These 3 Top-Ranked Companies Boast Robust Sales Growth

Consistent sales growth is critical for a company’s success, as it’s the foundation of generating profits. Strong revenue generation allows companies to achieve scaling efficiencies, generate continuous shareholder value, and many other clear benefits.

And when it comes to top line strength, three companies – lululemon (LULU) , Palo Alto Networks (PANW) , and Celsius Holdings (CELH) – have been standouts.

All three have enjoyed solid revenue growth over the last several years and have seen recent positive earnings estimate revisions, with the latter reflecting optimism among analysts.

For those seeking top line compounders, let’s take a closer look at each.

lululemon

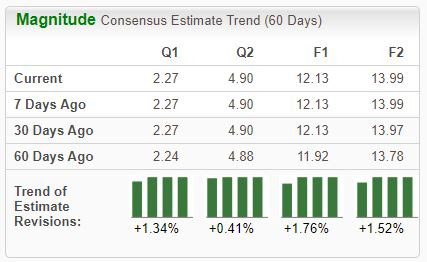

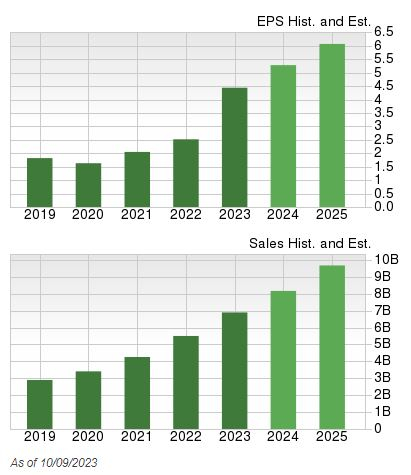

Lululemon Athletica designs, manufactures, and distributes athletic apparel and accessories for women, men, and female youth. The stock is currently a Zacks Rank #2 (Buy), with earnings expectations drifting higher across the board.

Image Source: Zacks Investment Research

The company is in full-on growth mode, with expectations for its current year suggesting a 20% earnings climb paired with an 18% revenue boost. And peeking ahead to FY25, estimates allude to a further 15% expansion in the bottom line on 13% higher sales.

Image Source: Zacks Investment Research

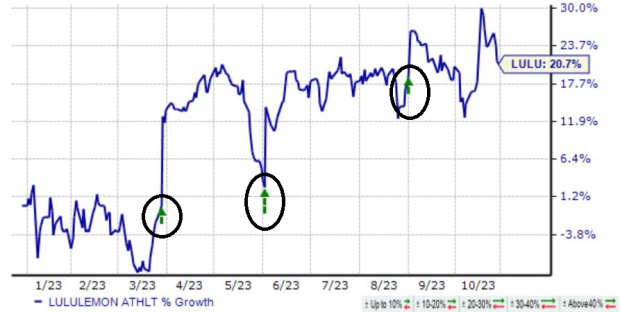

Continued business momentum has allowed the company to post robust quarterly results as of late, with LULU exceeding the Zacks Consensus EPS Estimate by an average of 6.8% across its last four releases. Shares have consistently seen buying pressure post-earnings in 2023, as illustrated below.

Image Source: Zacks Investment Research

Palo Alto Networks

Palo Alto Networks shares have seen favorable price action amid the artificial intelligence excitement in 2023, up 70% year-to-date. PANW operates Cortex XSIAM, the company’s integrated suite of AI-driven, intelligent products for Security Operations Centers (SOCs).

The stock is a Zacks Rank #2 (Buy), with the revisions trend particularly notable for its current fiscal year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company’s forecasted growth is rock-solid, with earnings forecasted to climb 20% in its current year on 19% higher revenues. Peeking ahead to FY25, estimates allude to a further 20% earnings growth paired with an 18% sales bump.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Interestingly enough, PANW shares have been long-term outperformers, penciling in a remarkable 1600% cumulative gain over the last decade. As shown below, the performance blows the S&P 500’s 200% gain away.

Image Source: Zacks Investment Research

Celsius Holdings

Celsius Holdings specializes in commercializing healthier, nutritional, functional foods, beverages, and dietary supplements. The stock is currently a Zacks Rank #2 (Buy), and like PANW, the revisions trend has been particularly bullish for its current fiscal year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The company’s top line growth has been robust, as we can see illustrated below. And the growth is slated to continue, with consensus expectations for its current year suggesting 170% earnings growth on nearly 90% higher sales.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming quarterly release expected on November 8th, as the Zacks Consensus EPS Estimate of $0.51 suggests a sizable 170% climb from the same period last year. Our consensus revenue estimate sits at $346.3 million, reflecting 83% growth.

Bottom Line

Consistent sales growth is critical for a company’s success, as it’s the foundation of generating profits.

And when it comes to top line compounders, three companies – lululemon (LULU Quick QuoteLULU - Free Report) , Palo Alto Networks (PANW Quick QuotePANW - Free Report) , and Celsius Holdings (CELH Quick QuoteCELH - Free Report) – have been standouts.

On top of robust revenue growth, all three currently sport a favorable Zacks Rank, reflecting optimism among analysts.

More By This Author:

Roku Gears Up To Report Q3 Earnings: What's In The Cards?

Bull Of The Day: Applied Industrial Technologies

PayPal To Post Q3 Earnings: What's In The Offing?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more