These 3 Quarterly Releases Positively Shocked The Market

Image Source: Unsplash

Another day, another round of earnings. The Q2 season is well underway, with an extensive list of companies delivering their results daily. So far, it’s been primarily positive, with the big banks kicking off the period with results that pleased investors.

Of course, there have been several notable surprises throughout the period, including those from General Electric (GE - Free Report), Johnson & Johnson (JNJ - Free Report), and Meta Platforms (META - Free Report).

All three posted solid results, causing buyers to swarm post-earnings. But what was there to like within the releases? Let’s take a closer look.

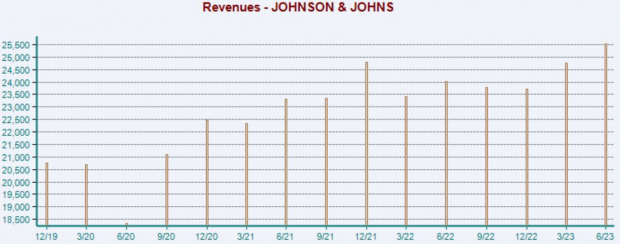

Johnson & Johnson

Johnson & Johnson beat expectations, with the company exceeding the Zacks Consensus EPS estimate by 7% and reporting revenue 3% ahead of expectations. Revenue throughout the period totaled $25.5 billion, growing 6% from the year-ago period.

Image Source: Zacks Investment Research

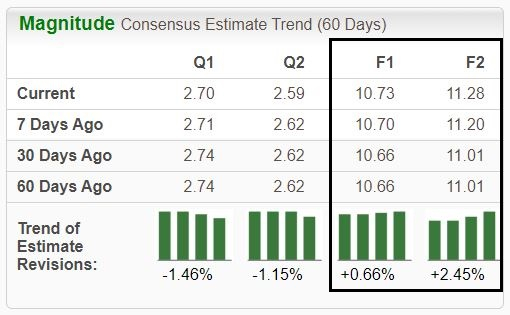

JNJ raised its FY23 adjusted EPS guidance following the better-than-expected results, expecting EPS of $10.70-$10.80 ($10.60-$10.70 previously). Positive earnings estimate revisions unsurprisingly followed, with the Zacks Consensus EPS FY23 estimate of $10.73 up nearly 1% since the end of June. The stock is now a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The market was impressed with the results, with JNJ shares closing 6% higher post-earnings.

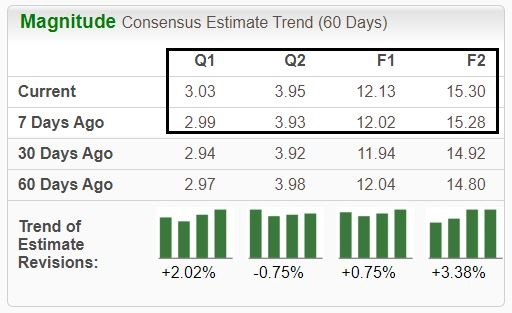

Meta Platforms

Technology titan Meta Platforms delivered another highly-favorable report, exceeding the Zacks Consensus EPS Estimate by more than 12% and reporting revenue 4% ahead of expectations. Investors cheered on the tech giant’s results, with META shares soaring post-earnings.

Analysts have raised their earnings expectations following the release, with the stock sporting a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Facebook users continue to grow, with 2.1 billion daily active users seeing an improvement of 5% from the year-ago period. In addition, ad impressions across the company’s family of apps increased by a solid 34% year-over-year.

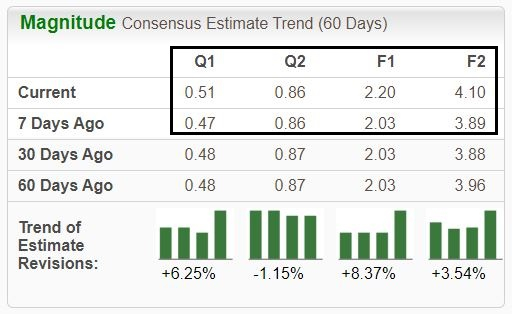

General Electric

General Electric exceeded quarterly expectations in a big way, beating earnings expectations by 48% and reporting revenue 5% above expectations. GE enjoyed double-digit growth in orders, revenue, operating profit, and cash, topping off the robust results with a guidance upgrade.

GE expects organic revenue growth in the low-double-digit range, up from the previously guided high-single-digit expectation. In addition, the company expects FY23 adjusted EPS in a range of $2.10-$2.30, up from the previous $1.70-$2.00 per share expected. And to top it off, General Electric forecasts FY23 free cash flow of $4.1-$4.6 billion (previously $3.6 billion-$4.2 billion).

The market took the better-than-results in stride, with GE shares jumping following the announcement in pre-market trading. Positive revisions have followed across nearly all timeframes following the quarterly release, helping vault GE into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Bottom Line

With earnings season in full swing, investors will be met with many surprises.

And so far, all three companies discussed above – General Electric (GE - Free Report), Johnson & Johnson (JNJ - Free Report), and Meta Platforms (META - Free Report) – have delivered strong results that have impressed the market.

00:01:02

More By This Author:

Low-Volatility ETFs InFocus

2 Intriguing Tech Stocks To Consider As Earnings Approach

3 Buy-Rated Stocks Breaking 52-Week Highs

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more