Bull Of The Day: Applied Industrial Technologies

Applied Industrial Technologies (AIT) is a leading industrial distributor that provides critical components, equipment, and value-added services to a wide range of industries, from manufacturing to utilities. With a vast network of suppliers and locations, AIT offers its customers access to a broad product portfolio, including bearings, power transmission components, fluid power components, and industrial supplies.

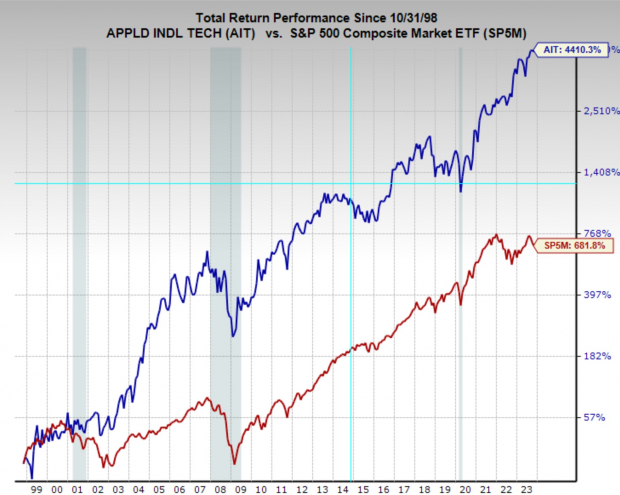

Applied Industrial Technology currently enjoys a Zacks Rank #1 (Strong Buy) rating, indicating upward trending earnings revisions and improving the near-term odds of a move higher in the stock. However, AIT stock has put up incredible returns over the long-term as well.

Over the last 25 years Applied Industrial Technology stock has compounded at an annual rate of 16.2%, double the average annual return on the S&P 500, and many multiples of total return.

(Click on image to enlarge)

Image Source: Zacks Investment Research

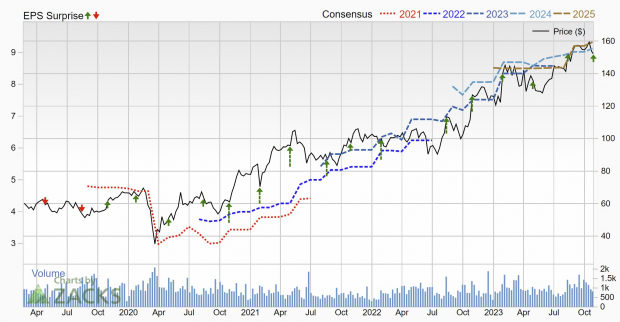

Earnings Estimates Climb

Applied Industrial Technologies’ earnings estimate have been on a steady climb higher over the last three years, along with its stock price.

Over the last two months, current quarter earnings estimates have been revised higher by 0.5% and are expected to grow 5.1% YoY to $2.07 per share. FY23 earnings estimates have been increased by 1.3% over that same period and are forecast to climb 4.3% YoY to $9.13 per share.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Compelling Free Cash Flow

In the chart below we can see that AIT has an FCF yield of 5.3%, which is above the industry average of 3.5% and a relatively high percentage in general. Furthermore, AIT has shown that it has maintained a history of positive free cash flow indicating financial discipline. The company has grown its annual FCF by a CAGR of 12.5% annually.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Relative Strength

In what has developed into an increasingly more challenging and choppy market, AIT is showing considerable relative strength against the broad market. While the S&P 500 and leading stocks have been trading sideways to lower since mid-summer, Applied Industrial Technologies continues to hold up well, and has outperformed the market by almost 20% over that time.

(Click on image to enlarge)

Image Source: TradingView

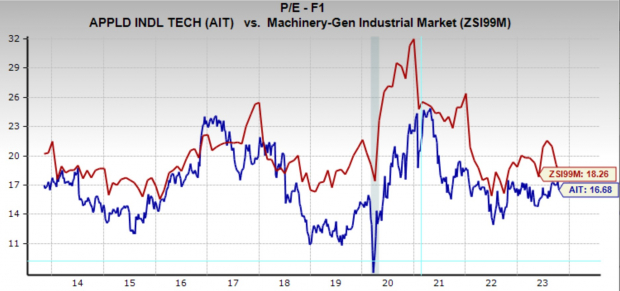

Valuation

Applied Industrial Technologies is trading at a one year forward earnings multiple of 16.7x, which is below the industry average and in line with its 10-year median. Additionally, the company pays a dividend yield of 0.9% and has raised the payment by an average of 3.1% annually over the last five years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Applied Industrial Technologies is an incredibly durable company with a very long history of earnings growth. Since 1994 it has increased its EPS from $0.34 per share to $8.75, an incredible compound annual growth rate of 11.9%. Because it creates products that have been, and will continue to be used for many decades, the earnings growth can be expected to persist.

Thus, any investor looking for a conservative investment, that also has near term bullish catalysts should most certainly consider Applied Industrial Technologies.

More By This Author:

PayPal To Post Q3 Earnings: What's In The Offing?Intel Q3 Earnings And Revenues Beat Estimates

META Up +4% On +23% Revenue Growth; IBM And NOW Also Beat

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more