This Meme-Stock Is Still Not Worth Buying At Any Price

We put AMC Entertainment (AMC) in the Danger Zone in April 2021, after what we thought would be the end of its meme-stock run. Our call was admittedly early and shares have nearly quadrupled since then. But, with little recovery of its pre-pandemic business, this meme-favorite looks more dangerous than ever. As we’ll show in this report, we do not think this stock is worth even $1/share.

Photo by Donreál Lunkin on Unsplash

AMC Has 100% Downside

- AMC shares have nearly quadrupled since our original report and remain so far removed from the fundamentals of the business that investors cannot make a straight-faced argument that the company will meet the expectations baked into its stock price.

- AMC Entertainment is currently priced as if it will improve profitability above historical averages and generate revenue equal to 35% of the projected global box office in 2030 (up from 13% in 2019).

- With nearly $12 billion in senior liabilities and no excess cash, it is unlikely that the company will ever make enough money to satisfy stakeholders who have higher claims on the firm’s cash flows than common shareholders. We do not think equity investors will ever see a single dollar of economic earnings.

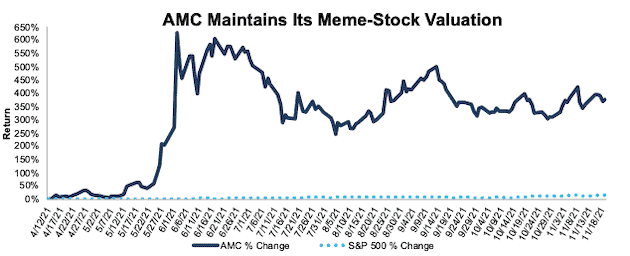

Figure 1: Danger Zone Performance: From Original Report Through 11/19/21

Sources: New Constructs, LLC and company filings.

What’s Working for the Business:

AMC beat on both the top- and bottom-lines in 3Q21. Of course, COVID-19 related shutdowns drove AMC’s revenue down 77% year-over-year (YoY) in 2020. Off that low base AMC reported rapid YoY revenue growth in the second and third quarters of this year. In 3Q21, revenue grew by 72% over the prior quarter and over 500% compared to 3Q20.

AMC has continued to attract interest from retail investors through its acceptance of Bitcoin, Ethereum, and other “meme-stock like” cryptocurrencies such as Shiba Inu and Dogecoin. The company also announced plans to sell its popcorn through traditional retail outlets, such as grocery stores, in 2022, though the actual results from this plan remain to be seen.

Industry-wide, October box office sales were the highest of any month in 2021 and are up nearly tenfold over 2020, growth that is a welcome sight in a beaten down industry.

What’s Not Working for the Business:

AMC has worked to sustain the meteoric rise of its stock by directly appealing to meme-stock investors and engaging with the popularity of crypto by accepting crypto as payment. While these actions may keep the stock’s momentum elevated temporarily, they do not improve business fundamentals. Despite rebounding from pandemic lows, the fundamentals of AMC and the overall film theater industry remain well below pre-pandemic levels. We hold significant doubts that the company will ever achieve the expectations baked into its stock price.

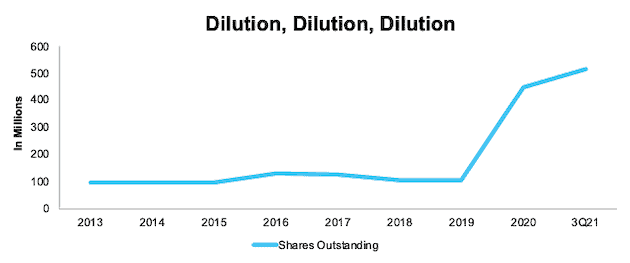

Dilution Runs Rampant. During the midst of its meme-stock rise, AMC heavily diluted investors. Per Figure 2, AMC’s shares outstanding increased nearly 5x, from 104 million in 2019 to 514 million at the end of 3Q21. The dilution could have been even worse, as the company announced a plan to authorize an additional 500 million new shares but later backtracked on the plan.

