These 10 Gold And Silver Juniors Have Parabolic Potential

On average, physical gold and silver prices are up 25% in the past 6 months, and gold and silver stocks - leveraged plays on gold - are up 58%. The current up-leg in precious metals is forecast to continue throughout this decade which suggests that the surge in mining shares has the potential of going dramatically higher - dare I say parabolic - in the years ahead.

This article provides the names of 10 grossly undervalued juniors with large quantities of reserves in the ground, sufficient insider stock ownership, acceptable trading volume, little to no short interest, and located in risk-averse jurisdictions.

Gold and silver stocks, particularly juniors, are ultimately leveraged plays on the price of physical precious metals because their earnings potential multiplies materially (2-3 times, on average) as gold and silver prices move upwards. For example, if gold was trading at $1,600 per troy ounce (ozt.) and a company's mining costs were $1,225/ozt. its potential profit would amount to $375/ozt.. If gold were to rally 25% to $2,000, as it just has, its profits would explode to $775 (assuming all-in sustaining costs don’t change that much), generating a 107% gain - and that is what fuels a gold stock's big upside leverage to the physical metal.

What can we expect to happen to such under-valued juniors if gold were to soar to $3,000/ozt., or even in excess of $10,000/ozt. as a few analysts forecast (see here)? The answer is a parabolic surge in their prices. Hence the attraction.

In preparation for a surge in gold prices, be it just to $2,500/ozt., or possibly to $25,000/ozt., below is a basket of 10 undervalued gold and silver juniors along with each stock's latest market capitalization and percentage change in stock price from its Base 1 level low at the end of September 2022, until mid-month April 2023, as follows:

- Equity Metals (EQMEF): +260%

- Mkt. Cap: $22M;

- exploring for gold, silver, zinc, copper and diamond ores;

- operating in Canada.

- Silver X Mining (AGXPF): +129%

- Mkt. Cap: $49M;

- exploring for silver;

- operating in Peru.

- Troilus Gold (CHXMF): +126%

- Mkt. Cap: $129M;

- exploring for gold and copper;

- operating in Canada.

- Bear Creek Mining (BCEKF): +114%

- Mkt. Cap: $93M;

- exploring for silver, lead, zinc, copper and mining gold;

- operating in Peru and Mexico (gold).

- Gold Mountain Mining (GMTNF): +60%

- Mkt. Cap: $14M;

- exploring for gold and silver;

- operating in Canada.

- Aftermath Silver (AAGFF): +50%

- Market Cap; $38M;

- exploring for silver, gold and copper;

- operating in Chile and Peru.

- Revival Gold (RVLGF): +43%

- Mkt. Cap: $53M;

- exploring for gold and phosphate;

- operating in USA.

- International Tower Hill Mines (THM): +37%

- Mkt. Cap: $115M;

- exploring for gold;

- operating in USA.

- Paramount Gold Nevada (PZG): +29%

- Mkt. Cap: $19M;

- exploring for gold and silver;

- operating in USA.

- Integra Resources (ITRG): +16%

- Mkt. Cap: $45M;

- exploring for gold and silver;

- operating in USA.

Average Market Capitalization: $58M; +63% in last 6.5 months

To put the above stocks' performances in perspective in the last 6.5 months, on average:

- the SIL and SLVP silver ETFs were +59%,

- the SGDJ and GDXF gold ETFs were +64%,

- the above 4 ETFs were + 58%,

- gold (GLD) was +23%,

- silver (SLV) was +42% and

- gold and silver, together, on average, were +25%

compared to the above selection of 10 juniors which has marginally outperformed the four gold and silver ETFs, outperformed silver by 1.5 times and gold by 2.5 times.

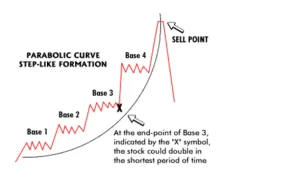

The above being the case, now is the time to do your homework and to get invested during what appears to be the first step in the progression of a parabolic curve (see below) that could culminate in potentially +10-fold gains in many exploration companies reported to have above-average resources in the ground.

Going forward the 10 stocks will be tracked in a basket which will be referred to as the "10 Gold/Silver Juniors With Parabolic Potential".

More By This Author:

3 Largest Pure-Play Plant-Based Food Stocks Down 9% Month-To-Date

Largest Canadian Cannabis LPs Already -6% In April; Now -22.5% YTD

15 Gold And Silver Junior "Miners" With Parabolic Potential

Disclaimer: None

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more