This Is Critical For Foot Locker

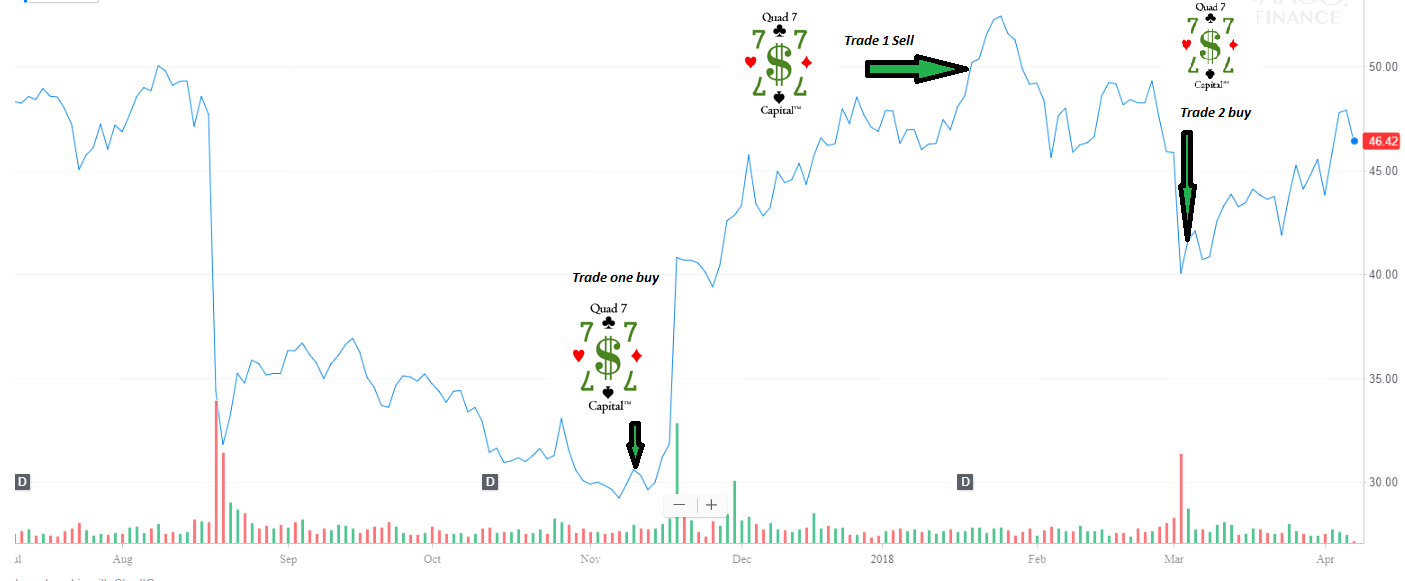

We are watching Foot Locker (FL) very closely as it is a key component of the BAD BEAT Investing portfolio run by Quad 7 Capital. We believe 2018 is a make or break year for the name. The reason that we added the name to the portfolio and have made several successful trades in the stock is because of the horrendous price action which drove the stock down to deep value.

Source: Yahoo Finance, graphics overlaid by Quad 7 Capital and BAD BEAT Investing

We first issued an alert at $29 in the fall, and took some profits when the stock returned to the mid-$40 range. Then after the most recent earnings report, we again issued a trade alert at $31 a share. These swing trades have been successful, but the position is a value holding.

We are gladly holding this American staple as it pays a dividend that is raised every year. It currently yields 2.6%. The company is buying back shares. It is getting aggressive in its property management. And, even at $45 a share, the company is priced at a discount on forward earnings and a price-to-sales basis.

