This Demand Zone In S&P 500 Needs To Hold

Image Source: Unsplash

Watch the video extracted from the WLGC session before the market open on 2 Apr 2024 below to find out the following:

- The demand zone that the S&P 500 needs to hold to avoid a meaningful pullback

- How the current supply and demand could affect the S&P 500 performance

- The likely development for the S&P 500 in the near term.

- and a lot more...

Video Length: 00:02:39

Market Environment

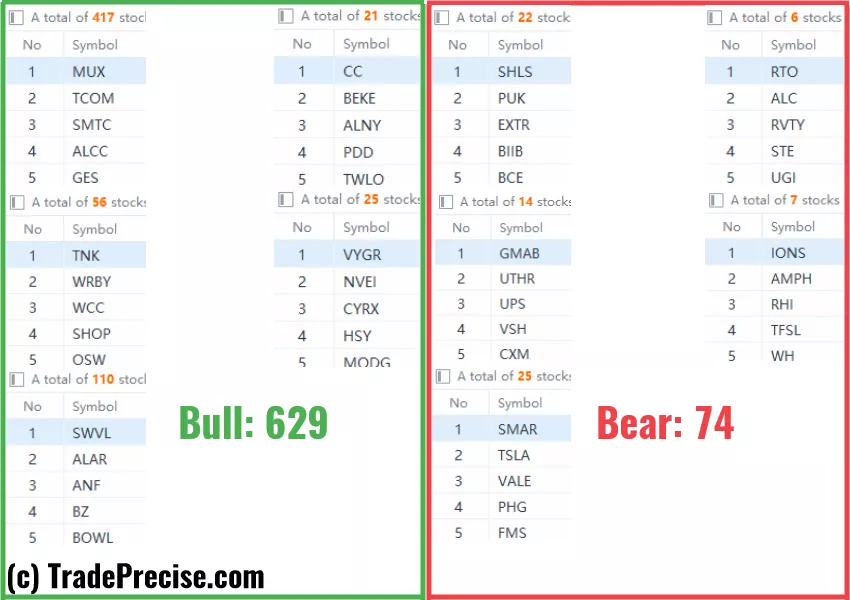

The bullish vs. bearish setup is 629 to 74 from the screenshot of my stock screener below.

Although there are plenty of setups, a rotation is already unfolding where the Russell 2000 (small cap) started to outperform while commodities like copper, and crude oil show strong relative strength with better follow-through in individual stocks.

Market Comment

17 “low-hanging fruits” (SM, PGR, etc…) trade entries setup + 18 actionable setups (RNA etc…) and 3 “wait and hold” candidates were discussed during the live session before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Crude Oil Poised For Bullish Breakout From Wyckoff Accumulation Pattern

Toppish Pattern Or A Rally In The Making For S&P 500?

Will S&P 500 Grind Higher Or Face A Dramatic Shakeout?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.