3 Buy-Rated Stocks Breaking 52-Week Highs

Image: Bigstock

Stocks making new highs tend to make even higher highs, especially when analysts' positive earnings estimate revisions begin rolling in. And by targeting stocks breaking out or near new highs, investors find themselves in favorable trends where buyers are in control.

With the market’s rebound in 2023, many stocks are now near or breaking 52-week highs, including Workday (WDAY - Free Report), Abercrombie & Fitch (ANF - Free Report), and Greif (GEF - Free Report).

In addition to seeing favorable price action, all three have enjoyed positive earnings estimate revisions, indicating optimism among analysts. Let’s take a closer look at each.

Greif

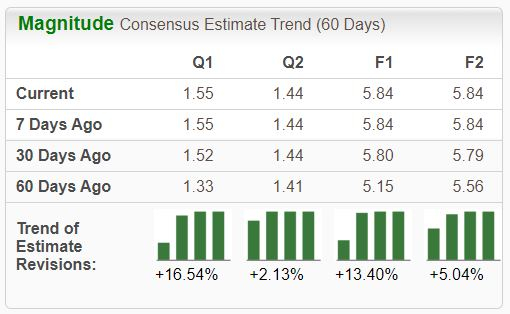

Greif is a leading global producer of industrial packaging products and services, with operations across several countries. The company has enjoyed positive earnings estimate revisions across all timeframes, helping land the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

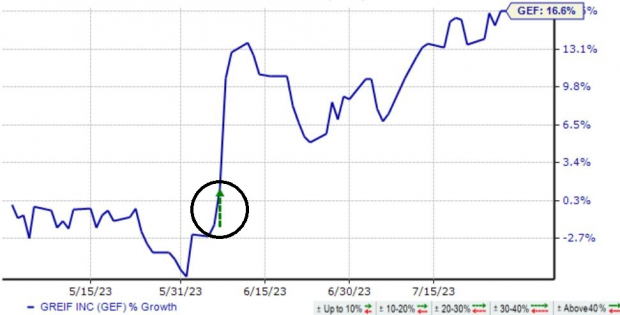

The company posted solid bottom line results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 35%. The better-than-expected results snapped a streak of negative bottom line surprises. Shares saw notable buying pressure following the release, as seen in the chart below.

Image Source: Zacks Investment Research

In addition, GEF shares provide a passive income stream, with the company’s annual dividend currently yielding a solid 2.7%. The company’s payout has grown nearly 3% over the last five years, with a sustainable payout ratio sitting at 29% of its earnings.

Workday

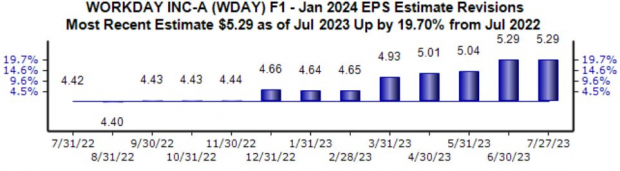

Workday provides enterprise-level software solutions for financial management and human resource domains. The stock is a Zacks Rank #1 (Strong Buy), with the revisions trend particularly noteworthy for its current fiscal year, up 20% since last July.

Image Source: Zacks Investment Research

Value-conscious investors may not find WDAY shares as attractive, with the current 8.4X forward price-to-sales ratio (F1) residing on the higher end of the spectrum. Still, shares are cheap on a relative basis, with the value well below the 11.1X five-year median.

Image Source: Zacks Investment Research

Keep an eye out for WDAY’s upcoming quarterly release expected on Aug. 24; the Zacks Consensus EPS Estimate of $1.24 suggests a sizable 50% improvement in earnings from the year-ago period.

Abercrombie & Fitch

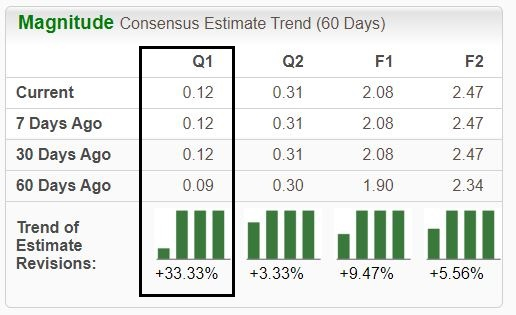

Abercrombie & Fitch operates as a specialty retailer of many types of premium, high-quality casual apparel for men, women, and kids through a vast store network. Analysts have taken their expectations higher across all timeframes, with the revisions trend notably strong for its upcoming release. The stock sports a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

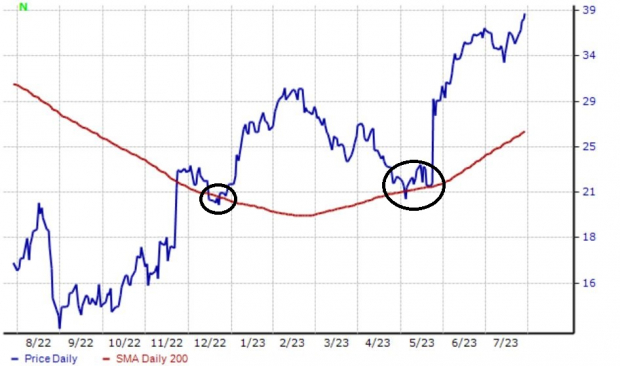

For those looking to add on pullbacks, the 200-day moving average could be an area of consideration. As shown below, ANF shares have respected the level in back-to-back instances, with buyers stepping up both times.

Image Source: Zacks Investment Research

In addition, the company’s growth trajectory is impossible to ignore, with earnings forecasted to soar 730% in its current fiscal year on 3.4% higher revenues. And in FY25, earnings and revenue are forecasted to see improvements of 19% and 2.4%, respectively.

Bottom Line

Stocks nearing or breaking 52-week highs reflect considerable momentum, with positive earnings estimates from analysts commonly providing the fuel needed to continue climbing.

And for those interested in stocks seeing notable buying pressure, all three discussed above – Workday (WDAY - Free Report), Abercrombie & Fitch (ANF - Free Report), and Greif (GEF - Free Report) – have witnessed precisely that.

More By This Author:

Altria Group Queues For Q2 Earnings: What's In The Cards?Bull Of The Day: Dorian

Bear Of The Day: Oxford Industries

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more