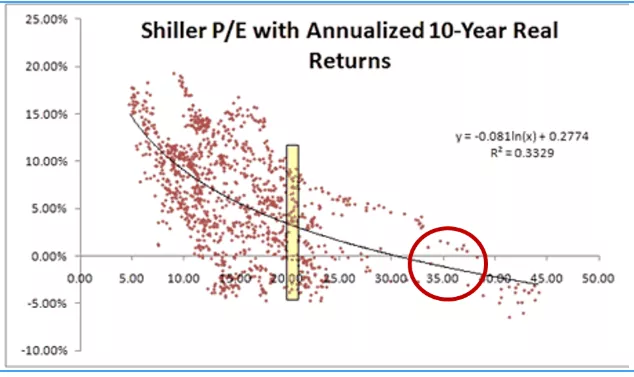

Another look is into the future, at what is in store based on the expense of the stock market. Howard Marks observes that "It shouldn’t come as a surprise that the return on an investment is significantly a function of the price paid for it.” As shown in the following from My Money Blog, the greater the P/E the lower the subsequent return, and the higher the likelihood of posting a lower return.

The Shiller P/E is currently 35, which is near the highest ever. Focusing on the red circle in the exhibit, when P/Es have reached 35 in the past, stock markets have returned near zero in the subsequent decade. And when P/Es have been above 35, stock markets have suffered losses in the subsequent decade every time.

So, increasing stock prices decrease subsequent returns. To state this in an obvious way, overpaying for something reduces your subsequent profit. In this case, a multiple above 35 has always preceded investment losses, so rising prices portend future losses.

Prices can continue to rise until they don’t.

The rest of the story

The US stock market has led the world for the past decade, but that changed this month, as shown in the following:

.webp)

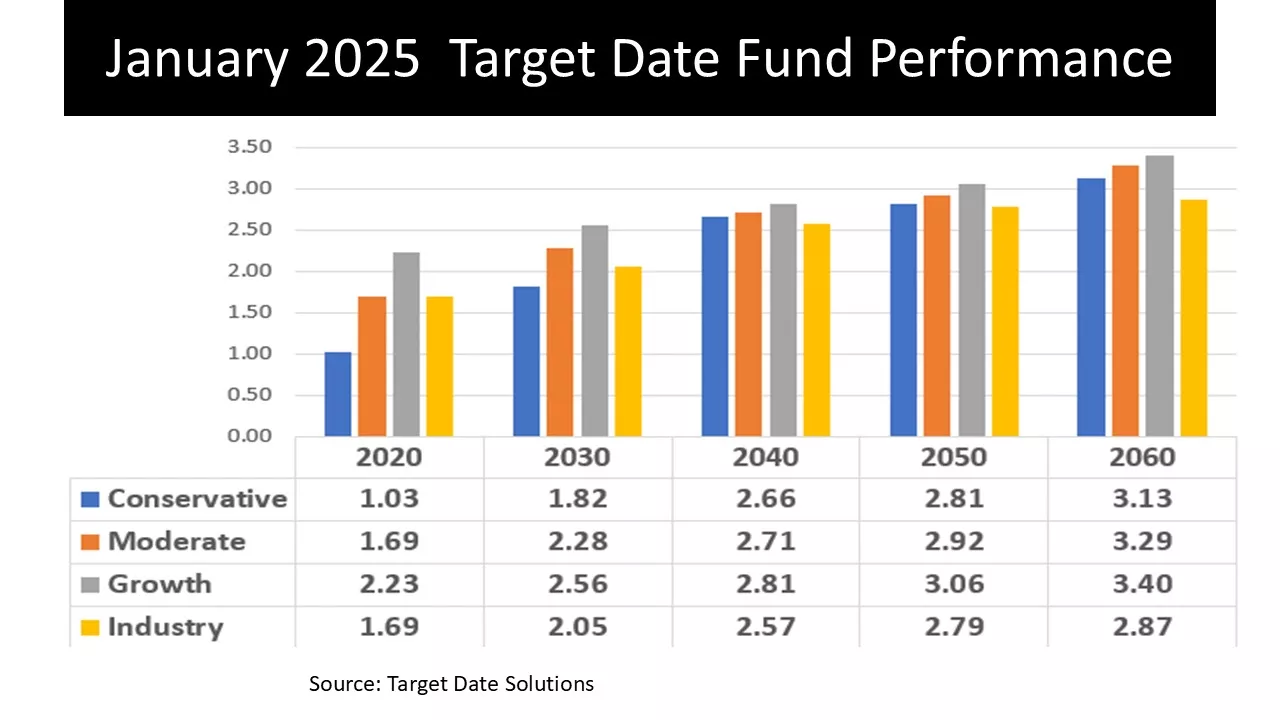

Gold and foreign stocks led in January. Consequently, greater diversification benefited performance, as shown in the following target date funds (TDFs) results.

TDFs are multi-asset portfolios. Longer dates, like 2060, are more aggressive than near dates like 2020. Also, the non-Industry results are for broadly diversified funds. Diversification beyond US stocks was rewarded in January.

Conclusion

Which do you think will prevail in 2025? Is the January Barometer forecasting a good year or is the Expensive Market forecasting a bad year? My personal view is that every day the stock market goes up, the odds and magnitude of a crash also go up.

More By This Author:

The Math Behind Earnings Growth Supporting High Stock PricesLife Without ZIRP Spells RIR: Rising Interest Rates

99 Year Perspective On U.S. Markets: Stocks, Bonds, T-Bills And Inflation. Is The Bull Getting Tired?