The Truth About Why Super Micro’s Stock Has Fallen 26% In The Last 5 Days

Super Micro

In this FAST Graphs Analyze Out Loud Video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation will analyze Super Micro Computer (SMCI) Chuck will also cover Nvidia Corp (NVDA).

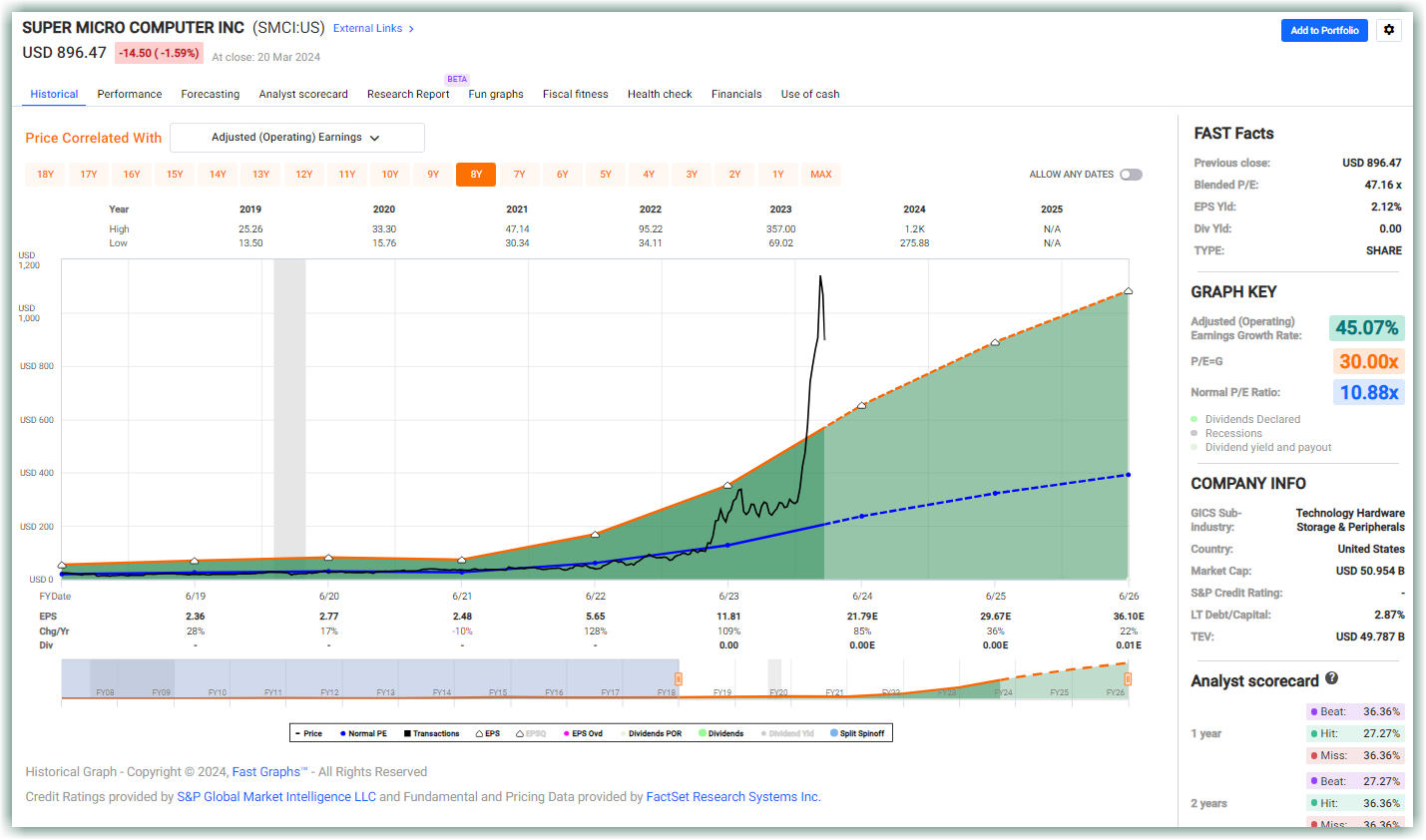

(Click on image to enlarge)

There is an obvious reason why Super Micro’s stock price has fallen over 26% in the past five days. Chuck will look at the company before it because such a massively overvalued stock. Historically it was a decent growth stock, averaging earnings growth around 11%. Along came artificial intelligence and Super Micro’s earnings began to accelerate dramatically. Chuck will go over the forecasting calculators to show you what analysts are expecting this stock to do.

Video Length: 00:06:13

More By This Author:

What Caused Humana’s Shocking Earnings Miss?

AES Corp, Renewable Returns: A Clean Energy Dividend Investment

Maximizing Returns: How REITs Offer High Income And Growth For Investors

Disclosure: Long NVDA.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more