Figure 2: AMC’s Shares Outstanding: 2013-3Q21

Sources: New Constructs, LLC

While the share issuances helped provide the firm cash, they have done little to improve the firm’s balance sheet. Cash and equivalents through 3Q21 sit at $1.6 billion, up from $418 million in 3Q20, and $100 million in 3Q19. That cash reserve will not last long given that free cash flow (FCF) was -$3.9 billion in 2020 and is -$2.9 billion over the TTM. Before the pandemic, AMC burned through $5.1 billion in free cash flow from 2014-2019.

The firm’s total debt, which includes short-term debt, long-term debt, and operating leases is $12.3 billion, only a marginal improvement from $12.7 billion in 3Q20, and up from $11.1 billion in 3Q19. Overall, AMC’s adjusted debt net of cash sits at $11.9 billion through 3Q21, and the company earns a Very Unattractive Credit Rating.

Rebound Remains Well Below Pre-Pandemic Levels. Despite impressive YoY revenue growth, AMC’s TTM revenue remains 72% below its 2019 revenue. As we noted in our original Danger Zone report, the company’s Core Earnings were in decline even before the pandemic and have not rebounded in any meaningful way yet.

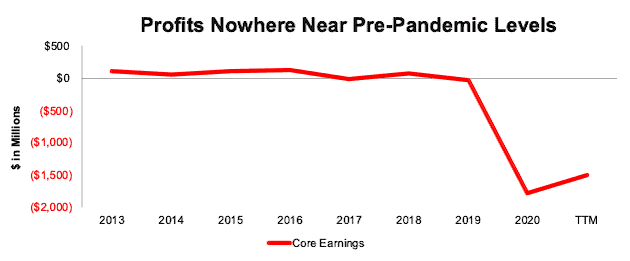

AMC’s Core Earnings over the TTM are -$1.5 billion, up slightly from -$1.8 billion in 2020, but still well below the -$30 million in 2019 and $78 million in 2018 (the last year AMC earned positive Core Earnings). See Figure 3.

Figure 3: AMC’s Core Earnings: 2013 – TTM

Sources: New Constructs, LLC and company filings.

The company’s TTM net operating profit after-tax (NOPAT) margin sits at -59%, which is up from -96% in 2020 but still well below the 8% NOPAT margin earned in 2019. Similarly, AMCs return on invested capital (ROIC) is -5% over the TTM, down from 3% in 2019. Despite the improvement from an abysmal 2020, AMC’s business still sits in a significantly worse position than it did pre-pandemic.

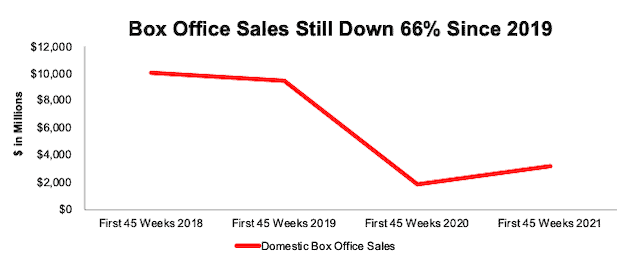

Industry Rebound Has Long Way to Go, Too. While domestic box office sales in 2021 are well above the lows of 2020, they have yet to recover to pre-pandemic levels. Gross domestic box office sales through the first 45 weeks of 2021 are down 66% from the same period in 2019 and 68% from the same period in 2018. Domestic ticket sales follow a similar trend and are down 65% from 2019 and 67% from 2018.

Figure 4: Domestic Box Office Sales: 2018-2021

Sources: New Constructs, LLC and Box Office Mojo

And May Never Fully Rebound. Perhaps most alarming for AMC (and any other movie theater operator) is that the number of theatrical releases has rebounded at a much faster pace than box office sales. Consumers simply aren’t returning to the theater as they once did.

So far in 2021, the number of movies released is just 24% below 2019 and 31% below 2018. The disconnect between the number of movie releases and box office revenue indicates the COVID-19 pandemic likely created a structural shift in the movie viewing experience. With movies released on-demand at the same time as theatrical, or even just a few weeks later, consumers are forgoing the movie theater for the comfort of their own home.

AMC Is Priced to Take 35% of 2030 Box Office Sales

While attempting to short AMC could be a losing proposition, we think it is important to highlight the high risk in owning the stock by quantifying the future cash flow expectations in the current stock price. At $42/share, AMC Entertainment is priced as if it will improve profitability above historical averages and generate revenue equal to 35% of the global box office in 2030 (up from 13% in 2019).