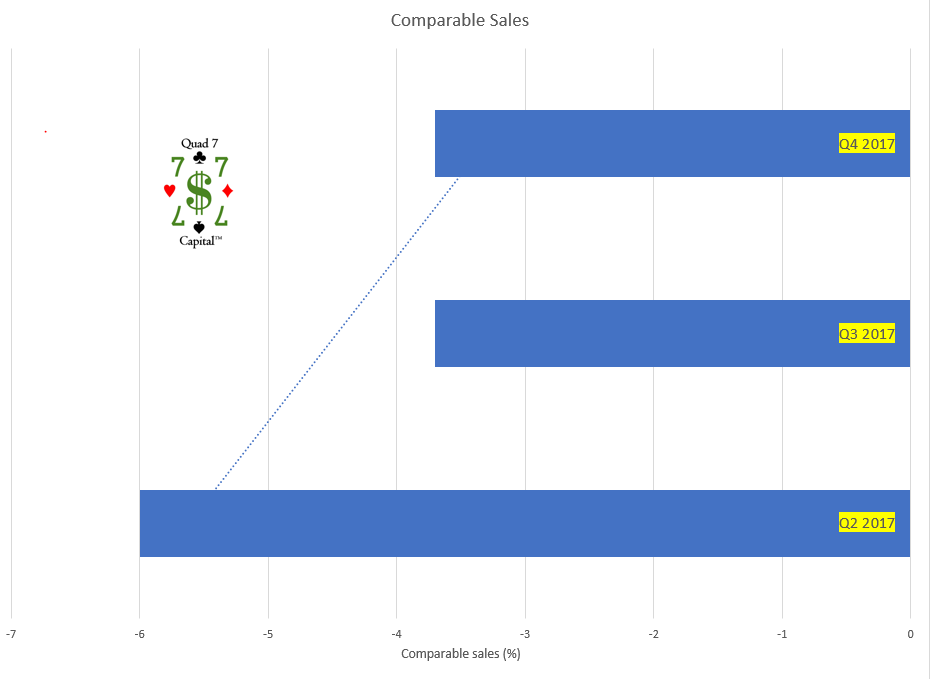

With that said, there are many critical metrics that we will be watching for in 2018, but in this column, we specifically want to talk about comparable sales, as this indicator alone could drive investors to sell, or bid up the name. There is no doubt about it, declining comparable sales are a key weakness for the company right now. Foot Locker has got to do better here.

In fact, poor comps crushed Foot Locker, but we think this was overdone. We need to point our that for the year 2018, we are projecting flat-to-slightly positive same-store sales. It should be noted that we anticipated a weak start to the year on this metric, but comparable sales were below our projections of down 2-3%, coming in at -3.7%:

Source: SEC filings; chart made by author in MS Excel

While this may look a little scary, there is actually some good news here. First, comps appear to be in recovery mode as they are starting to trend higher off of the horrendous results last summer. In addition, we have great expectations for Foot Locker on this measure this year. Comparable sales are expected to ramp up from their lows seen in Q2 2017, where they fell a devastating 6%.

The present quarter’s miss versus our expectations of -2.5% is probably the greatest weakness for the company, and this is why investors initially dumped the stock. We considered it a BAD BEAT, because many of the other indicators, such as overall sales and earnings, were fine. This measure spooked the Street.

Because comparable sales are indeed a key indicator, and they had been robust for many quarters up until spring of 2017, the recent weakness was enough to drive the Street to sell first and ask questions later.

As such, we saw this a BAD BEAT with value. Despite a -3.7% comparable sales figure in the most recent quarter, we were pleased with the result in one sense only because comps are still trending upward off the lows from Q2 2017, but there is much work to be done moving forward.

This is why 2018 is a make or break year. The future matters here, and the Street is looking for clarity on where Foot Locker is heading as a company. We think this is even more simplistic. We simply ask, will comparable sales rebound, or not. It is really that simple.

Looking ahead to Q1, we expect a continued drag on comparable sales, but this will be in large part due to heavy promotional activity to move merchandise as the company transitions into the latter half of 2018 and beyond. However, the second half of the year is critical.

On a forward basis, we believe that Q3 and Q4 this year will see a ramp-up in comparable sales, and we stand by that call, but we fully believe the second half of the year is absolutely critical. There is uncertainty about the future, and investors are pricing this into the stock. That said, the company is laser focused on correcting these issues through promotions, property management, direct-to-consumer sales, and more.

We believe that the comparable sales indicator is what investors should watch, followed of course by total sales and earnings. We are very selective about the BAD BEAT portfolio. Foot Locker earned a place thanks to our view that the risk-reward is attractive here given the moderate yield from the company’s dividend, and established dividend growth. This is further bolstered by the aggressive corrective action being put into place by Foot Locker. We now have to see it translate to comparable sales.

Disclosure: We are long Foot Locker

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the material and want to ...

more

What do you base your belief on that there will be a ramp up in sales in Q3 and Q4? Much hinges on that.