This 2018 IPO Is Starting To Look Like A Bargain

Our latest featured stock is a company we recently upgraded after being lukewarm on its IPO last year. We pulled this highlight from last week’s research of 232 10-K filings.

Analyst Jacob McDonough found several unusual items in the footnotes of AXA Equitable Holdings’ (EQH) 2018 10-K.

When EQH went public last year, we initiated coverage with a Neutral rating. The company’s economic earnings– the true cash flows of the business – had improved in 2017, but we weren’t sure if it was a one-year blip or a longer trend. In addition, the company still had a modest return on invested capital (ROIC) of 7% and negative free cash flow, so we advised caution.

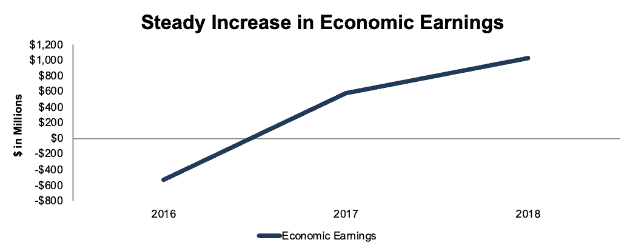

As Figure 1 shows, EQH’s economic earnings continued to improve in 2018.

Figure 1: Economic Earnings for EQH Since 2016

Sources: New Constructs, LLC and company filings.

Along with growth in economic earnings, EQH’s ROIC improved from 7% to 10%, and its free cash flow turned positive.

We made two key adjustments to EQH’s income statement in order to calculate ROIC and economic earnings:

- On page 244, we removed a $109 million (1% of revenue) non-recurring pension settlement charge from operating expenses

- On page 264, we removed a $7 million restructuring charge from operating earnings

We also made an important balance sheet adjustment:

- On page 261, we added back $1.4 billion in accumulated other comprehensive loss

Despite its fundamental improvements, EQH is down 3% from its first day post IPO closing price (vs. S&P up 4%), which leaves the stock with a price to economic book value (PEBV) ratio of 0.3. This ratio means the market expects the company’s after-tax operating profit (NOPAT) to permanently decline by 70%.

This cheap valuation, along with its improved cash flows, led us to upgrade the stock to Very Attractive.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

In total, we made the following adjustments to AXA Equitable Holdings’ 2018 10-K:

Income Statement: we made $913 million of adjustments, with a net effect of removing $543 million in non-operating expense. We removed $185 million in non-operating income and $728 million in non-operating expense. You can see all the adjustments made to EQH’s income statement here.

Balance Sheet: we made $7.5 billion of adjustments to calculate invested capital with a net increase of $5.2 billion. You can see all the adjustments made to EQH’s balance sheet here.

Valuation: we made $4.1 billion of adjustments with a net effect of decreasing shareholder value by $4.1 billion. You can see all the adjustments made to EQH’s valuation here.

The Power of the Robo-Analyst

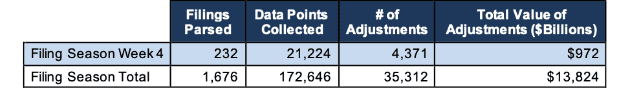

We pulled this highlight from last week’s research of 232 10-K filings, from which our Robo-Analyst technology collected 21,224 data points. Our analyst team used this data to make 4,371 forensic accounting adjustments with a dollar value of $972 billion. The adjustments were applied as follows:

- 1,776 income statement adjustments with a total value of $88 billion

- 1,834 balance sheet adjustments with a total value of $364 billion

- 761 valuation adjustments with a total value of $521 billion

Figure 2: Filing Season Diligence for Week of March 11-17

Sources: New Constructs, LLC and company filings.

Every year in this six-week stretch from mid-February through the end of March, we parse and analyze roughly 2,000 10-Ks to update our models for companies with 12/31 and 1/31 fiscal year ends. This effort is made possible by the combination of expertly trained human analysts with what we call the “Robo-Analyst.” Featured by Harvard Business School in “Disrupting Fundamental Analysis with Robo-Analysts”, our research automation technology uses machine learning and natural language processing to automate robust financial modeling.

No Substitute for Diligence

Our technology enables us to deliver fundamental diligence at a previously impossible scale. We believe this research is necessary to uncover the true profitability of a firm and make sound investment decisions. Ernst & Young’s recent white paper, “Getting ROIC Right”, demonstrates how the adjustments we make contribute to materially superior models and metrics.

Only by reading through the footnotes and making adjustments to reverse accounting distortions can investors and advisors alike get beyond the noise and get the truth about earnings and valuation.

Disclosure: David Trainer, Jacob McDonough, and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.