Specifically, to justify its current price of $42/share, AMC must:

- improve its NOPAT margin to 10% (above its 5-year pre-pandemic average [9%] from 2015-2019, compared to -59% TTM), and

- grow revenue by consensus estimates in 2021 (104%) and 2022 (84%) and

- grow revenue 18% a year from 2023 through 2030 (1.5x 2023 consensus estimates).

In this scenario, AMC Entertainment would generate nearly $18 billion in revenue in 2030, which is 3x its previous record revenue of $5.5 billion in 2019 and nearly half the global box office revenue in 2019.

If we assume global box office revenue grows at consensus forecasts through 2025, and then 3.7% a year from 2025 through 2030 (equal to CAGR from 2009 to 2019), the scenario above implies AMC Entertainment’s revenue would equal 35% of the global box office revenue in 2030, up from ~13% in 2019 and higher than at any point in our model, which goes back to 2013. For reference, the second and third largest theater operators (by number of screens) behind AMC, Cineworld Group and Cinemark, owned just 10% and 8% of global box office revenue in 2019.

This scenario also implies AMC generates $1.8 billion in NOPAT in 2030. For reference, AMC has never generated more than $522 million in NOPAT, which it earned in 2018.

We think it’s overly optimistic to assume AMC will reverse margin deterioration (even before COVID-19), grow revenue well above 2023 consensus estimates and the overall industry, and achieve a market share previously unheard of. In the more realistic, yet still optimistic, scenario detailed below, the stock has large downside risk.

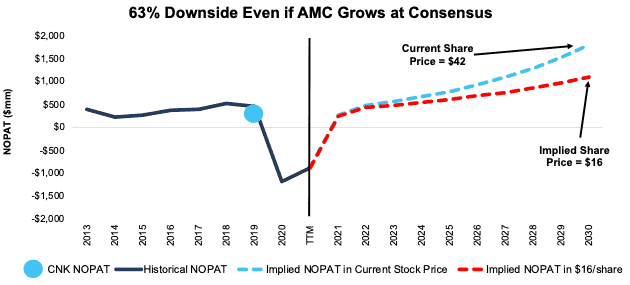

AMC Has 63%+ Downside if Consensus Is Right: if we assume AMC Entertainment’s:

- NOPAT margin improves to 9% (pre-pandemic 5-year average) and

- revenue grows at consensus rates in 2021 and 2022, and

- revenue grows 13% a year in 2024-2030 (continuation of 2023 consensus estimates), then

the stock is worth just $16/share today – a 63% downside to the current price. This scenario still implies AMC’s revenue grows to 2x its record 2019 levels. If AMC fails to grow revenue as quickly, or improve margins as much as we assume for this scenario, the downside risk in the stock would be even higher.

Figure 5 compares AMC’s historical NOPAT to the NOPAT implied by each of the above DCF scenarios. For reference, we include Cinemark Holdings’ (CNK) pre-pandemic 2019 NOPAT.

Figure 5: AMC Entertainment’s Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

Stock is Not Worth $1

Each of the above scenarios also assume AMC grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate the extraordinarily high expectations embedded in the current valuation.

Given that the performance required to justify its current price and $16/share look overly optimistic, we dig deeper to see if this stock is worth buying at any price. The answer is no. Given $11.9 billion in the fair value of total debt, $44 million in underfunded pensions, $27 million in net deferred tax liabilities, and no excess cash, it is unlikely that the company will ever make enough money to satisfy stakeholders who have higher claims on the firm’s cash flows. In other words, we do not think equity investors will ever see $1 of economic earnings.

This article originally published on November 22, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

David Trainer, how can you say that $AMC is not even worth a $1? They may be overvalued, but who wouldn't grab some $AMC stock at only a buck?

Did you read the whole article? If you judge worth in terms of it functioning as a business then it's not worth anything. In pyramid-scheme terms, ie finding some other meme-stock sucker to buy your share, sure. In my mind it boils down to, are you a trader or an investor. To an investor, it's not worth investing in. IMHO.

Not liking this stock at any price.